Stock Market Forecast: I Know First World Indexes Coverage Update for 2021

Executive Summary:

- I Know First Provides an updated stock market forecast package of some 300 world indices

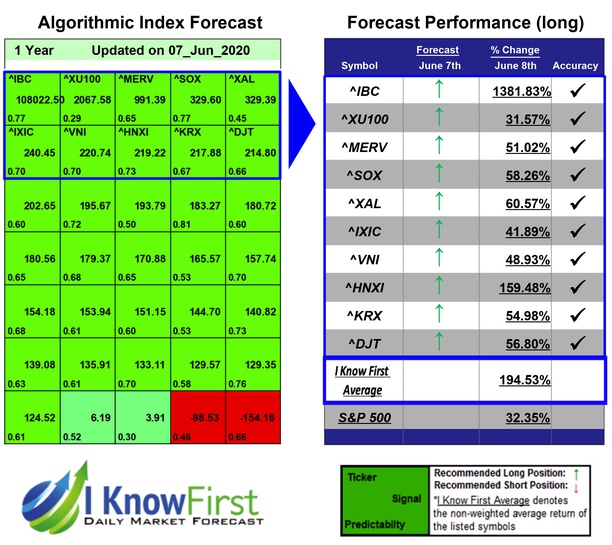

- The best performers are the ^HNXI (up 159.48% over 3-Month) and ^IBC (up 1382% over 3-Months).

- I Know First continues to perfect the AI algorithm and provides World Indices services to both institutional and private customers.

I Know First currently provides daily stock market forecast for almost 300 equity and other types’ indices including a mix of geographical, volatility, and sector-specific and asset type measures. In particular, I Know First has recently added coverage of regional, sector-specific, and interest rate indexes from around the globe, such as the Nifty 500 and the TA-90 index have been added. However, over the past year alone I Know First has increased the world indices coverage by some 178%.

The World Indices Package is one of I Know First’s quantitative investment solutions. The world indices stock market forecast is determined by screening the database daily using the advanced algorithm.

World Indices Market Forecast – I Know First Recent Performance

One of the best performing regional indices in terms of signal, predictability, and returns in the table above is the Hanoi Stock Exchange Index (^HNXI) with a 27.61% 3-months return (Figure 1) from 2nd March 2021 to 2nd June 2021. Another extraordinary performing index was ^IBC (Caracas Stock Exchange) that showed almost 1382% growth over the year-long period ending on June 8th.

Finally, from the above figure, we can see that our proprietary AI algorithm was successful in predicting a few very important US stock market indices such as NASDAQ 100 (^IXIC), Dow Jones Transportation Index (^DJT), as well as NYSE Arca Airline Index (^XAL) – besides high signal values provided a year ago during the most volatile market time due to COVID-19 crisis, the algorithm provided a high degree of confidence for its predictions reflected by predictability values ranging from 0.45 to 0.7. While the above are specific cases, I Know First published recently an evaluation report for the stock market predictions that our AI algorithm provided over last year featuring the hit ratios for S&P 500, NASDAQ, SPY, and more market indices.

How to interpret these diagrams.

Please note – for trading decisions use the most recent forecast. Get today’s stock market forecast.

The Structure of the Updated Package

I Know First currently generates daily stock market forecast for over 10,500 assets, covering some 89% of the MSCI All Country World Index, 106 Equity ETFs, and is continuing to expand its coverage. Over the past year following requests from our clients I Know First has expanded its coverage of world indices. As a result, the full list of the world indices asset universe that I Know First cover as part of its daily stock market forecast:

