AI Stock Picking Algorithm Will Strongly Support TD Ameritrade Investors

This TD Ameritrade article was written by Erica McGillicuddy, Analyst at I Know First.

This TD Ameritrade article was written by Erica McGillicuddy, Analyst at I Know First.

Summary

- The amount of trades through TD Ameritrade has drastically increased as a result of the pandemic

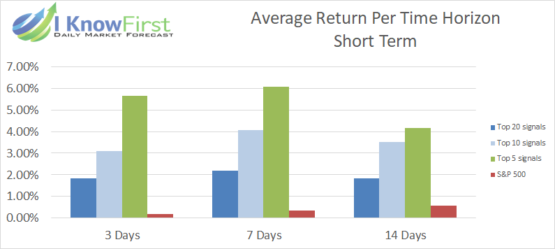

- Combining intel from TD Ameritrade and I Know First will help educate TD Ameritrade’s large base of beginners

- I Know First’s customizable forecasts allow users to double check TD Ameritrade resources and advisors' recommendations

This article was written by Isaac Rothstein - Analyst at

This article was written by Isaac Rothstein - Analyst at  Read The Full Premium Article

Read The Full Premium Article This AMZN stock forecast article is written by Hao Liu, Financial Analyst at I Know First.

This AMZN stock forecast article is written by Hao Liu, Financial Analyst at I Know First. Read The Full Premium Article

Read The Full Premium Article This Coronavirus stock market prediction article is written by Hao Liu, Financial Analyst at I Know First.

This Coronavirus stock market prediction article is written by Hao Liu, Financial Analyst at I Know First.