Stock Forecast: Has ULTA Stock Become Overvalued from Short-Term Meager Growth?

This article was written by Esther Hanon, a Financial Analyst at I Know First.

[Source: Downtown Summerlin, May 8th 2018]

[Source: Downtown Summerlin, May 8th 2018]

“Looking ahead to 2018, we are deploying a portion of the tax reform benefits to invest in our people and accelerate investments to drive growth and innovation,”

—Mary Dillon, CEO of ULTA Beauty

Stock Forecast: ULTA Beauty’s Aim to Surpass Competition in the E-Commerce Realm

Summary:

- Thus far, ULTA’s shares have outperformed the market by 24%; however, shares are still trading almost 20% below their 52-week highs.

- ULTA is evolving their marketing strategy to compete in such a competitive saturated market of beauty care

- Comps are slowing, but underlying business still looks strong.

- ULTA seemingly is overvalued, although some analysts postulate the company is headed in an upward trajectory in the coming years.

- Tax reform will provide a boost.

Recently, ULTA’s (NASDAQ: ULTA) shares have outperformed the market by 24%, and have shown positive results ever since they released their earnings report on March 15th, 2018. ULTA documented the following results on their earnings release: net sales increased 22.6%, comparable sales increased 8.8%, and diluted EPS increased 51.8% to $3.40, including $0.65 net benefit from Tax Reform related items. The company also issued one-time bonuses for hourly associates and approved new share repurchase authorization of $625 million.

ULTA had a solid 2017, growing comparable store sales (“comps”) by 11%, with retail comps up 7.1%. The company is expecting growth in comps of only about 6% to 8% going forward; however, done with e-commerce growth in the 40% range. Despite the seemingly impressive digital sales growth, e-commerce is starting from a much smaller base: something that the firm will have to overcome. The company has stated that looking ahead to 2018, they are deploying a portion of the tax reform to invest in their people and accelerate investments to drive growth. They have also recognized operating margin headwinds from various cost pressures facing all retailers, their higher than expected mix of e-commerce, and the new revenue recognition accounting standard. To help offset these pressures, they are implementing a cost optimization program to deliver benefits in the areas of indirect procurement, end-to-end operational efficiency, real estate costs, and merchandise margin improvement.

Going forward, they plan to increase operating profit margin rate over the long term, increase total sales in the low teens percentage range, achieve comparable sales growth of approximately 6% to 8%, including the impact of e-commerce, and growth e-comerce sales in the 40% range. For the first quarter of fiscal 2018, they expect net sales in the range of $1,506 million to $1,519 million, compared to the actual net sales of $1,314.9 million in the first quarter of fiscal 2017. Comparable sales for the first quarter of fiscal 2018, including e-commerce sales, are expected to increase 6% to 7%. ULTA reported a comparable sales increase of 14.3% in the first quarter of fiscal 2017.

[Source: Yahoo Finance, May 8th, 2018]

Market analysts’ consensus outlook for this coming year seems optimistic, with earnings climbing by a robust 16.38%. This growth seems to continue into the following year with rates reaching double digit 33.11% compared to today’s earnings, and finally hitting US$812.13M by 2021.

[Source: Simply Wall St., May 8th, 2018]

A Glimpse into ULTA’s Company Valuation:

The company also continues to grow retail sales per square foot, but comparing these past results with its future guidance for 2018, it appears that this will be the year that growth begins to slow.

Return on equity: Continued improvement

The company continues to improve profitability, but it should also be noted that it enjoyed an extra week in fiscal 2017 (53 weeks versus only 52 in 2016), which added about $108.8 million in extra sales.

[Source: Joseph Harry, Seeking Alpha, May 8th 2018]

[Source: Joseph Harry, Seeking Alpha, May 8th 2018]

The added week in 2017 means that sales and earnings are inflated, but ULTA managed to improve its asset turnover even after stripping out the extra $108.8 million from the firm’s top line. The adjusted asset turnover is at about 2.11 for 2017 if the extra sales are taken away- up from 2016’s ratio of just 2.03x. This tells us that the firm continues to drive underlying ROE higher with better asset efficiency. However, the company’s margins fell slightly, but the improved asset turnover and modest increase in leverage more than offset the drop in margins. A lighter tax burden also helped propel the firm’s ROE over 30% in 2017, which will continue to be the story going forward now that tax reform has made lower taxes a reality going forward.

