Stock Predictions Based On Artificial Intelligence: Up to 15.57% Return in 14 Days

Stock Predictions

This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

- top ten aggressive stocks picks that best fit for long position

- top ten aggressive stocks picks that best fit for short position

- top ten conservative stocks picks that best fit for long position

- top ten conservative stocks picks that best fit for short position

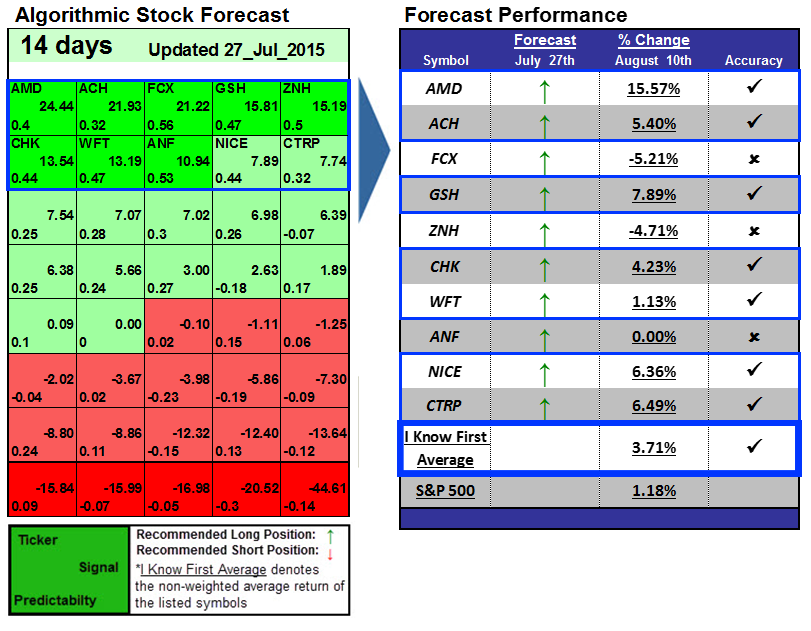

Package Name: Risk-Conscious Forecast Length: 14 Days (7/27/2015 – 8/10/2015)

Forecast Length: 14 Days (7/27/2015 – 8/10/2015)

I Know First Average: 3.71%

Get the “Risk-Conscious” Package.

The top 10 stocks for the short position were included in the Risk-Conscious forecast from 07/27/15 that was part of the Risk-Conscious Package. For the long position AMD had the best performance during the predicted time horizon with a solid return of 15.57% (long). Other stocks (long) with positive performances during the time horizon were GSH and CTRP with returns of 7.89% and 6.49%.

Regarding GSH, there are a number of brokerage firms which offer projections on earnings and future stock movement of the stock. On a technical level the stock has a 50 Days Moving Average of 25.34 and the price to earnings ratio, or the valuation ratio of a company’s current share price compared to its per-share earnings sits at 27.14. This is an important indicator as a higher ratio typically suggests that investors are expecting higher future earnings growth compared to companies in the same industry with lower price to earnings ratios. When calculating in the EPS estimates for the current year from sell-side analysts, the Price to current year EPS stands at 1221.50. Investors looking further ahead, will note that the Price to next year’s EPS is 814.33.

Business overview: Guangshen Railway Company Limited (NYSE:GSH) is engaged in passenger and freight transportation businesses, the Hong Kong Through Train passenger services in cooperation with MTR Corporation Limited (the MTR’, and management services for commissioned transportation for other railway companies in China. The Company is also engaged in the provision of integrated services in relation to railway facilities and technology, commercial trading and other industrial businesses.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.