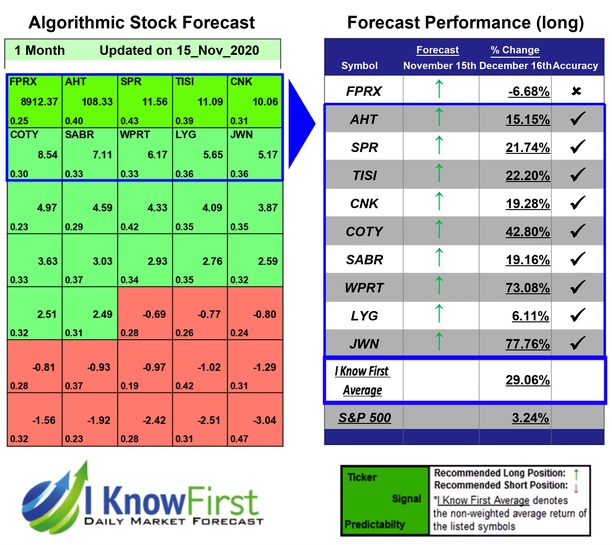

Stocks With High Implied Volatility Based on Data Mining: Returns up to 77.76% in 1 Month

Stocks With High Implied Volatility

This stocks with high implied volatility forecast is part of the Implied Volatility Options Package is designed for investors and analysts who need implied volatility predictions for options trading. It includes 20 stock options with bullish and bearish signals for implied volatility and indicates the best options to buy and sell:

- Implied volatility Top 10 call options

- Implied volatility Top 10 put options

Package Name: Implied Volatility Options

Recommended Positions: Long

Forecast Length: 1 Month (11/15/2020 – 12/16/2020)

I Know First Average: 29.06%

9 out of 10 stock prices in this forecast for the Implied Volatility Options Package moved as predicted by the algorithm. The highest trade return came from JWN, at 77.76%. WPRT and COTY also performed well for this time horizon with returns of 73.08% and 42.8%, respectively. The package had an overall average return of 29.06%, providing investors with a 25.82% premium over the S&P 500’s return of 3.24% during the period.

Nordstrom, Inc. (JWN), a fashion specialty retailer, offers apparel, shoes, cosmetics, and accessories for men, women, and children in the United States and Canada. It operates through two segments, Retail and Credit. The Retail segment offers a selection of brand name and private label merchandise through various channels, including Nordstrom branded full-line stores and online store at Nordstrom.com; Nordstrom Rack stores; Nordstromrack.com and HauteLook; and other retail channels, including Trunk Club showrooms and TrunkClub.com, Jeffrey boutiques, and clearance store that operates under the name Last Chance. The Credit segment operates Nordstrom fsb, a federal savings bank, which provides a private label credit card, two Nordstrom VISA credit cards, and a debit card. Its credit and debit cards feature a shopping-based loyalty program. As of October 21, 2016, the company operated 346 stores in 40 states, including 123 full-line stores in the United States and Canada; 213 Nordstrom Rack stores; 2 Jeffrey boutiques; and 2 clearance stores. Nordstrom, Inc. (JWN) also sells its products through catalogs. The company was founded in 1901 and is based in Seattle, Washington.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.