| Ticker | Description |

| ^5SP10 | S&P 500 Energy Sector |

| ^5SP2030 | S&P 500 TRANSPORTATION INDEX (INDUST) |

| ^AEX | AMSTERDAM SE EOE INDEX |

| ^ALLGOVB | ALL GOV BOND |

| ^ALLINDB | ALL INDEXD BONDS |

| ^AORD | S&P ASX ALL ORD INDEX |

| ^APAPR.T | PAPER & PULP |

| ^ATG | ATHENS SE GENERAL INDEX |

| ^ATX | VIENNA SE AUSTRIAN TRADED IDX |

| ^AUX | ISE Australian Dollar FX Spot |

| ^AXJO | S&P ASX 200 INDEX |

| ^BBUF246T | .BBUF246T |

| ^BCOMAL | Bloomberg Aluminum Subindex |

| ^BCOMBO | Bloomberg Soybean Oil Subindex |

| ^BCOMCC | Bloomberg Cocoa Subindex |

| ^BCOMCL | Bloomberg WTI Crude Oil Subindex |

| ^BCOMCL1 | Bloomberg WTI Crude Oil Subindex 1 M |

| ^BCOMCL1T | Bloomberg WTI Crude Oil Subindex 1 M |

| ^BCOMCL2 | Bloomberg WTI Crude Oil Subindex 2 M |

| ^BCOMCL2T | Bloomberg WTI Crude Oil Subindex 2 M |

| ^BCOMCL3 | Bloomberg WTI Crude Oil Subindex 3 M |

| ^BCOMCL3T | Bloomberg WTI Crude Oil Subindex 3 M |

| ^BCOMCL6 | Bloomberg WTI Crude Oil Subindex 6 M |

| ^BCOMCL6T | Bloomberg WTI Crude Oil Subindex 6 M |

| ^BCOMCLTR | Bloomberg WTI Crude Oil Subindex Tot |

| ^BCOMCN | Bloomberg Corn Subindex |

| ^BCOMCN2 | Bloomberg Corn Subindex 2 Month Forward |

| ^BCOMCO | Bloomberg Brent Crude Subindex |

| ^BCOMCO1 | Bloomberg Brent Crude Subindex 1 Mon |

| ^BCOMCO1T | Bloomberg Brent Crude Subindex 1 Mon |

| ^BCOMCO2 | Bloomberg Brent Crude Subindex 2 Mon |

| ^BCOMCO2T | Bloomberg Brent Crude Subindex 2 Mon |

| ^BCOMCO3 | Bloomberg Brent Crude Subindex 3 Mon |

| ^BCOMCO3T | Bloomberg Brent Crude Subindex 3 Mon |

| ^BCOMCO6 | Bloomberg Brent Crude Subindex 6 Mon |

| ^BCOMCO6T | Bloomberg Brent Crude Subindex 6 Mon |

| ^BCOMCOT | Bloomberg Brent Crude Subindex Total |

| ^BCOMF1 | Bloomberg Commodity Index 1 Month Fo |

| ^BCOMFC | Bloomberg Feeder Cattle Subindex |

| ^BCOMHG1T | Bloomberg Copper Subindex 1 Month Fo |

| ^BCOMKC | Bloomberg Coffee Subindex |

| ^BCOMKW | Bloomberg Kansas Wheat Subindex |

| ^BCOMLH | Bloomberg Lean Hogs Subindex |

| ^BCOMNG | Bloomberg Natural Gas Subindex |

| ^BCOMNG2 | Bloomberg Natural Gas Subindex 2 Mon |

| ^BCOMNG2T | Bloomberg Natural Gas Subindex 2 Mon |

| ^BCOMNG3 | Bloomberg Natural Gas Subindex 3 Mon |

| ^BCOMNG3T | Bloomberg Natural Gas Subindex 3 Mon |