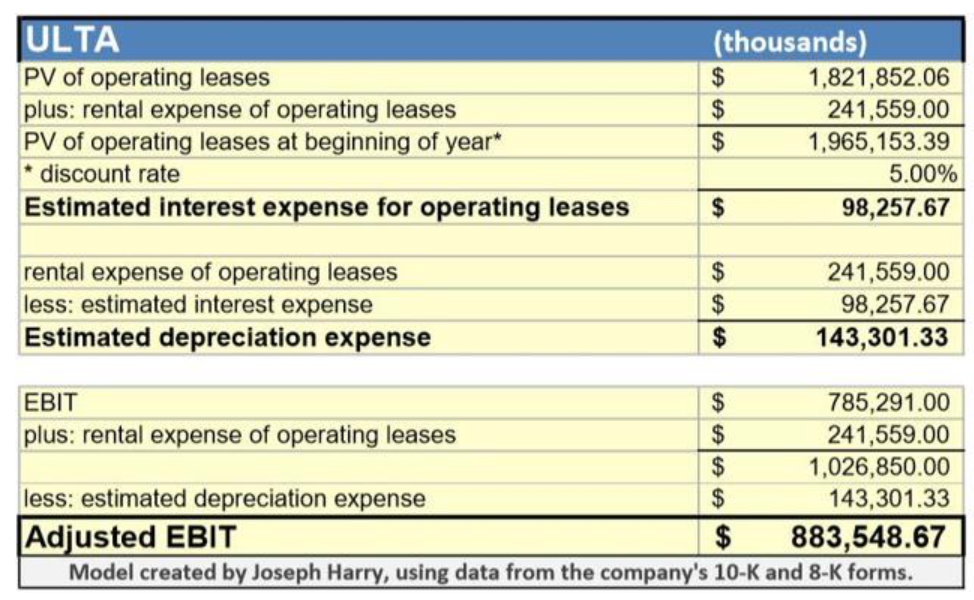

Adjusting for operating leases

ULTA, like most retailers and businesses with a large physical footprint, utilizes a sizable amount of “off-balance sheet” operating leases. If we decide to capitalize these leases, since they are mostly long-term in nature and noncancelable, then we can examine their impact on the firm’s capital structure (and return on invested capital). A 5% discount rate was used.

Now that we’ve estimated this number, we can insert the leases into ULTA’s capital structure to arrive at what its debt-to-equity ratio looks like (versus its advertised ratio of 0 times).

The company’s debt-to-equity ratio is likely above 1x if we choose to capitalize its off-balance sheet leases.

Return on invested capital analysis

If we theoretically capitalize ULTA’s operating leases, bringing them into the capital structure, then we also need to adjust its operating profit.

After adjusting EBIT for lease-related interest and depreciation expenses, we can then take taxes into account – before dividing our adjusted operating profit (after tax) number by the previously calculated capital base to arrive at an estimate of the firm’s ROIC.

The company’s underlying ROIC comes in at roughly 17%, or almost 3% better than the estimated ROIC for fiscal 2016. It appears that lower taxes and better efficiency are keeping the company’s capital allocation ratios afloat, which demonstrates that there’s still a solid moat in place. ROIC of 17% is likely far above the firm’s cost of capital, so ULTA remains an above-average operation in my book – as long as it continues to earn excess profits on its supplied capital anyways.

Cash flow analysis

As the years progress, increasing inventories and a slowing cash conversion cycle are the main focuses of the firm.

The company improved its cash conversion cycle in 2017, which indicates that it was able to convert its raw inputs into cash quicker.

The firm improved its CCC by about 3 days through a combination of stretching its payables (a.k.a paying suppliers slower) and an improving operating cycle (mostly by improving Days Inventory Outstanding by a few days).

Average inventory per store did increase in fiscal 2017, however, by about 5.3% – largely due to the ramping up of a distribution center in Texas, the opening of 100 new stores (net), and to support growing sales. As long as sales are growing at a decent clip and inventory doesn’t balloon super fast (in other words, at a rate far faster than sales), this remains a trend I’ll continue to monitor, but not really worry about.

Valuations

ULTA’s shares have traditionally traded at steep multiples. The five-year average price-to-earnings ratio is about 36.50 and the thirteen-year median multiple is roughly 34.41 times earnings.

At a tick under 32 times earnings, it appears shares are actually a little cheap here when compared to historical earnings valuations, but as previously noted, growth in comps is expected to slow (and margins will likely continue to be pressured), so perhaps a discount is warranted. Alternatively, we can also attempt to value shares based on sales. The five-year average price-to-sales ratio is 2.97x, while the thirteen-year median is only 2.48x. At about 2.8 times sales, shares look decently valued compared to history, but once again, growth isn’t expected to be as impressive in fiscal 2018.

Analyst Recommendations:

According to analyst recommendations from Yahoo Finance, the current consensus is a “Buy” in ULTA Stock, with 5 advising a “Strong Buy”, 10 advising a “Buy” and 10 advising a “Hold”.

I Know First’s Success With ULTA Beauty:

Conclusion

Valuation multiples have contracted on ULTA’s shares, and they’re still off their 52-week highs by almost 20%. Shares have appreciated by about 18.9% since approximately December 2017. Analysts expect earnings per share of roughly $10.76 in fiscal 2018, putting shares at about 24 times forward earnings, which doesn’t look so bad. Lower taxes will likely be a large contributor as well, coupled with underlying earnings growth. The problem with ULTA shares at the moment isn’t necessarily value, but the possibility of them being a “value-trap,” due to the difficulty of valuing a company with potentially slowing comps growth and margin contraction after a period of above-average growth. There doesn’t seem to be much of a margin of safety here, but I also wouldn’t be surprised if shares outperformed from here, either – especially if it hits earnings estimates for 2018 and the market allows it to retain its premium PE ratio of above 30 times earnings.

I Know First Algorithm Heatmap Explanation:

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation-based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.

About Ulta Beauty Inc.:

Ulta Beauty, Inc.(NASDAQ: ULTA) is a holding company for the Ulta Beauty group of companies. The Company is a beauty retailer. The Company offers cosmetics, fragrance, skin, hair care products and salon services. The Company offers approximately 20,000 products from over 500 beauty brands across all categories, including the Company’s own private label. The Company also offers a full-service salon in every store featuring hair, skin and brow services. The Company operates approximately 970 retail stores across over 48 states and the District of Columbia and also distributes its products through its Website, which includes a collection of tips, tutorials and social content. The Company offers makeup products, such as foundation, face powder, concealer, color correcting, face primer, blush, bronzer, contouring, highlighter, setting spray, shine control, makeup remover, eyeshadow palettes, mascara, eyeliner, nail polish, cleansers, moisturizers, serums, suncare products, shampoos, conditioners, hair styling products, hair styling tools and perfumes. The Company also offers makeup brushes and tools, and makeup bags and cases.