Insight on Insider Trading

Summary:

- According to the study conducted by New York University and McGill University professors, “a quarter of all public company deals may involve in some kind of insider trading”.

- Legal regulations allow key personnel of the company to trade in the stock only during a certain allowable window period and such trading is prohibited around the date of declaration of financial results by the company.

- I Know First provides a solution for Insider Trading based on an Artificial Intelligence algorithm.

Read The Full Premium Article

Read The Full Premium Article

Subscribe to receive exclusive PREMIUM content hereWinning AZPN Stock Forecast: Solid Long-Term Success as APM Business Took off

Winning AZPN Stock Forecast

“Real-time asset connectivity and system-level views of asset performance data are critical for making informed business decisions and add further value to the asset optimization solutions we offer customers today.”— John Hague, Senior Vice President and General Manager, AspenTech APM.

Aspen Technology, Inc. (Nasdaq: AZPN) provides asset optimization solution software and services in the United States, Europe, and internationally. It operates through two segments, Subscription and Software, and Services. The solutions are designed to optimize assets across the design, operations and maintenance lifecycle for various capital-intensive industries.

(Source: Wikimedia)

Aspen Technology has seen a steady and rapid growth from the beginning of 2016. The stock price rose 212.54% up to $97.70 until July 13, 2018. The continuous long-term growth is driven by the company’s good fundamentals and operating results, with an emphasis on its substantial growth and expansion of its Asset Performance Management (APM) segment. Aspen introduced its new product suite APM that helps to address business problems including process disruptions, low asset availability and unexpected downtime in November 2016. As an extension of its original engineering (ENG) and manufacturing & supply chain (MSC) product portfolio, the new segment thrives to optimize customers’ assets throughout their entire lifecycle.

Exhibit: Solution Portfolio

(Source: Investor Presentation)

There has been significant growth in this sector since its launch. The entire APM pipelines has grown to represent 32% of their total pipeline within the last two years. As more expenditures and efforts are spent to improve APM capabilities, educate customers of the usefulness of their products and better price and package the software, great potential market and opportunities are still expected in the foreseeable future.

In addition, the successful operating results also benefit from the solid demand for the company’s all three pipelines, ENG, MSC and APM. Aspen continuously saw growing demand trend from its good performance from owner-operator customers. For engineering & construction customers, there are also signs of an improving demand environment especially in Europe and Asia.

(Source: businesswire.com)

I Know First algorithm bullish one-year forecast for AZPN

On July 12, 2017, I Know First algorithm issued a bullish one-year forecast for AZPN to July 12, 2018.

This winning AZPN stock forecast illustrated a signal of 278.90 and a predictability of 0.74. In accordance with this bullish forecast, AZPN stock returned 73.21% over this time horizon, highlighting the accuracy of I Know First’s prediction.

Current I Know First subscribers received this bullish AZPN forecast onJuly 12, 2017.

How to read the I Know First Forecast and Heatmap

Please note-for trading decisions use the most recent forecast.