| ^BCOMNI | Bloomberg Nickel Subindex |

| ^BCOMRBTR | Bloomberg Unleaded Gasoline Subindex |

| ^BCOMSB | Bloomberg Sugar Subindex |

| ^BCOMZS | Bloomberg Zinc Subindex |

| ^BFLY | The CBOE S&P 500 Iron Butterfly Inde |

| ^BFX | BRUSSELS SE BEL-20 INDEX |

| ^BKX | BANK |

| ^BNKILIQ | LIQUIDITY INDEX |

| ^BNSXFGG | LONG GILT ROLLING FUTURE INDEX |

| ^BNSXFOEE | BOBL ROLLING FUTURE INDEX |

| ^BNSXFRXE | BUND ROLLING FUTURE INDEX |

| ^BNSXFTYU | US TREASURY NOTE 10Y ROLLING FUTURE |

| ^BNSXFUSU | US TREASURY LONG BOND ROLLING FUTURE |

| ^BPVIX | CBOECME FX British Pound Volatility |

| ^BPX | ISE British Pound FX Spot |

| ^BRB | ISE Brazilian Real FX Spot |

| ^BSESN | BOMBAY SE SENSEX INDEX |

| ^BTK | BIOTECH INDEX |

| ^BUCODE | Bloomberg Brent Crude Subindex Euro |

| ^BVSP | BOVESPA INDEX |

| ^CDD | ISE Canadian Dollar FX Spot |

| ^CEX | S&P CHEMICALS |

| ^CIBCUS2B | Thomson Reuters US 2 year US Bond |

| ^CIISEMET | Citi Earnings Momentum Pure Europe T |

| ^CSE | COLOMBO SE ALL SHARE INDEX |

| ^CSI000001 | .CSI000001 |

| ^CSI000016 | SSE 50 INDEX |

| ^CSI000300 | CSI 300 INDEX |

| ^CSI000905 | .CSI000905 |

| ^CSI000985 | .CSI000985 |

| ^CTNGER | Bloomberg CMCI USD ER Natural Gas In |

| ^CTXBTR | Bloomberg CMCI USD TR RBOB Gasoline |

| ^DBODIXX | DeutscheBank Liquid CommodOil ER Idx |

| ^DFMGI | DFM GENERAL IDX |

| ^DJI | Dow Jones INDU AVERAGE NDX |

| ^DJT | Dow Jones TRAN AVERAGE NDX |

| ^DJU | Dow Jones UTIL AVERAGE NDX |

| ^dMGWD00000GUS | .dMGWD00000GUS |

| ^dMGWD00000NUS | .dMGWD00000NUS |

| ^dMGWD00000PUS | .dMGWD00000PUS |

| ^dMICN00000GAU | MSCI CHINA IDX |

| ^dMIEM00000PEU | MSCI International EMU Price Index E |

| ^dMIEO00000PUS | MSCI EURO INDEX USD |

| ^dMIJP000S0G | MSCI International Japan Small Gross |

| ^dMITR000LVG | .dMITR000LVG |

| ^dMIWD00000G | MSCI ACWI FREE |

| ^dMIWD00000GUS | MSCI ACWI FREE |

| ^DVSTXT | DYN VSTOXX TR INDEX |

| ^DXY | US DOLLAR INDEX |

| ^EGX100 | EGX 100 IDX |

| ^EGX30 | CASE 30 IDX |

| ^EUI | ISE European Dollar FX Spot |

| ^EUVIX | CBOECME FX Euro Volatility Index |

| ^EVZ | .EVZ |

| ^FCHI | CAC 40 INDICE |

| ^FRSID5BT | ROLLING STRAT TR INDEX |

| ^FRSIEUB | EUR Bond Futures Rolling Strategy In |

| ^FRSIJPB | JGB Futures Rolling Strategy Index |

