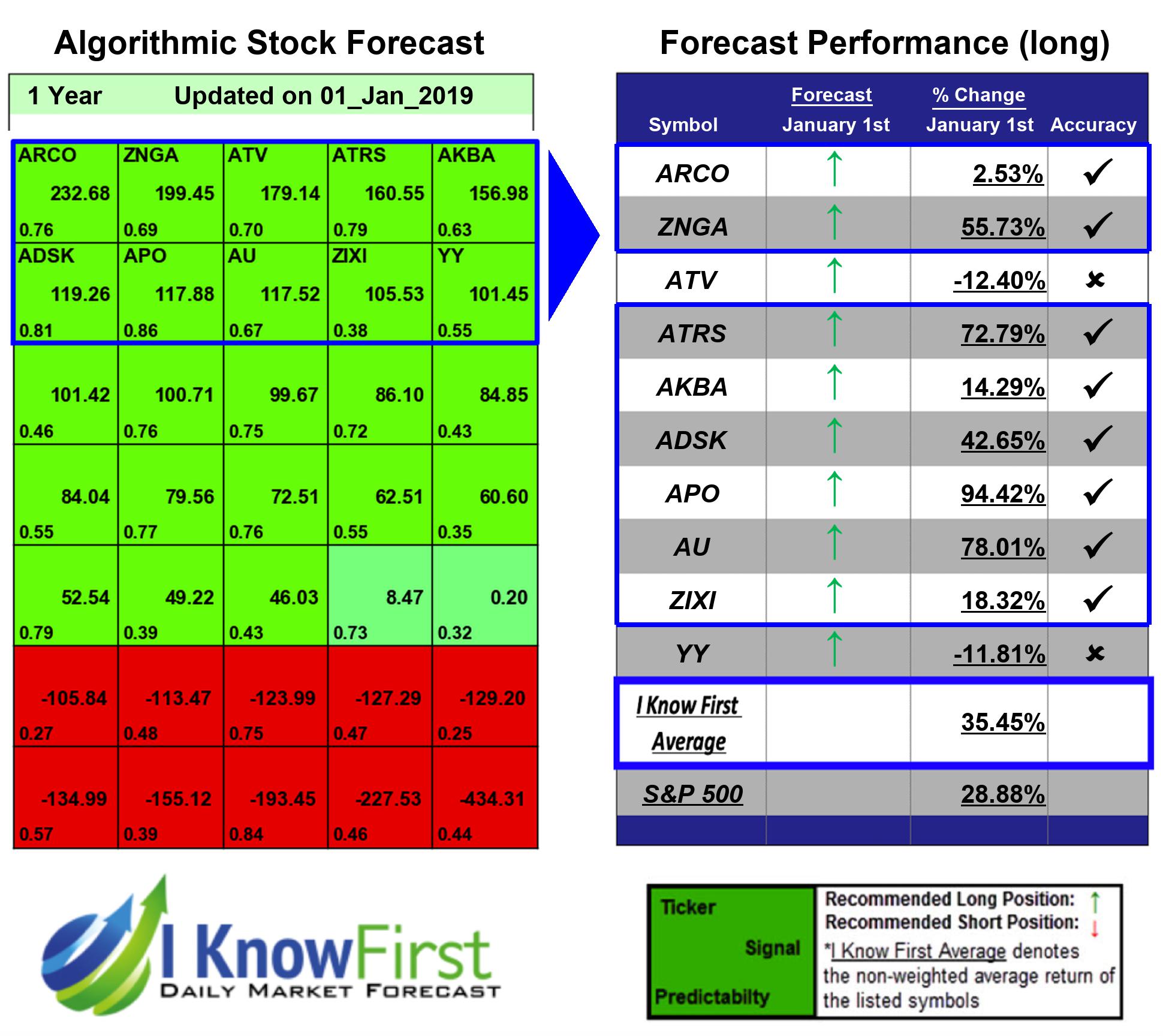

Stock Ideas Based on Machine Learning: Returns up to 94.42% in 1 Year

Stock Ideas

The Fundamental Package includes our algorithmic forecasts for stocks screened by fundamental criteria. Our algorithms help you find best opportunities for both long and short positions for the stocks within each fundamental screen. The stock ideas are selected according to five basic valuation categories:

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

- short ratio

Package Name: Fundamental – Low PEG Stocks

Recommended Positions: Long

Forecast Length: 1 Year (1/1/2019 – 1/1/2020)

I Know First Average: 35.45%

I Know First’s State of the Art Algorithm accurately forecasted 8 out of 10 trades in this Fundamental – Low PEG Stocks Package for the 1 Year time period. The highest trade return came from APO, at 94.42%. AU and ATRS saw outstanding returns of 78.01% and 72.79%. The package saw an overall yield of 35.45% versus the S&P 500’s return of 28.88% implying a market premium of 6.57%.

Apollo Global Management, LLC (APO) is a publicly owned investment manager. The firm primarily provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. It manages client focused portfolios. The firm launches and manages hedge funds and mutual funds for its clients. It also manages real estate funds and private equity funds for its clients. The firm invests in the fixed income and alternative investment markets across the globe. Its alternative investments include investment in private equity and real estate markets. The firm’s private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, turnaround, corporate restructuring, special situation, acquisition, and industry consolidation transactions. Its fixed income investments include income-oriented senior loans, bonds, collateralized loan obligations, structured credit, opportunistic credit, non-performing loans, distressed debt, mezzanine debt, and value oriented fixed income securities. The firm seeks to invest in chemicals, commodities, consumer and retail, oil and gas, metals, mining, agriculture, commodities, distribution and transportation, financial and business services, manufacturing and industrial, media distribution, cable, entertainment and leisure, natural resources, energy, packaging and materials, and satellite and wireless industries. It seeks to invest in companies based in across North America with a focus on United States, and Europe. The firm also makes investments outside North America, primarily in Western Europe and Asia. It employs a combination of contrarian, value, and distressed strategies to make its investments. The firm conducts an in-house research to create its investment portfolio. It seeks to acquire minority positions in its portfolio companies. The firm seeks to make investments in the range of $200 million and $1.5 billion. Apollo Global Management, LLC (APO) was founded in 1990 and is headquartered in New York City, with additional offices in New York City; Bethesda, Maryland; Chicago, Illinois; Los Angeles, California; Purchase, New York; Houston, Texas; London, United Kingdom; Frankfurt, Germany; Mumbai, India; Central, Hong Kong; Singapore; and Luxembourg.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.