Stock Market Analysis Based on Algo Trading: Returns up to 95.82% in 3 Months

Stock Market Analysis

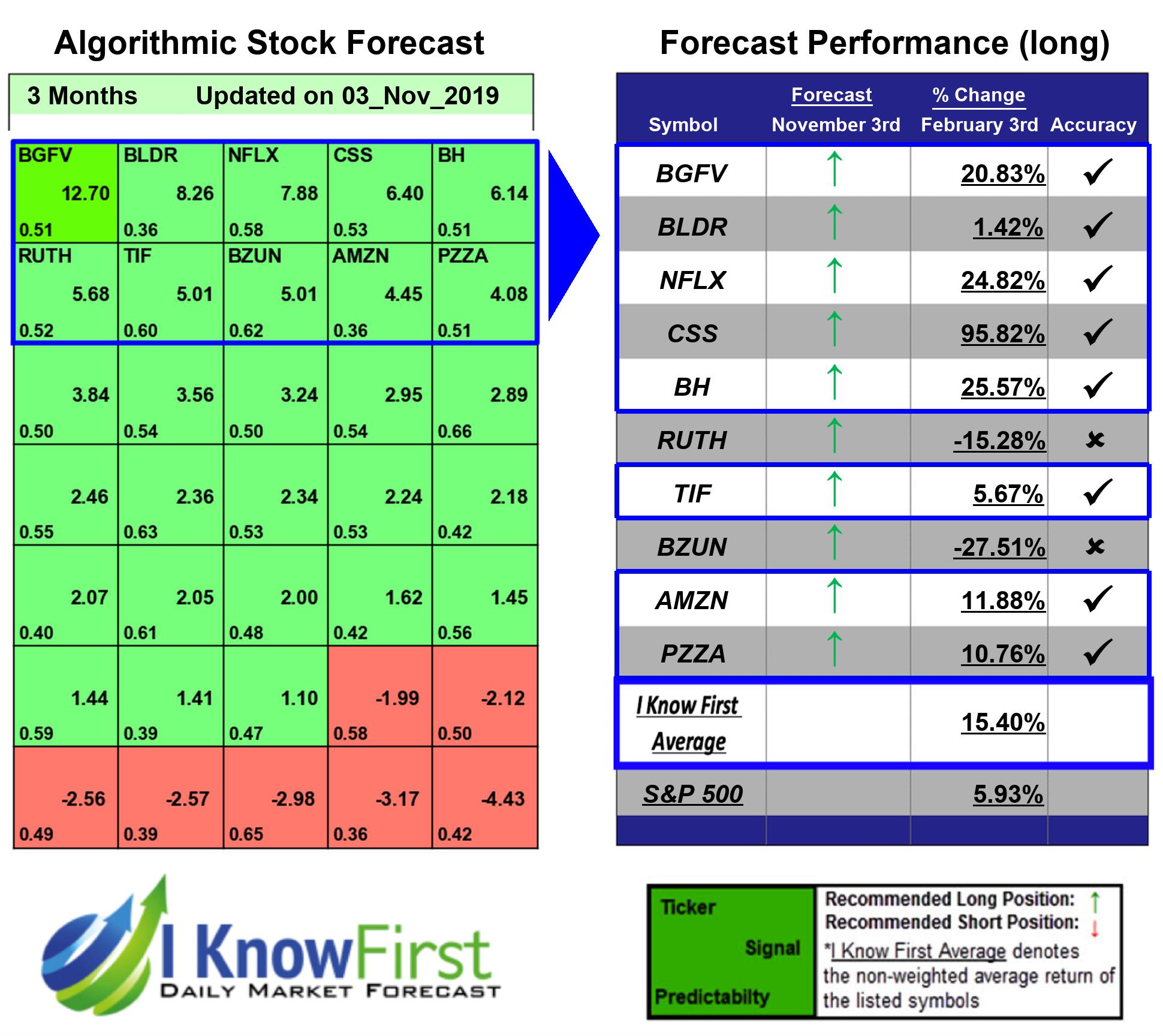

This Retail Stocks forecast is designed for investors and analysts who need stock market analysis for the best stocks to invest in the retail estate sector (see Retail Stocks Package). It includes 20 stocks with bullish and bearish signals:

- Top 10 Retail stocks for the long position

- Top 10 Retail stocks for the short position

Package Name: Retail Stocks

Recommended Positions: Long

Forecast Length: 3 Months (11/3/2019 – 2/3/2020)

I Know First Average: 15.4%

The algorithm correctly predicted 8 out 10 of the suggested trades in the Retail Stocks Package for this 3 Months forecast. The greatest return came from CSS at 95.82%. BH and NFLX also performed well for this time horizon with returns of 25.57% and 24.82%, respectively. With these notable trade returns, the package itself registered an average return of 15.4% compared to the S&P 500’s return of 5.93% for the same period.

CSS Industries, Inc. (CSS), a consumer products company, engages in the design, manufacture, procurement, distribution, and sale of various occasion and seasonal social expression products primarily to mass market retailers in the United States and Canada. Its occasion and seasonal products include decorative ribbons and bows, classroom exchange Valentines, infant products, journals, buttons, boxed greeting cards, gift tags, gift card holders, gift bags, gift wrap, decorations, floral accessories, craft and educational products, Easter egg dyes and novelties, memory books, scrapbooks, stickers, stationery, and other items. The company offers its products primarily under the Paper Magic, Berwick, Offray, C.R. Gibson, Markings, Stepping Stones, Tapestry, Seastone, Dudley’s, Eureka, Stickerfitti, Favorite Findings, and La Mode brand names. CSS Industries, Inc. (CSS) sells its products to mass market, craft, specialty, and floral retail and wholesale distribution customers, as well as to the education market through account sales managers, sales representatives, product specialists, and a network of independent manufacturers’ representatives. The company was founded in 1923 and is headquartered in Plymouth Meeting, Pennsylvania.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.