| ^FRSIJPE | Japanese Equity Futures Rolling Stra |

| ^FRSIUSB | US Bond Futures Rolling Strategy Ind |

| ^FRSIUSE | US Equity Futures Rolling Strategy I |

| ^FTELSWH | .FTELSWH |

| ^FTFF | FT FIXED INTEREST 5-15 YEARS |

| ^FTFTEMSLU | FTSE Emerging Super Liquid Index |

| ^FTFTSEMIBN | .FTFTSEMIBN |

| ^FTFV | FT FIXED INTEREST 5 YEARS |

| ^FTIR | FIXED INTEREST IRREDEEMABLE |

| ^FTMC | FTSE 250 MID INDEX |

| ^FTMIB | FTSE MIB INDEX |

| ^FTOV | FIXED INTEREST OVER 15 YEARS |

| ^FTSE | FTSE 100 INDEX |

| ^FVX | 5 YR TSY YLD NDX |

| ^GDAX | DEUTSCHE BORSE DAX INDEX |

| ^GDAXI | GERMAN SE XETRA DAX INDEX |

| ^GSPTSE | S&PTSX COMP IDX |

| ^GVX | CBOECOMEX Gold Volatility Index |

| ^GVZ | CBOE GOLD VOL ID |

| ^HGX | HOUSING INDEX |

| ^HNXI | .HNXI |

| ^HSFI | HANG SENG FUTURES INDEX |

| ^HSI | HANG SENG INDEX |

| ^IBC | IBC I-IBC INDEX |

| ^IBC: | IBC I-IBC INDEX – Caracas Stock Exchange |

| ^IBEX | IBEX 35 COMPOSITE INDEX |

| ^ICEEX | ICE Euro FX Index |

| ^ICEJX | ICE Yen FX Index |

| ^ICET10MD | ICE US Treasury 10 – 20 Year Index |

| ^ICET1MD | ICE US Treasury 1 – 3 Year Index – M |

| ^ICET20IN | ICE U.S. Treasury 20+ Year Bond 1X I |

| ^ICET25TR | ICE U.S. Treasury 25+ Year TR Index |

| ^ICET7IN | ICE U.S. Treasury 7-10 Year Bond 1X |

| ^ICETCMD | ICE US Treasury Core Bond Index – Mo |

| ^ICETIP0TR | ICE U.S. TREASURY INFLATION LINKED B |

| ^ICETIPTR | ICE U.S. TREASURY INFLATION LINKED B |

| ^IPNG | ICE Natural Gas Index |

| ^IRTS | RTS1 INDEX |

| ^ISEQ | IRISH SE ISEQ OVERALL INDEX |

| ^ISEXFCP | ISTOXX EU MF P E INDEX |

| ^ISX10CHP | STX SW TM10 P E INDEX |

| ^ISX20JPP | STX JP TM20 P E INDEX |

| ^ISX60USP | STX US TM60 P E INDEX |

| ^IXIC | NASDAQ NMS COMPOSITE INDEX |

| ^JALSH | ALL SHARE |

| ^JKSE | JSX COMPOSITE INDEX |

| ^JNIV | NIKKEI VLTILITY INDEX |

| ^JPLAT | PLATINUM MIN |

| ^JPMDE10YCMY | GERMANY 10YR |

| ^JPMDE3YCMY | GERMANY 3YR |

| ^JPMDE5YCMY | GERMANY 5YR |

| ^JPMDE7YCMY | GERMANY 7YR |

| ^JPMFR10YCMY | FRANCE 10YR |

| ^JPMFR3YCMY | FRANCE 3YR |

| ^JPMFR5YCMY | FRANCE 5YR |

| ^JPMFR7YCMY | FRANCE 7YR |

| ^JPMGB10YCMY | UK 10YR |

| ^JPMGB3YCMY | UK 3YR |

| ^JPMGB5YCMY | UK 5YR |

| ^JPMGB7YCMY | UK 7YR |

| ^JPMJP10YCMY | JAPAN 10YR |

| ^JPMJP2YCMY | JAPAN 2YR |

