Stock Market Opportunities at Coronavirus Times Based on Machine Learning: Returns up to 10.67% in 7 Days

Stock Market Opportunities at Coronavirus Times

This Coronavirus Stock Market Forecast identifies the most affected stocks in negative way while also highlighting the opportunities arising in the stock market during these extraordinary market situation. The package covers the assets that may be affected by the coronavirus with the biggest financial exposures and it includes assets such as gold and relevant commodities, biotech companies’ stocks, pharmaceutical companies’ stocks, semiconductors and technological sectors stocks and more.

- Top 10 stocks for the long position

- Top 10 stocks for the short position

Package Name: Coronavirus Stock Market Forecast

Recommended Positions: Long

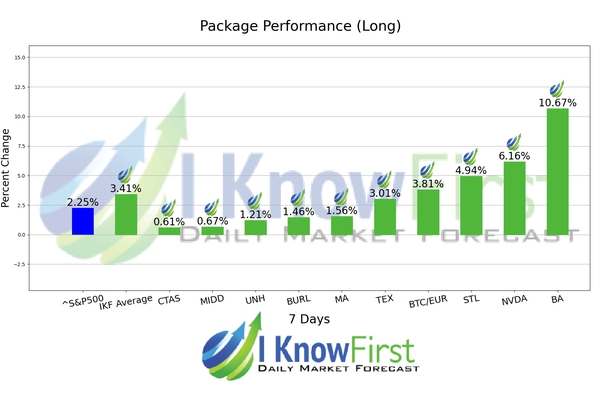

Forecast Length: 7 Days (3/10/21 – 3/17/21)

I Know First Average: 3.41%

10 out of 10 stock prices in this forecast for the Coronavirus Stock Market Forecast Package moved as predicted by the algorithm. The top performing prediction from this package was BA with a return of 10.67%. The suggested trades for NVDA and STL also had notable 7 Days yields of 6.16% and 4.94%, respectively. This algorithmic forecast package presented an overall return of 3.41% versus S&P 500’s performance of 2.25% providing a market premium of 1.16%.

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight, and launch systems and services worldwide. The company operates in five segments: Commercial Airplanes, Boeing Military Aircraft, Network & Space Systems, Global Services & Support, and Boeing Capital. The Commercial Airplanes segment develops, produces, and markets commercial jet aircraft for various passenger and cargo requirements, as well as provides related support services to the commercial airline industry. This segment also offers aviation services support, aircraft modifications, spare parts, training, maintenance documents, and technical advice to commercial and government customers. The Boeing Military Aircraft segment is involved in the research, development, production, and modification of manned and unmanned military aircraft and weapons systems for the global strike, vertical lift, and autonomous systems, as well as mobility, surveillance, and engagement. The Network & Space Systems segment engages in the research, development, production, and modification of electronics and information solutions; strategic missile and defense systems; space and intelligence systems; and space exploration products. The Global Services and Support segment offers integrated logistics, including supply chain management and engineering support; maintenance, modification, and upgrades for aircraft; and training systems and government services, such as pilot and maintenance training. The Boeing Capital segment facilitates, arranges, structures, and provides financing solutions, such as equipment under operating leases, finance leases, notes and other receivables, assets held for sale or re-lease, and investments. The Boeing Company was founded in 1916 and is headquartered in Chicago, Illinois.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.