GSK Stock Analysis: Attractive Price For Incredible Dividend Yield

Summary

- GlaxoSmithKline’s stock price has fallen over the past year as its core performance struggles.

- The price is now near its 52-week low, and is unlikely to fall much further limiting the risk involved with the stock.

- Sales will improve next year, offering upside potential, and investors can enjoy the dividend yield until then.

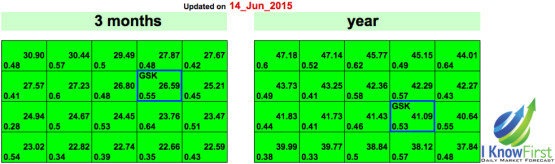

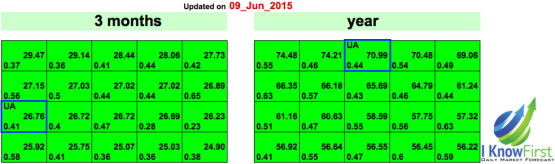

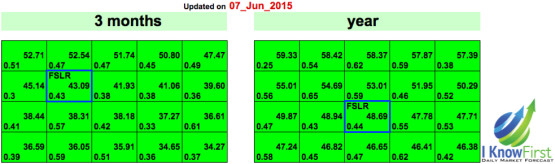

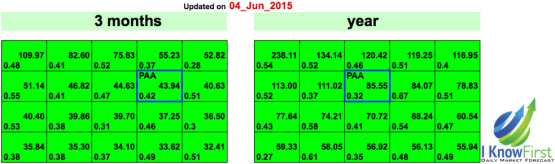

- I Know First Algorithm is bullish on this stock for the long-term, believing it is perfect for patient, income-seeking investors.