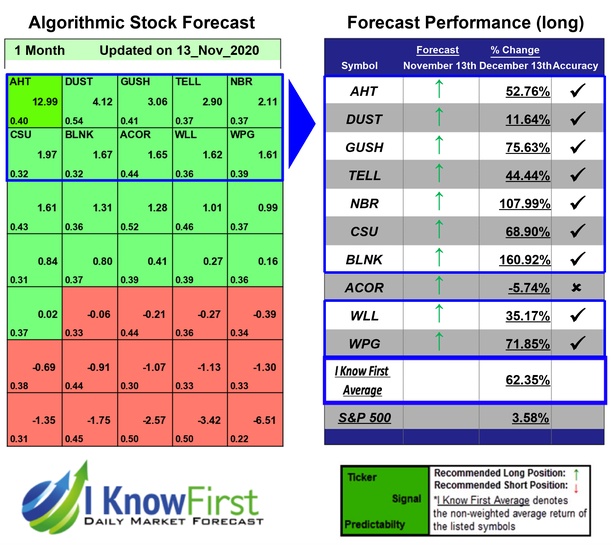

Stocks to Buy Based on Big Data: Returns up to 160.92% in 1 Month

Stocks to Buy

This stocks to buy forecast is part of the Risk-Conscious Package, as one of I Know First’s equity research solutions. We determine our aggressive stock picks by screening our algorithm daily for higher volatility stocks that present greater opportunities but are also riskier. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks divided into four main categories:

- Top 10 Aggressive stocks for the long position

- Top 10 Aggressive stocks for the short position

- Top 10 Conservative stocks for the long position

- Top 10 Conservative stocks for the short position

Package Name: Aggressive Stocks Forecast

Recommended Positions: Long

Forecast Length: 1 Month (11/13/2020 – 12/13/2020)

I Know First Average: 62.35%

I Know First’s State of the Art Algorithm accurately forecasted 9 out of 10 trades in this Aggressive Stocks Forecast Package for the 1 Month time period. The top performing prediction from this package was BLNK with a return of 160.92%. NBR, and GUSH had notable returns of 107.99% and 75.63%. The package had an overall average return of 62.35%, providing investors with a premium of 58.77% over the S&P 500’s return of 3.58% during the same period.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.