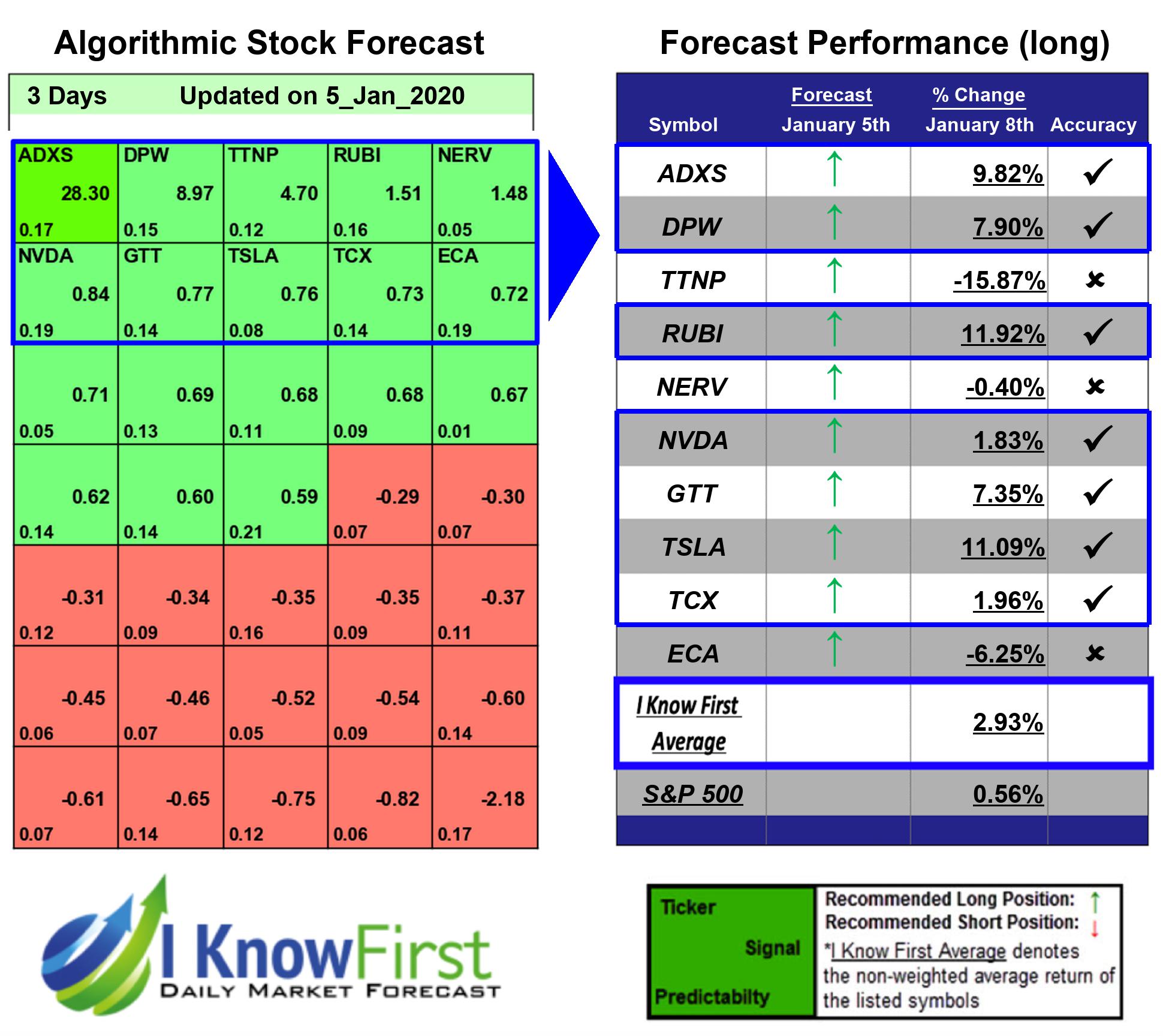

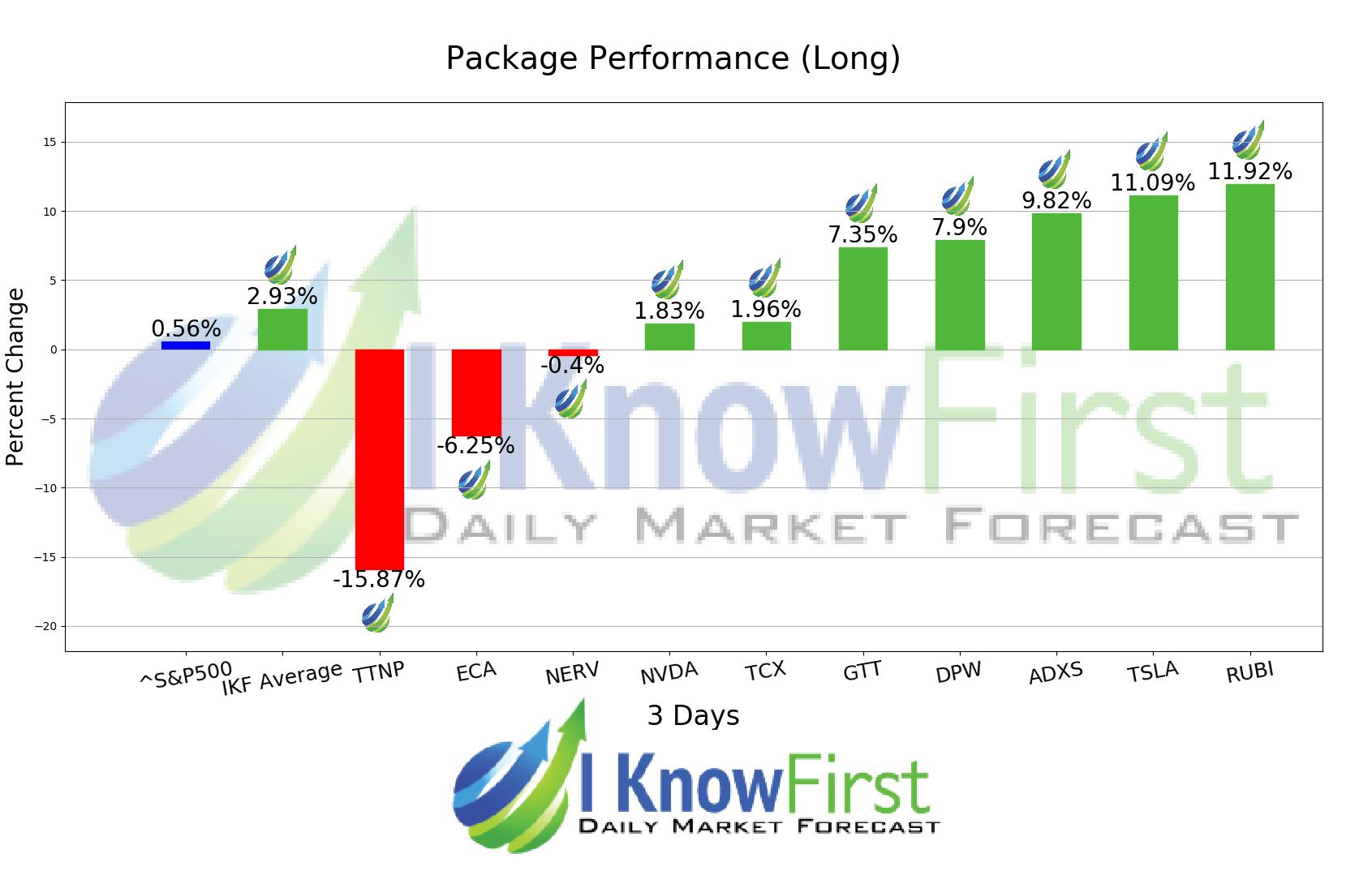

Stock Predictions Based on Big Data Analytics: Returns up to 11.92% in 3 Days

Stock Predictions

An insider is legally permitted to buy and sell shares of the firm – and any subsidiaries – that employs him or her. However, these transactions must be properly registered with the Securities and Exchange Commission (SEC) and are done with advance filings. You can find details of this type of insider trading on the SEC’s EDGAR database. These algorithmic stock predictions are for stocks with recently reported insiders’ transactions.

An “insider” is any person who possesses at least one of the following:

- access to valuable non-public information about a corporation (for example a company’s directors and high-level executives)

- ownership of more than 10% of the company’s equity

Package Name: Insider Trades

Recommended Positions: Long

Forecast Length: 3 Days (1/5/2020 – 1/8/2020)

I Know First Average: 2.93%

The algorithm correctly predicted 7 out 10 of the suggested trades in the Insider Trades Package for this 3 Days forecast. The greatest return came from RUBI at 11.92%. TSLA and ADXS also performed well for this time horizon with returns of 11.09% and 9.82%, respectively. This algorithmic forecast package presented an overall return of 2.93% versus S&P 500’s performance of 0.56% providing a market premium of 2.37%.

The Rubicon Project, Inc. (RUBI), a technology company, engages in automating the buying and selling of advertising. The company offers advertising automation platform that creates and powers a marketplace for buyers and sellers to readily buy and sell advertising at scale. Its advertising automation platform features applications for digital advertising sellers, including Websites, mobile applications, and other digital media properties to sell their advertising inventory; applications and services for buyers comprising advertisers, agencies, agency trading desks, demand side platforms, and ad networks to buy advertising inventory; and a marketplace over which such transactions are executed. The company was founded in 2007 and is headquartered in Los Angeles, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.