Top Stock Picks: Daily US Stocks Forecast Performance Evaluation Report

Executive Summary

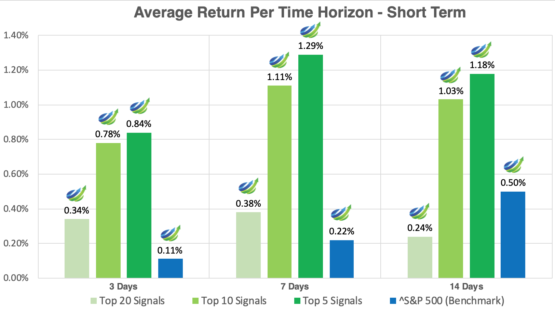

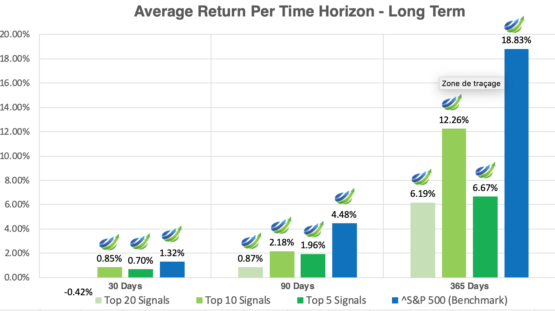

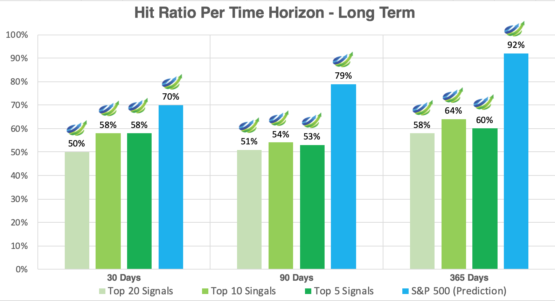

In this stock market forecast evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for Top 10 US stocks for long and short positions (20 stocks) and S&P 500 Index which were daily sent to our customers. Our analysis covers the time period from January 1, 2019, to March 15, 2020.

Top 10 US Stocks Evaluation Highlights:

- I Know First reached 92% accuracy for S&P 500 forecasts on the 1 year time horizon.

- The Top 10 and Top 5 signal groups generated by I Know First succeeded in outperforming S&P 500 Index in short term horizons.

- The Top 10 and Top 5 signal groups achieved positive returns for all time horizons.