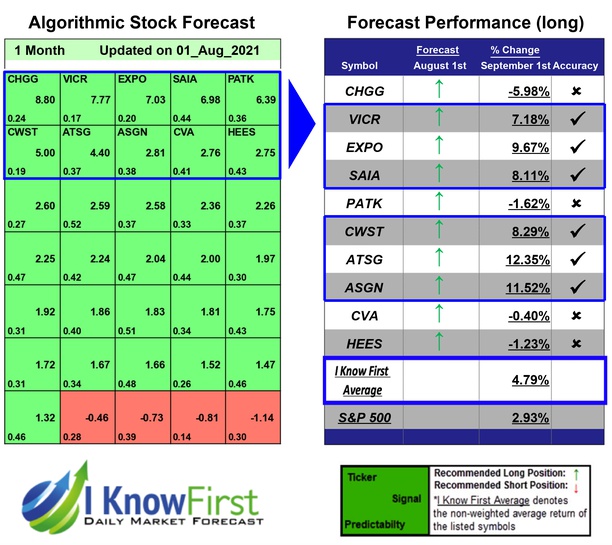

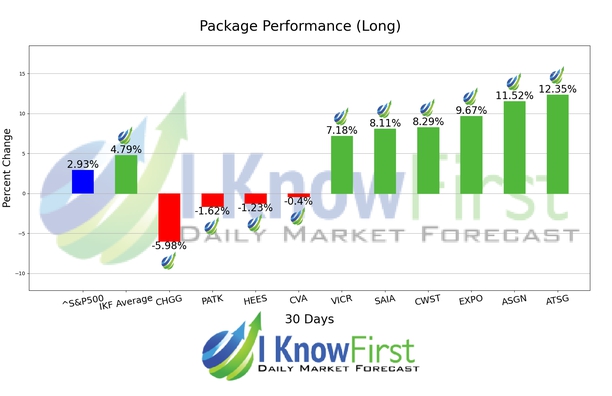

Stock Picking Based on Machine Learning: Returns up to 12.35% in 1 Month

Stock Picking

This Stock Picking Basic Industry forecast is designed for investors and analysts who need daily stock market predictions of the best-performing stocks for the whole Basic Industry (see Basic Industry Stocks Package). It includes 20 stocks with bullish and bearish signals and indicates the best basic industry stocks to buy based on artificial intelligence:

- Top 10 Basic Industry stocks for the long position

- Top 10 Basic Industry stocks for the short position

Package Name: Basic Industry Forecast

Recommended Positions: Long

Forecast Length: 1 Month (8/1/21 – 9/1/21)

I Know First Average: 4.79%

For this 1 Month forecast the algorithm had successfully predicted 6 out of 10 movements. ATSG was our best stock pick this week a return of 12.35%. ASGN and EXPO saw outstanding returns of 11.52% and 9.67%. This algorithmic forecast package presented an overall return of 4.79% versus S&P 500’s performance of 2.93% providing a market premium of 1.86%.

Air Transport Services Group, Inc. (ATSG), incorporated on September 5, 2007, is a holding company. The Company provides airline operations, aircraft leases, aircraft maintenance and other support services primarily to the cargo transportation and package delivery industries. The Company offers aircraft, crew, maintenance and insurance (ACMI) for specified cargo operations. The Company’s segments include ACMI Services and CAM. Through the Company’s subsidiaries, it offers a range of complementary services to delivery companies, freight forwarders, airlines and government customers. ATSG’s leasing subsidiary, Cargo Aircraft Management, Inc. (CAM), leases cargo aircraft to ATSG’s airlines, as well as to non-affiliated airlines and other lessees. Airborne Global Solutions, Inc. (AGS) is its subsidiary that assists the Company’s businesses in marketing plans and provides sales leads to its subsidiaries by identifying customers’ business and operational requirements. The Company owns two airlines, ABX Air, Inc. (ABX) and Air Transport International, Inc. (ATI). ABX operates Boeing 767 freighter aircraft, while ATI operates Boeing 767 and Boeing 757 freighter and 757 combi aircraft. The Company’s other business operations include aircraft maintenance and modification services; aircraft part sales and brokerage; equipment and facility maintenance, mail and package sorting, and flight support.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.