Stock Predictions: Fast-Growing 5G Infrastructure Deployments Is A Tailwind For Corning

This Corning stock predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Corning stock predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Corning Stock Predictions Summary:

- Corning Incorporated’s stock price has a 6-month return of -13.69%. It is now cheaper to own.

- The depressed stock price of GLW gave it a much lower Price/Sales valuation ratio than its peers, INTC, QCOM, and CSCO.

- Corning has an emerging growth driver in 5G. Intel and Verizon are now partners with Corning’s fiber optics-centric 5G infrastructure deployment.

- It is not only smartphones that’s driving 5G adoption. Businesses, factories, homes, offices, are all future 5G adopters.

- The global 5G infrastructure market is growing at 95.8% from 2018 to 2025. It will have a market size of $58.17 billion by 2025.

Now is the time to go long on Corning Incorporated (GLW). The -13.69% 6-month price return of GLW made if more affordable. Due to its recent dip in price, Corning’s stock now has a lower Price/Sales valuation than its peers. Please study the chart below, GLW has better 5-year revenue growth rate than its peers. However, Corning’s stock now has a notably lower Price/Sales ratio than industry peers like Intel (INTC), Qualcomm (QCOM), and Cisco (CSCO).

It is a bargain buying opportunity whenever GLW trades at 2.02x Price/Sales ratio. Corning is the number one in fiber optic connectivity. My long-term view is that Corning can also become a leader in wireless 5G infrastructure deployment. Intel chose Corning as its partner on in-building 5G (5th Generation) network deployment. Corning was chosen by Intel probably because of its long experience in scalable all-fiber infrastructure Distributed Antenna System (DAS) for wireless operators and enterprise users.

DAS is the pre-dominant choice for indoor/outdoor base stations for 3G/4G connectivity. Huawei is proposing its DIS or Digital Indoor Systems for in-building 5G. However, Huawei will have a hard time convincing American firms like Intel to support the new DIS standard.

Intel will most likely depend on Corning’s ONE Wireless Platform to design in-building 5G networks for small and large enterprise offices. Corning ONE is the first future-ready, all-optical cellular, Wi-Fi, and Ethernet Backhaul solution for enterprise and wireless operators. Intel’s massive list of enterprise or data center customers can help Corning sell more of its wireless 5G infrastructure solutions.

Verizon also chose Corning’s fiber-optic cables to power its 5G rollout for factories and retail stores. Corning is helping Verizon build a 5G network for Internet of Things and manufacturing centers. Going forward, Corning can play a large role in enabling the 5G internet connectivity of buildings and smart devices.

Verizon and Intel are potent partners who can help Corning get a sizable market share in the fast-growing 5G infrastructure business. Allied Market Research reported that the 5G infrastructure industry is enjoying a CAGR of 95.8% from 2018 to 2025. Six years from now, the business of setting up 5G networks/connectivity will be worth $58.17 billion/year.

Why It Matters

The 5G-related products of Corning like the ONE Wireless Platform is under its biggest business segment, Optical Communications. The emerging global adoption of 5G is obviously a welcome tailwind for Corning’s most important revenue/profit generator. With the help of Intel, Verizon, and other partners, Corning can leverage the 5G infrastructure boom to improve the $1.1 billion/quarter revenue of its Optical Communications segment.

Going forward, my fearless forecast is that Optical Communications can deliver double-digit year-over-year growth rate through 5G infrastructure deployments. It will not surprise me if Corning will end 2020 with $5 billion in annual sales from Optical Communications.

Consequently, stronger sales for Optical Communications can boost Corning’s bottom line. Better profitability can help Corning maintain its good dividend history. For the past eight years, Corning has consistently increased its dividend payments.

My fearless prediction is that Corning can again deliver double-digit growth in dividend payments for the next three years. Corning only needs to win more 5G infrastructure deployment contracts to make my prediction come true.

It is also a tailwind for Corning that there’s a persistent anti-Huawei feeling in the West. Without Huawei and its DIS design, Corning’s single-mode fiber DAS 5G network solutions will likely find more customers. Like Cisco, Corning also benefits from the anti-Huawei stance of the U.S. and its allies.

Conclusion

GLW is a buy. Corning is leader in fiber optics and display technologies. The rising adoption of 5G connectivity in smartphones, laptops, smart devices, and Internet of Things will boost Corning’s Optical Communications and Display Technologies business segments. Thanks to 5G, these two biggest segments of Corning will likely see double-digit revenue growth rate until 2023.

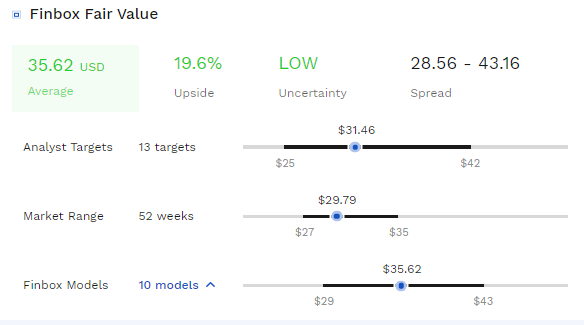

Using 10 DCF valuation models, Finbox gave GLW an average fair value price of $35.62. I agree with Finbox’s assessment. Due to its many patents and key technologies on fiber optics and displays, Corning’s stock deserves a fair value of $35.

My buy recommendation for GLW is congruent with its bullish one-year algorithmic market trend score from I Know First. Corning’s stock got a one-year score of 141.15. It is also important to note that I Know First stock prediction has a high score of 0.75 on GLW. I Know First stock prediction algorithms have a great track record of correctly predicting the 12-month market trend patterns of GLW.

I Know First Stock Predictions

Here at I Know First, our stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock predictions, gold price predictions, currency forecast and, in particular, Apple stock predictions. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our algorithmic trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

Please note-for trading decisions use the most recent forecast.

To subscribe today click here.