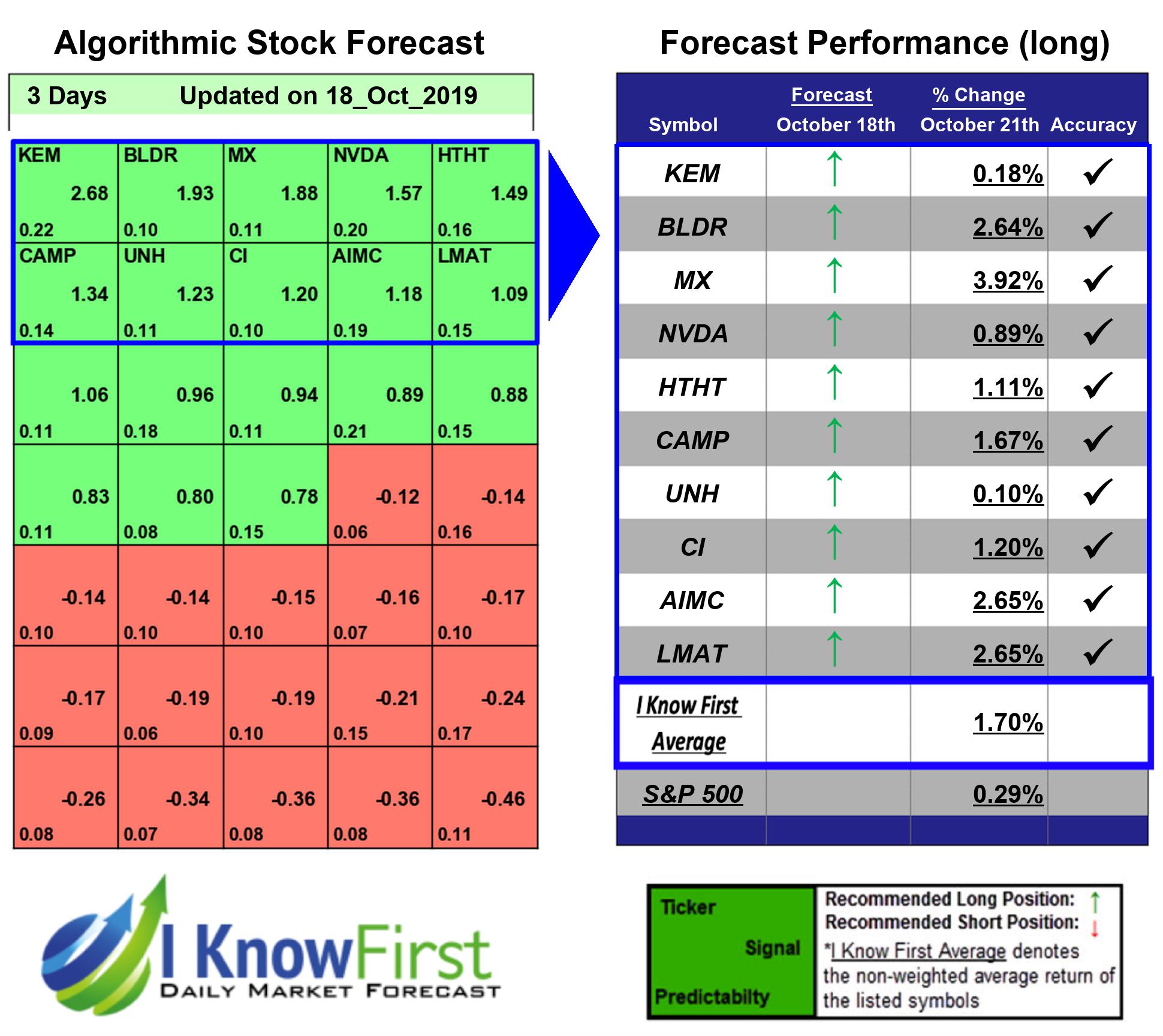

Stock Market Forecast Based on Big Data: Returns up to 3.92% in 3 Days

Stock Market Forecast

The Fundamental Package includes our algorithmic stock market forecast for stocks screened by fundamental criteria. Our algorithms help you find best opportunities for both long and short positions for the stocks within each fundamental screen. The stocks are selected according to five basic valuation categories:

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

- short ratio

Package Name: Fundamental – High P/E Stocks

Recommended Positions: Long

Forecast Length: 3 Days (10/18/2019 – 10/21/2019)

I Know First Average: 1.7%

The algorithm correctly predicted 10 out 10 of the suggested trades in the Fundamental – High P/E Stocks Package for this 3 Days forecast. MX was the highest-earning trade with a return of 3.92% in 3 Days. Other notable stocks were AIMC and LMAT with a return of 2.65% and 2.65%. With these notable trade returns, the package itself registered an average return of 1.7% compared to the S&P 500’s return of 0.29% for the same period.

MagnaChip Semiconductor Corporation (MX) designs and manufactures analog and mixed-signal semiconductor products for consumer, computing, communication, industrial, automotive, and Internet of Things (IoT) applications worldwide. The company operates through two segments, Foundry Services Group, and Standard Products Group. The company provides display solutions, such as source and gate drivers, and timing controllers that cover a range of flat panel displays used in ultra high definition (UHD), high definition, full high definition, light emitting diode (LED), 3D and organic light emitting diodes televisions and displays, notebooks, and mobile communications and entertainment devices. It also offers a range of sensors, such as e-Compass sensors, digital hall sensors, and temperature and humidity sensors; and power management products, including metal oxide semiconductor field effect transistors, insulated gate bipolar mode transistor, power modules, AC-DC and DC-DC converters, LED drivers, solid state drives PMIC, switching regulators, and linear regulators for liquid crystal display, LED, 3D and UHD televisions, smartphones, mobile phones, desktop PCs, notebooks, tablet PCs, other consumer electronics, consumer appliances, and industrial applications, such as power suppliers, LED lighting, and motor control. In addition, it provides foundry services to fabless analog and mixed-signal semiconductor companies and IDMs for the manufacture of display drivers, LED drivers, audio encoding and decoding devices, microcontrollers, touch screen controllers, RF switches, park distance control sensors for automotive, electronic tag memories, and power management semiconductors. It sells its products through direct sales force, as well as through a network of agents and distributors to consumer, computing, and industrial electronics OEMs; original design manufacturers; electronics manufacturing services companies; and subsystem designers. The company is based in Luxembourg.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.