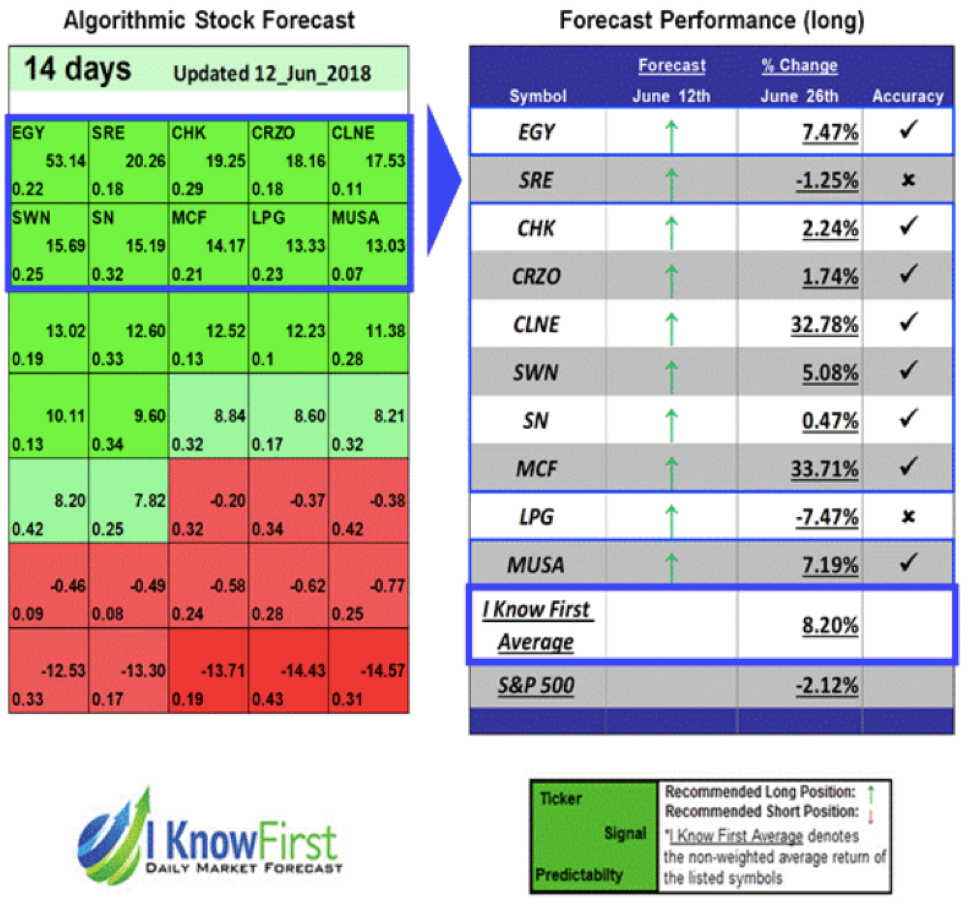

Winning MCF Stock Forecast: Insider Trading Indicates Significant Undervaluation

Contango Oil & Gas Company (NYSE: MCF) is an independent oil and natural gas company which engages in the acquisition, exploration, development and production of crude oil and natural gas properties in Mexico and the United States. On June 12, I Know First algorithm issued a bullish 14-day forecast for MCF to June 26. The forecast illustrated a signal of 14.17 and a predictability of 0.21. In accordance with this bullish forecast, MCF stock returned 33.71% over this time horizon, highlighting the accuracy of I Know First’s prediction.

MCF stock jumped by 40.71% since June 8 and closed at $5.91 on June 19, drawing interest from investors and traders. Contango’s rally after being in a downtrend since entering this year may be the result of recent insider stock trading. John Goff, a major Fort Worth-based real estate investor of the company, and his three related investment funds have entered into a series of transactions to buy a substantial position since June 5, 2018. According to the SEC filings, Goff and his family holdings bought more than 4.8 million shares valued at more than $25 million through five consecutive transactions up to June 26. It is reported that the purchase is based on the belief that the stocks were significantly undervalued at the time of purchase. The purpose of the transaction is to invest and to influence the company’s management and operations. Consistent with this purpose, Goff will seek to engage in discussions with the company’s shareholders, board of directors and management team about its operations, assets, business strategy, corporate governance and financial condition.

Current I Know First subscribers received this bullish MCF forecast on June 12, 2018.

How to read the I Know First Forecast and Heatmap

Please note-for trading decisions use the most recent forecast.

Get today’s forecast and Top stock picks.

NFLX Stock Analysis: Looming Presidential Election Creates Extreme Gains, or Extreme Losses

The article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

The article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.NFLX Stock Analysis

Summary

- Background on NFLX

- NFLX Trading

- Analysts Recommendations

Read The Full Premium Article

Read The Full Premium Article

Subscribe to receive exclusive PREMIUM content here