| ^JPMJP3YCMY | JAPAN 3YR |

| ^JPMJP5YCMY | JAPAN 5YR |

| ^JPMJP7YCMY | JAPAN 7YR |

| ^JPMUS10YCMY | US 10YR |

| ^JPMUS2YCMY | US 2YR |

| ^JPMUS3YCMY | US 3YR |

| ^JPMUS5YCMY | US 5YR |

| ^JPMUS7YCMY | US 7YR |

| ^JYVIX | CBOECME FX Yen Volatility Index |

| ^KLSE | KLSE COMPOSITE INDEX |

| ^KRX | KBW REGION BANK |

| ^KS11 | KOREA SE KOSPI IDX |

| ^KS200 | KOREA SE KOSPI 200 INDEX |

| ^KSE | KARACHI SE 100 INDEX |

| ^MERV | BUENOS AIRES SE MERVAL INDEX |

| ^MID | .MID |

| ^MIEF0ECW0GUS | MSCI Emerging Markets Equal Country |

| ^MIEM00000GEU | MSCI International EMU Gross Index E |

| ^MIKR00002ZUS | MSCI Korea 25-50 100% Hedged to USD |

| ^MSCIEU | MSCI EUROPE IDX |

| ^MSCIWO | MSCI WORLD IDX |

| ^MXX | MXSE IPC INDEX |

| ^N100 | EURONEXT 100 ID |

| ^N225 | NIKKEI 225 INDEX |

| ^N225VF | N225 VI FUTURES |

| ^NBI | NASDAQ BIOTECH |

| ^NDX | NASDAQ 100 INDEX |

| ^NIF500TRI | NIFTY 500 TRI |

| ^NIFGS10 | NIFTY GS 10YR |

| ^NIFGS48 | NIFTY GS 4 8YR |

| ^NIFGS813 | NIFTY GS 8 13YR |

| ^NIFTY100 | .NIFTY100 |

| ^NIFTYFIN | .NIFTYFIN |

| ^NIFTYPSU | .NIFTYPSU |

| ^NSEI | INDIA INDEX SVC@S&P CNX NIFTY INDEX |

| ^NWX | AMERICAN SE NETWORK INDEX |

| ^NYA | NYSE COMPOSITE |

| ^OBX | OSLO OBX INDEX |

| ^OEX | S&P 100 INDEX |

| ^OIV | CBOENYMEX WTI Volatility Index |

| ^OMXC20 | KFX CASH |

| ^OMXHPI | HEL GENERAL INDEX |

| ^OMXS30 | STO OMX INDEX |

| ^OSEAX | ALL SHARE IDX GI |

| ^OSX | PHILADELPHIA SE OIL SVC SECTOR NDX |

| ^PFTLC | FTA 350 PE RATIO |

| ^PFTMC | FTA 250 PE RATIO |

| ^PFTVC | FTSE INTL NON-FIN PE RATIO |

| ^PSI | PHILIPPINE SE COMPOSITE INDEX |

| ^PSI20 | INTERBOLSA PSI20 INDEX |

| ^RFJGUSBE | J.P. Morgan US Treasury Note Futures |

| ^RMZ | MSCI US REIT |

| ^RNSMALL | .RNSMALL |

| ^RNSMALLJP | RussellNomura Small Cap JPY |

| ^RUA | RUSSELL 3000 IND |

| ^RUI | RUSSELL 1000 IND |

| ^RUT | RUSSELL 2000 IND |

| ^SET50 | SET 50 INDEX |

| ^SETB | SET BANKING IDX |

| ^SETEN | SET ENERGY & UTILITY IDX |

| ^SETI | SET IDX |

| ^SG6MIZTR | S&P GSCI Zinc 6 Month Forward TR |

| ^SGIXGILT | SGI – Long Gilt Index |

| ^SGIXIRSP | SGI – Interest Rate Strangle Premium |

| ^SKEWDEX | NATIONS SKEWDEX INDEX |

| ^SKEWX | CBOE SKEW Index |

| ^SOX | SEMICONDUCTOR |

| ^SPASIA5060 | S&P Asia 50 Real Estate (Sector) |

