Stock Market Opportunities at Coronavirus Times Based on Deep Learning: Returns up to 14.25% in 14 Days

Stock Market Opportunities at Coronavirus Times

This Coronavirus Stock Market Forecast identifies the most affected stocks in negative way while also highlighting the opportunities arising in the stock market during these extraordinary market situation. The package covers the assets that may be affected by the coronavirus with the biggest financial exposures and it includes assets such as gold and relevant commodities, biotech companies’ stocks, pharmaceutical companies’ stocks, semiconductors and technological sectors stocks and more.

- Top 10 stocks for the long position

- Top 10 stocks for the short position

Package Name: Coronavirus Stock Market Forecast

Recommended Positions: Long

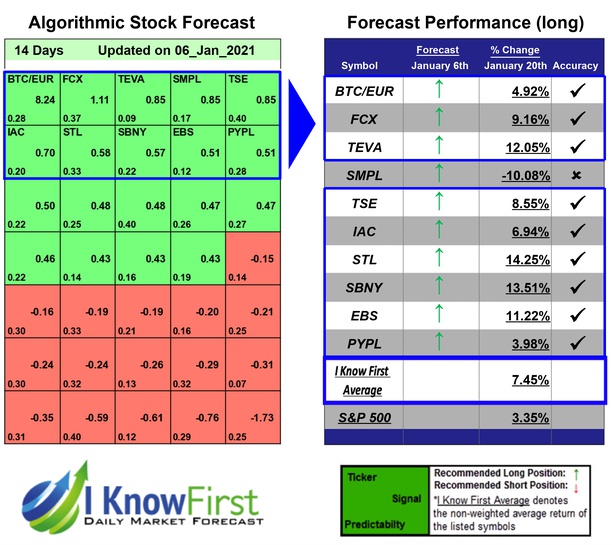

Forecast Length: 14 Days (1/6/21 – 1/20/21)

I Know First Average: 7.45%

I Know First’s State of the Art Algorithm accurately forecasted 9 out of 10 trades in this Coronavirus Stock Market Forecast Package for the 14 Days time period. STL was the top performing prediction with a return of 14.25%. The suggested trades for SBNY and TEVA also had notable 14 Days yields of 13.51% and 12.05%, respectively. The package saw an overall yield of 7.45% versus the S&P 500’s return of 3.35% implying a market premium of 4.10%.

Sterling Bancorp (STL) operates as the bank holding company for Sterling National Bank that provides various banking services to commercial, consumer, and municipal clients in the United States. The company accepts deposit products, such as savings deposits, demand deposits, certificates of deposit, money market deposits, senior notes, and other borrowings. Its loan portfolio includes commercial mortgages, residential mortgages, and other consumer loans; payroll finance, warehouse, factored receivables, and equipment finance lending; commercial and industrial loans; commercial real estate and multi-family loans; and acquisition, development, and construction loans. The company also offers wealth management products. As of December 31, 2015, it operated 52 full-service retail and commercial financial centers, which include 16 offices in Westchester County, 11 offices in Rockland County, 7 offices in Orange County, 2 offices in Long Island, and 12 offices in New York City, as well as 1 office in each of Ulster, Sullivan, and Putnam Counties in New York; and 1 office in Bergen County, New Jersey. Sterling Bancorp (STL) was founded in 1888 and is based in Montebello, New York.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.