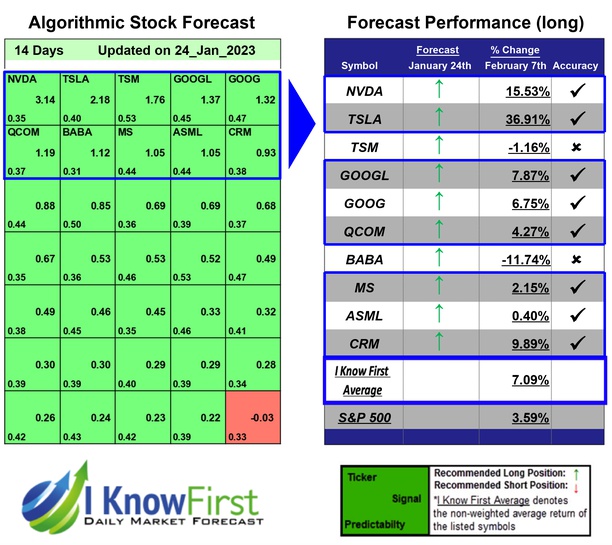

Megacap Stocks Based on Artificial Intelligence: Returns up to 36.91% in 14 Days

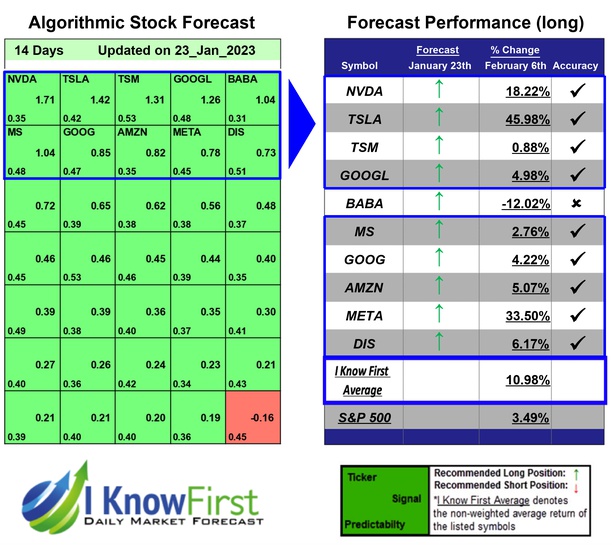

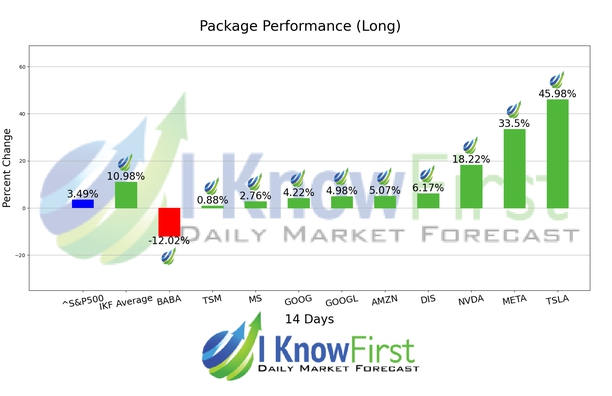

Package Name: Mega Cap Forecast

Recommended Positions: Long

Forecast Length: 14 Days (1/24/23 - 2/7/23)

I Know First Average: 7.09%

Recommended Positions: Long

Forecast Length: 14 Days (1/24/23 - 2/7/23)

I Know First Average: 7.09%

Read The Full Forecast

Package Name: Implied Volatility Options

Package Name: Implied Volatility Options