| ^SPBDA1PT | S&P ASX Aus FI 10 Year+ Idx |

| ^SPBDASXT | S&P ASX Aus FI Idx |

| ^SPBDU5N | S&P U.S. Treasury Bond Current 5-Yea |

| ^SPBDUB6T | S&P U.S. Treasury Bill 3-6 Month Ind |

| ^SPBDUBYT | S&P U.S. Treasury Bill 9-12 Month In |

| ^SPBLPGPT | .SPBLPGPT |

| ^SPBMIWJREITGTR | S&P Developed Ex-Jpn REIT GR |

| ^SPBNCAT | S&P A-Grade Corporate Bond Index |

| ^SPBNK5E | S&P NZX FI INDEX |

| ^SPCBMICJPREIT | .SPCBMICJPREIT |

| ^SPCY | S&P SMLCP 600 |

| ^SPDVXE | S&P 500 Dynamic VIX Futures ER |

| ^SPEUBDP | S&P Euro-Bund Futures Excess Return |

| ^SPEUBDTR | S&P Euro-Bund Total Return Index |

| ^SPS10Y | S&P 10 Year Swap Index |

| ^SPS1Y | S&P 1 Year Swap Index |

| ^SPSUPX | S&P COMP 1500 |

| ^SPTSECP | TORONTO SE SPTSE 60 CAP NDX |

| ^SPX | S&P 500 INDEX |

| ^SRVIX | CBOE Interest Rate Volatility Index |

| ^SSEC | SHANGHAI SE COMPOSITE INDEX |

| ^SSMI | SMI SWISS MARKET INDEX |

| ^STI | STRAIT TIMES INDEX |

| ^STOXX | Dow Jones STOXX |

| ^STOXX50 | Dow Jones STOXX 50 |

| ^STOXX50E | Dow Jones EURO STOXX 50 |

| ^STOXXE | Dow Jones EURO STOXX |

| ^STXGCPI12M | STOXX GC P E 12 INDEX |

| ^STXGCPI12MC | STOXX GC P E 12 INDEX |

| ^STXGCPI12MV | STOXX GC P E 12 INDEX |

| ^TA125 | .TA125 |

| ^TA35 | .TA35 |

| ^TA90 | TASE TA-90 IDX |

| ^TABNK | TASE CMRC BANKS IDX |

| ^TAOILGAS | TASE TA OIL & GAS IDX |

| ^TASI | SAUDI GEN INDEX |

| ^TEREAL | TASE REAL ESTATE IDX |

| ^TNX | 10 Y TSY YLD NDX |

| ^TOPX | TOPIX PRICE INDEX |

| ^TR20 | Dow Jones TURKEY 20 |

| ^TRCGVEUE1 | Thomson ReutersS-Network Europe Gov |

| ^TWAV1 | CBOE 1st VIX Futures Mid-Morning 15 |

| ^TWAV2 | CBOE 2nd VIX Futures Mid-Morning 15 |

| ^TWII | TAIWAN SE WEIGHTED INDEX |

| ^TYX | 30 Y TSY YLD NDX |

| ^URAXPD | World Uranium$ |

| ^VALUA1 | .VALUA1 |

| ^VHSI | HSI VOLATILITY |

| ^VIX | CBOE MKT VOLATILITY IDX |

| ^VNI | VIETNAM INDEX |

| ^VSTG | The CBOE VIX Strangle Index |

| ^VXAPL | CBOE Apple VIX Index |

| ^VXD | Dow JonesIA VOLATILITY |

| ^VXN | CBOE NASDAQ MKT VOL NDX |

| ^VXO | OEX MKT VOL NDX |

| ^W5000 | .W5000 |

| ^WTEI | WisdomTree U.S. Earnings Index |

| ^XAL | AIRLINE INDEX |

| ^XNG | NATURAL GAS |

| ^XOI | OIL INDEX |

| ^XTXBCE | Bloomberg CMCI RBOB Gasoline Hedged |

| ^XU100 | IST ULUSAL-100 |