Stock Market Trends Based on Algo Trading: Returns up to 8.25% in 14 Days

Stock Market Trends

This Utilities Stocks forecast is designed for investors and analysts who need predictions and stock market trends to buy for the whole Industry. It includes 10 stocks with bullish and bearish signals and indicates the best utilities stocks to buy:

- Top 10 Utilities stocks for the long position

- Top 10 Utilities stocks for the short position

Package Name: Utilities Stocks

Recommended Positions: Long

Forecast Length: 14 Days (9/18/2020 – 10/4/2020)

I Know First Average: 1.23%

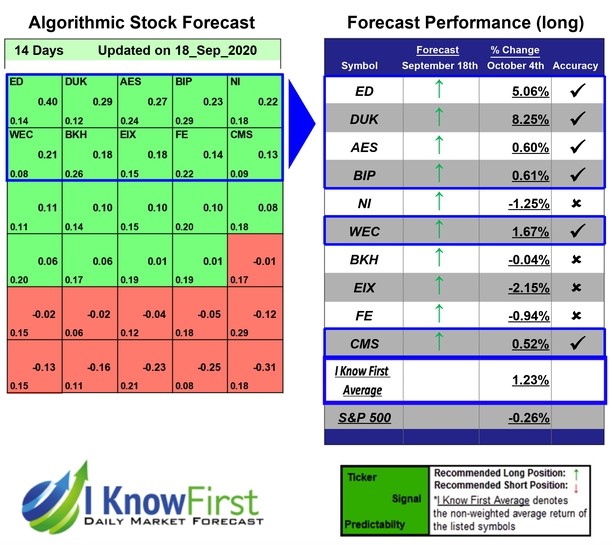

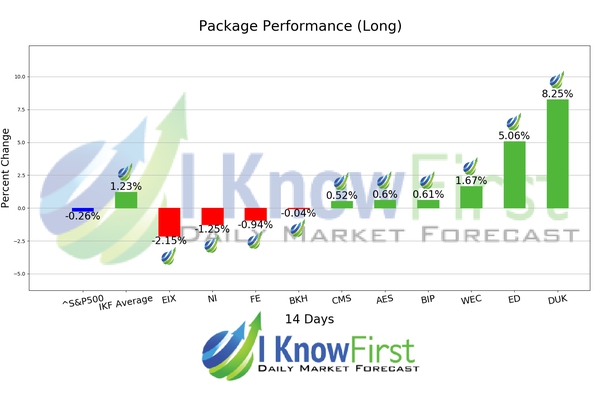

Several predictions in this 14 Days forecast saw significant returns. The algorithm had correctly predicted 6 out 10 stock movements. DUK was the highest-earning trade with a return of 8.25% in 14 Days. ED and WEC saw outstanding returns of 5.06% and 1.67%. With these notable trade returns, the package itself registered an average return of 1.23% compared to the S&P 500’s return of -0.26% for the same period.

Duke Energy Corporation (DUK), together with its subsidiaries, operates as an energy company in the United States and Latin America. It operates through three segments: Regulated Utilities, International Energy, and Commercial Portfolio. The Regulated Utilities segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, Ohio, Kentucky, and Indiana; and transports and sells natural gas in southwestern Ohio and northern Kentucky. This segment owns approximately 50,000 megawatts (MW) of generation capacity; and uses coal, hydroelectric, natural gas, oil, and nuclear fuel to generate electricity. It serves approximately 7.4 million retail electric customers in 6 states in the Southeast and Midwest regions of the United States with a service area covering approximately 95,000 square miles; and approximately 525,000 retail natural gas customers in southwestern Ohio and northern Kentucky. This segment is also involved in the wholesale of electricity to incorporated municipalities, electric cooperative utilities, and other load-serving entities. The International Energy segment operates and manages power generation facilities; and markets and sells electric power, natural gas, and natural gas liquids. This segment serves retail distributors, electric utilities, independent power producers, marketers, and industrial and commercial companies. The Commercial Portfolio segment acquires, builds, develops, and operates wind and solar renewable generation and energy transmission projects. Its portfolio includes nonregulated renewable energy, electric transmission, natural gas infrastructure, and energy storage businesses. This segment has 22 wind farms and 38 commercial solar farms with a capacity of 2,400 MW across 11 states. The company was formerly known as Duke Energy Holding Corp. and changed its name to Duke Energy Corporation (DUK) in April 2005. Duke Energy Corporation (DUK) was incorporated in 2005 and is headquartered in Charlotte, North Carolina.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.