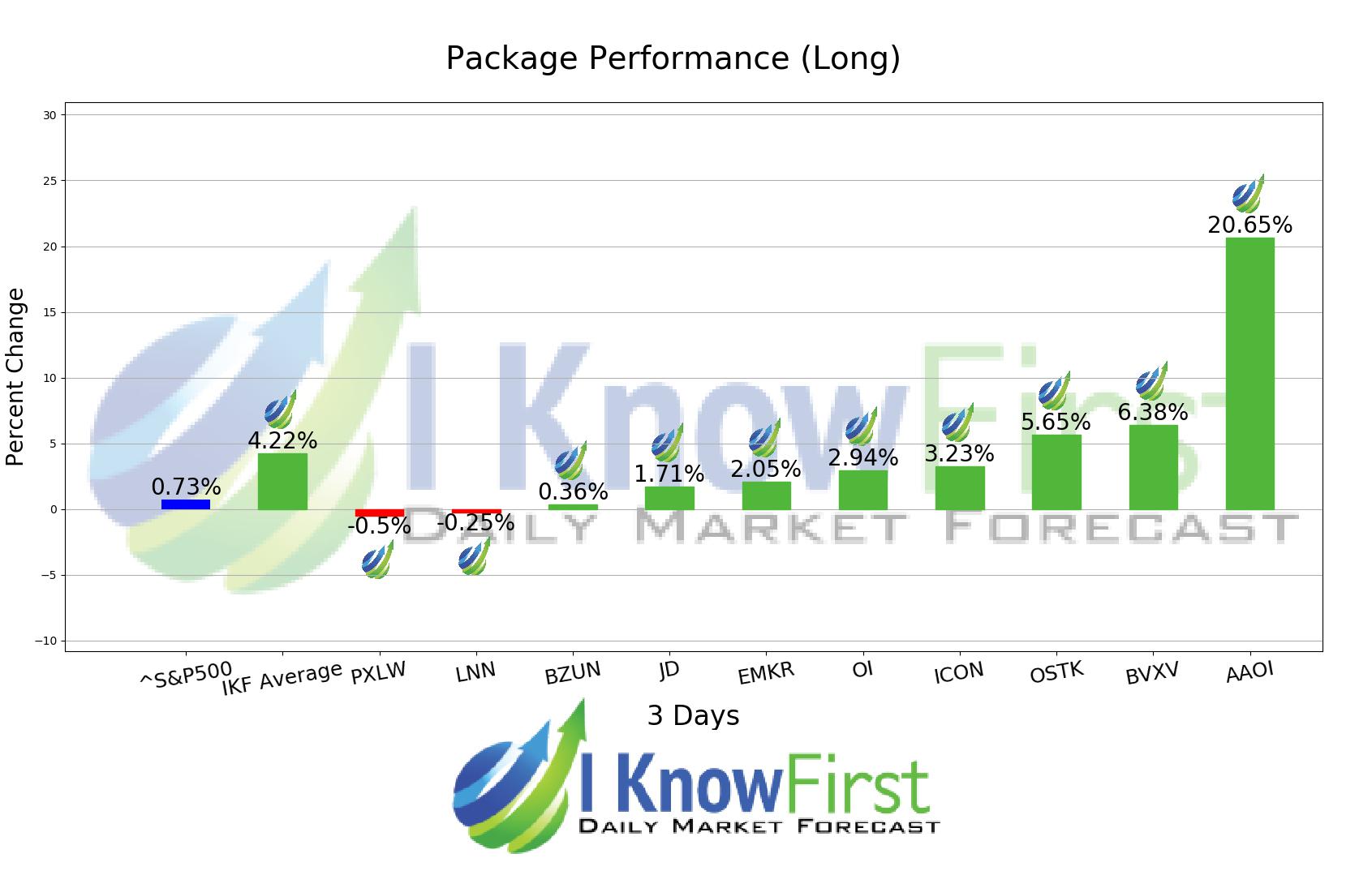

Stock Market Outlook Based on Stock Market Algorithm: Returns up to 20.65% in 3 Days

Stock Market Outlook

The Fundamental Package includes our algorithmic stock market outlook for stocks screened by fundamental criteria. Our algorithms help you find best opportunities for both long and short positions for the stocks within each fundamental screen. The stocks are selected according to five basic valuation categories:

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

- short ratio

Package Name: Fundamental – Low PEG Stocks

Recommended Positions: Long

Forecast Length: 3 Days (1/12/2020 – 1/15/2020)

I Know First Average: 4.22%

I Know First’s State of the Art Algorithm accurately forecasted 8 out of 10 trades in this Fundamental – Low PEG Stocks Package for the 3 Days time period. AAOI was our best stock pick this week a return of 20.65%. BVXV, and OSTK had notable returns of 6.38% and 5.65%. With these notable trade returns, the package itself registered an average return of 4.22% compared to the S&P 500’s return of 0.73% for the same period.

Applied Optoelectronics, Inc., incorporated on March 25, 2013, is a vertically integrated provider of fiber-optic networking products, primarily for networking end markets, such as Internet data center, cable television (CATV), fiber-to-the-home (FTTH) and telecommunications (telecom). The Company designs and manufactures a range of optical communications products at varying levels of integration, from components, subassemblies and modules to turnkey equipment. To Internet-based (Web 2.0) data center operators, the Company supplies optical transceivers that plug into switches and servers within the data center and allow these network devices to send and receive data over fiber optic cables. The Company supplies a range of products, including lasers, transmitters and transceivers, and turnkey equipment, to the CATV market.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.