AMD Stock Prediction: Why AMD Stock Has A Bright Future

This article was written by Mathieu Stalder, a Financial Analyst at I Know First.

This article was written by Mathieu Stalder, a Financial Analyst at I Know First.

Summary

- Stock is in a decisive technical area, as the stock price approaches a resistance and a support zone

- Solid financial figures but fundamentals indicate a clear overvaluation as the price to book ratio of 15.83 is rather expensive, as the industry average is only 2.10.

- AMD has been added to NASDAQ-100 due to its high valuation

- Huge Potential in the Semiconductor Industry as HIS Markit forecasts that by 2025 , there will be around 75 billion installed Internet of Things (IoT)

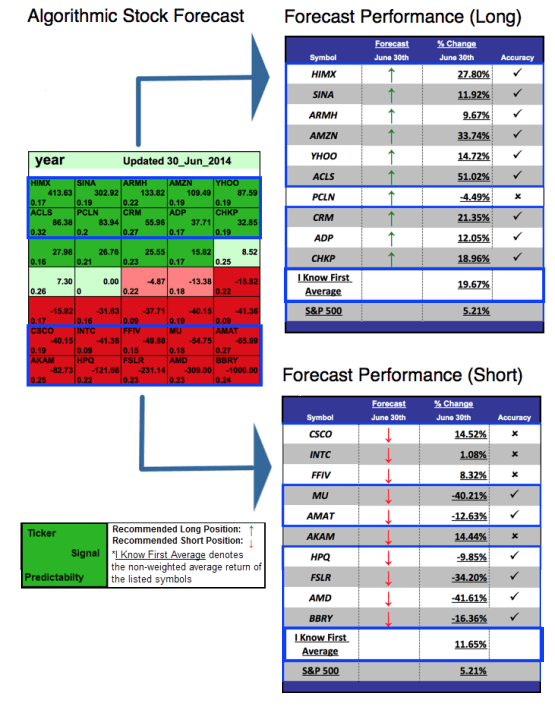

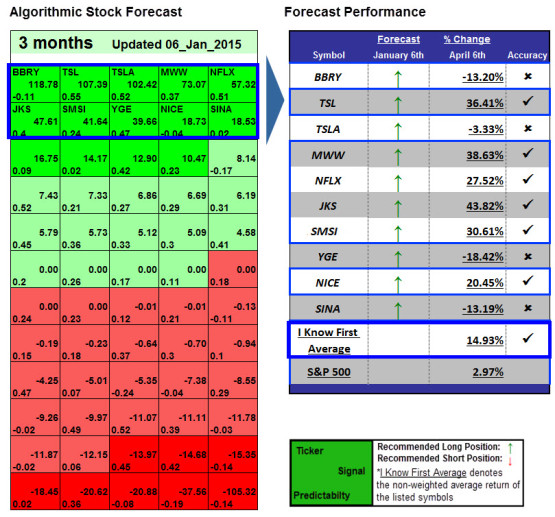

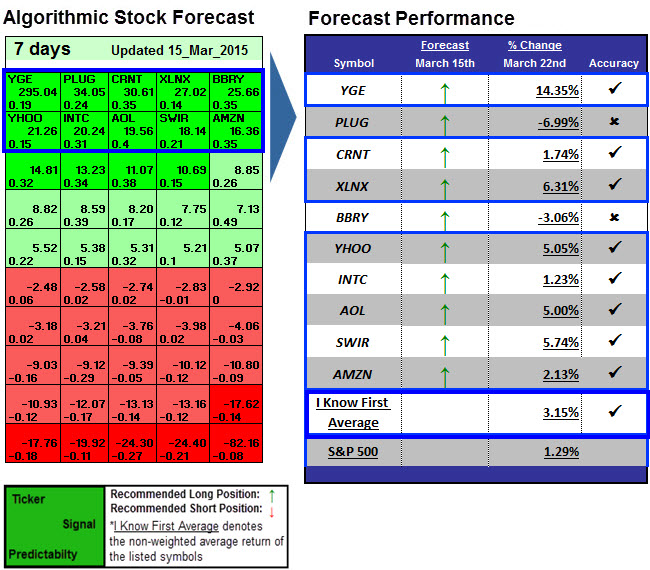

- Current Bullish Long Term I Know First Algorithm Forecast

Technical Analysis

Overall seen AMD is one of the best performing stocks in the market as it outperforms 94% of the stocks in the Electronic Components and Accessories industry. This is mostly due to strong growth of the stock 4 month ago. The stock is currently trading in the middle of the 52 weeks range, whereas the S&P500 Index is on the lower end of its 52-week range, which shows that AMD is doing a bit better than the Index. By analyzing the chart of the AMD stock price, it clearly shows that there is a support zone

Read The Full Premium Article

Read The Full Premium Article