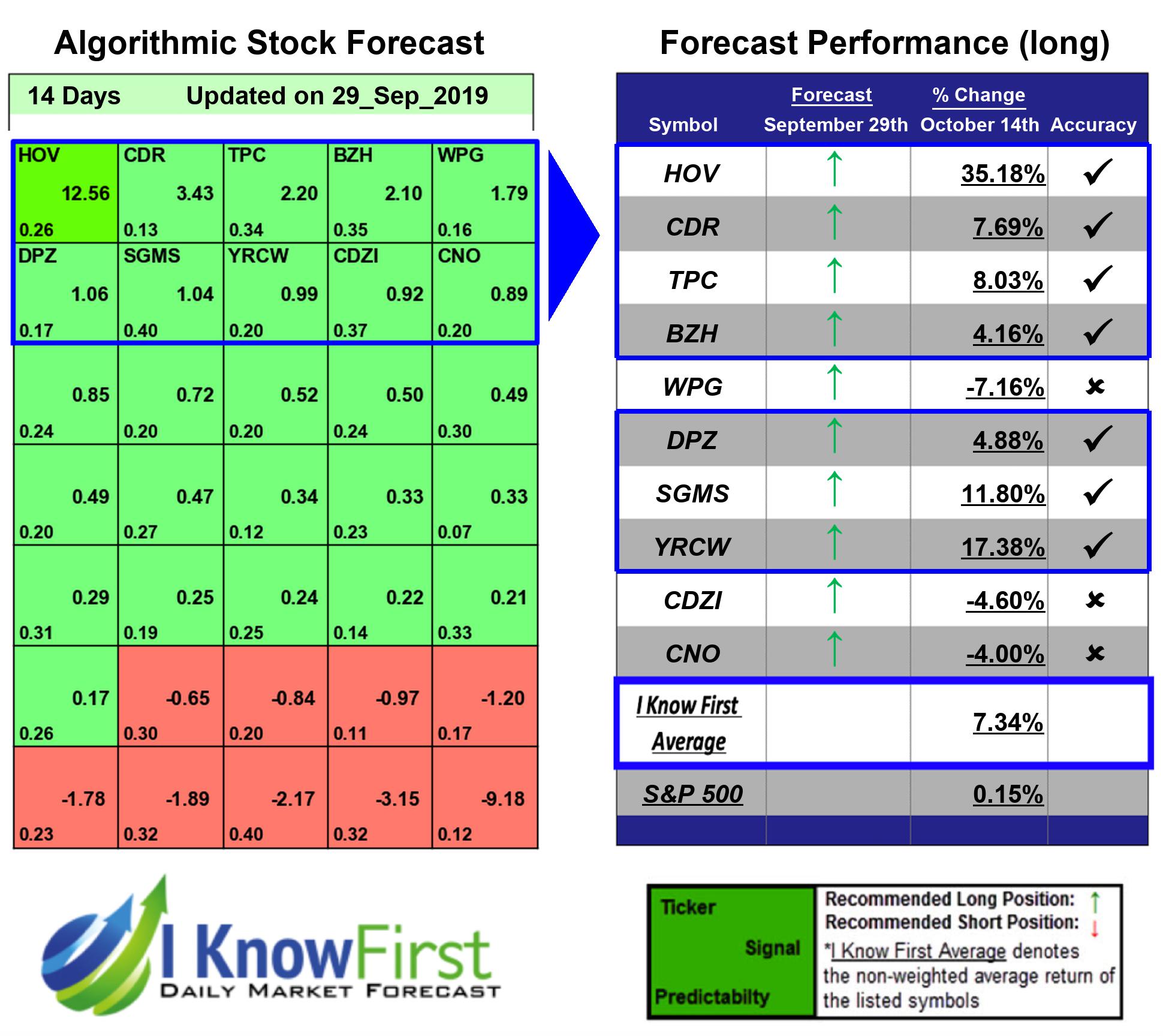

Stock Market Outlook Based on Stock Prediction Algorithm: Returns up to 35.18% in 14 Days

Stock Market Outlook

The Fundamental Package includes our algorithmic stock market outlook for stocks screened by fundamental criteria. Our algorithms help you find best opportunities for both long and short positions for the stocks within each fundamental screen. The stocks are selected according to five basic valuation categories:

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

- short ratio

Package Name: Fundamental – Low Price-to-Book ratio Stocks

Recommended Positions: Long

Forecast Length: 14 Days (9/29/2019 – 10/14/2019)

