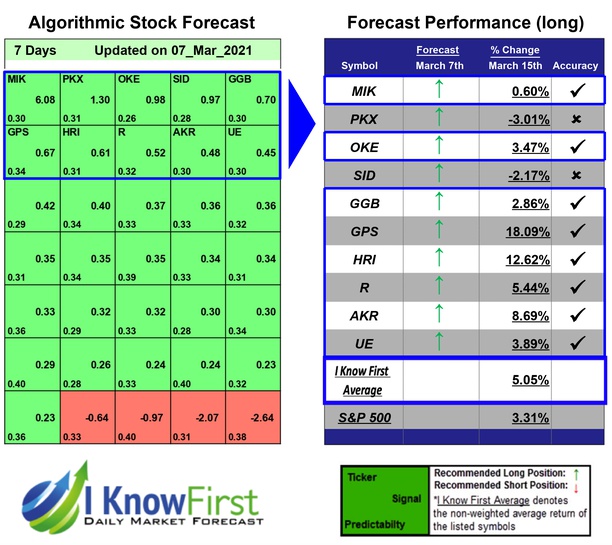

Stock Predictions Based on Artificial Intelligence: Returns up to 18.09% in 7 Days

Stock Predictions

An insider is legally permitted to buy and sell shares of the firm – and any subsidiaries – that employs him or her. However, these transactions must be properly registered with the Securities and Exchange Commission (SEC) and are done with advance filings. You can find details of this type of insider trading on the SEC’s EDGAR database. This algorithmic forecast is for stocks with recently reported insiders’ transactions.

An “insider” is any person who possesses at least one of the following:

- access to valuable non-public information about a corporation (for example a company’s directors and high-level executives)

- ownership of more than 10% of the company’s equity

Package Name: Insider Trades

Recommended Positions: Long

Forecast Length: 7 Days (3/7/21 – 3/15/21)

I Know First Average: 5.05%

For 7 Days stock predictions the algorithm had successfully predicted 8 out of 10 movements. The highest trade return came from GPS, at 18.09%. HRI and AKR followed with returns of 12.62% and 8.69% for the 7 Days period. The overall average return in this Insider Trades package was 5.05%, providing investors with a 1.74% premium over the S&P 500’s return of 3.31% during the same period.

The Gap, Inc. operates as an apparel retail company worldwide. It offers apparel, accessories, and personal care products for men, women, and children under the Gap, Banana Republic, Old Navy, Athleta, and Intermix brands. The company provides apparel, eyewear, jewelry, shoes, handbags, and fragrances; and performance and lifestyle apparel for use in yoga, strength training, and running, as well as seasonal sports, including skiing and tennis. The Gap, Inc. offers its products through company-operated stores, franchise stores, Websites, e-commerce and social media sites, and catalogs. The company has franchise agreements with unaffiliated franchisees to operate Gap, Banana Republic, and Old Navy stores in Asia, Australia, Europe, Latin America, the Middle East, and Africa. As of August 11, 2016, it operated 3,300 company-operated stores and 450 franchise stores. The company was founded in 1969 and is headquartered in San Francisco, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.