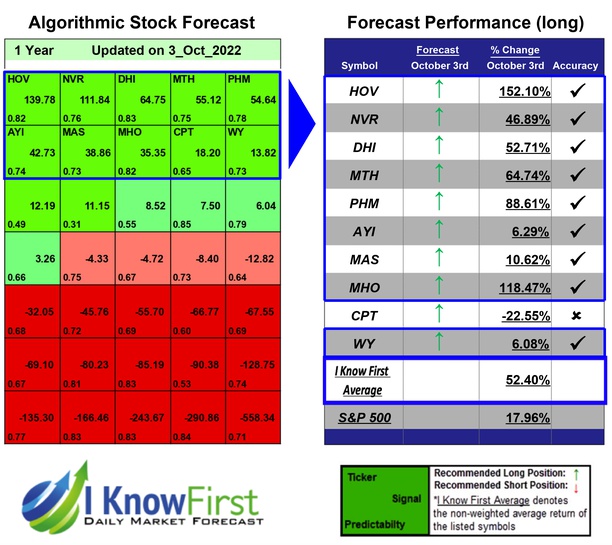

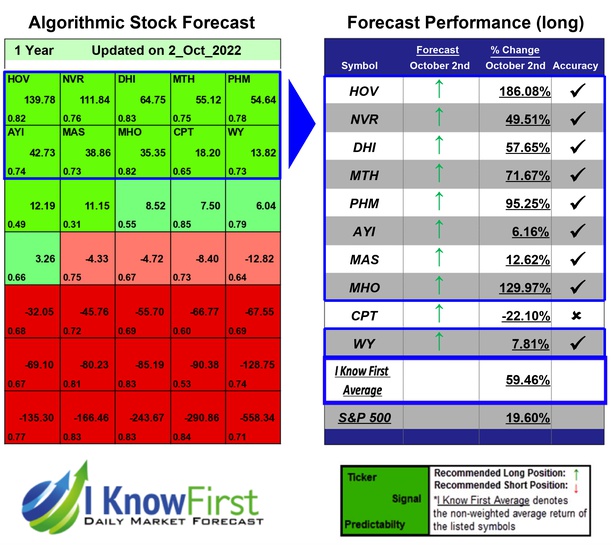

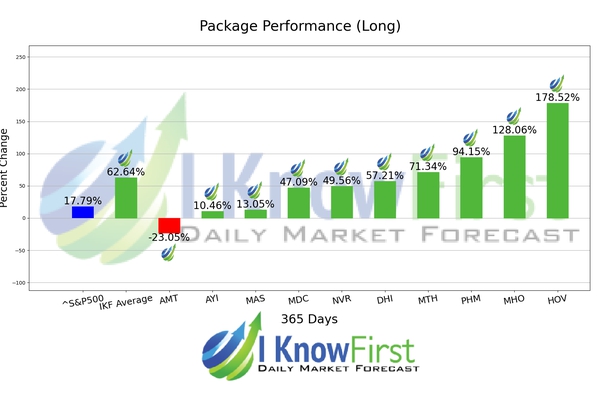

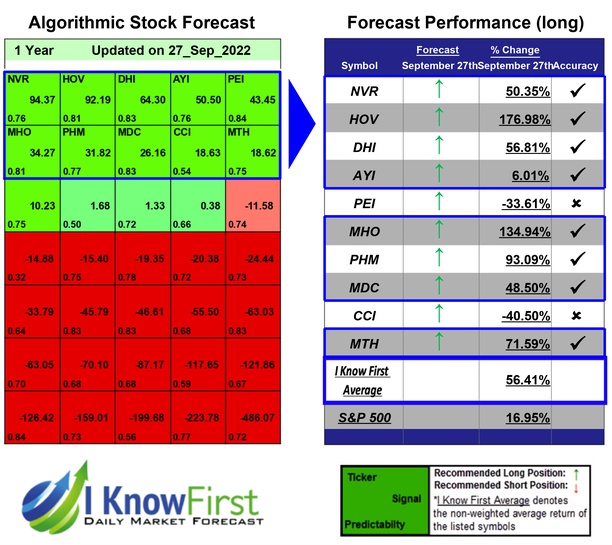

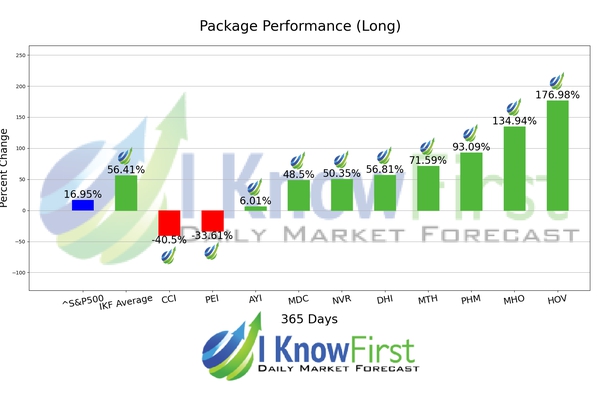

Home Builders Stocks Based on Big Data Analytics: Returns up to 152.1% in 1 Year

Package Name: Home Builders

Recommended Positions: Long

Forecast Length: 1 Year (10/3/22 - 10/3/23)

I Know First Average: 52.4%

Recommended Positions: Long

Forecast Length: 1 Year (10/3/22 - 10/3/23)

I Know First Average: 52.4%

Read The Full Forecast

Read The Full Premium Article

Read The Full Premium Article