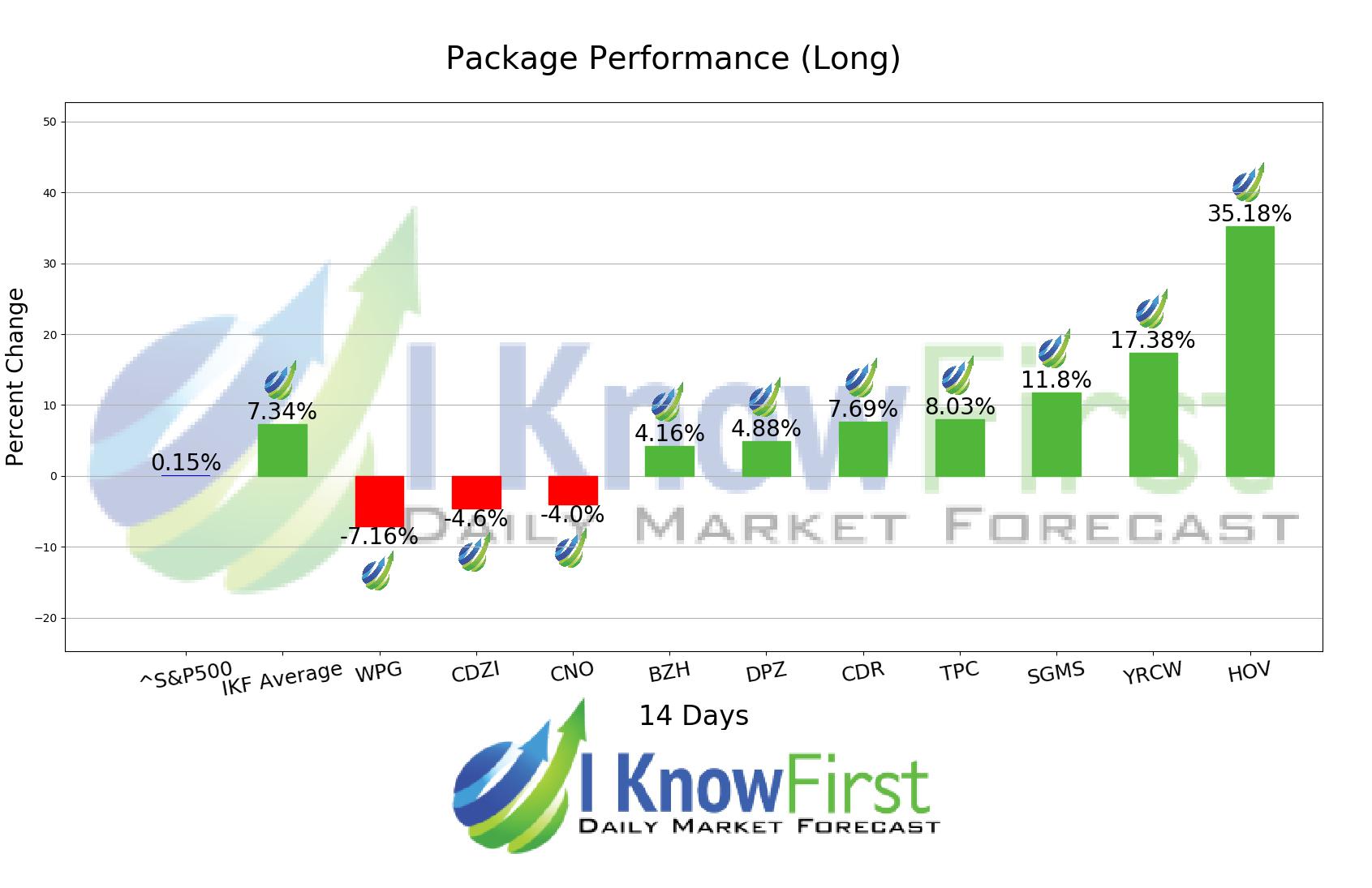

I Know First Average: 7.34%

In this 14 Days forecast for the Fundamental – Low Price-to-Book ratio Stocks Package, there were many high performing trades and the algorithm correctly predicted 7 out 10 trades. HOV was the highest-earning trade with a return of 35.18% in 14 Days. YRCW and SGMS followed with returns of 17.38% and 11.8% for the 14 Days period. With these notable trade returns, the package itself registered an average return of 7.34% compared to the S&P 500’s return of 0.15% for the same period.

Hovnanian Enterprises, Inc. designs, constructs, markets, and sells residential homes in the United States. It constructs single-family detached homes, attached townhomes and condominiums, urban infill, and active lifestyle homes. The company markets its build homes for first-time buyers, first-time and second-time move-up buyers, luxury buyers, active lifestyle buyers, and empty nesters in 219 communities in 34 markets. It also provides financial services comprising originating mortgages from homebuyers and selling such mortgages in the secondary market, as well as offers title insurance services. The company was founded in 1959 and is headquartered in Red Bank, New Jersey.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.