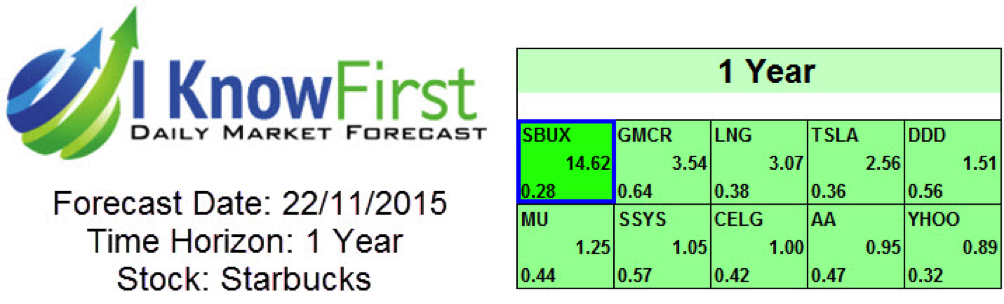

Starbucks Stock Analysis: 2016 Stock Forecast

Starbucks Stock Analysis: Executive Summary

- Non-GAAP EPS = $0.43

- Above Average and Predictable Same Store Sales

- Strong Free Cash Flow Generation

- Year End 2016 Price Target = $67

SBUX hit very high expectations in 4Q15, and more importantly the company stressed that digital and partner investments are being made for future brand and profit growth. SBUX’s CEO Howard Shultz informed analysts to not expect or model more than mid-single digit growth for the upcoming quarter. “If we’re in a position to surprise on the upside, that’s wonderful, but not to count on it, and certainly not to model it”. We believe this is a time to heavily invest and distance the company and brand far ahead of competition. These investments are being done from a position of strength and add to SBUX’s longer-term visibility and longevity. SBUX performance is scarce, and shares are deservedly expensive. On the other hand for large cap, visibility oriented growth managers; SBUX continues to be a relative safe haven. It is to be note that SBUX demonstrated great holistic brand management optimization in 2015.

Source: Google Images, Lifehacker.com

The Coffee Chain Continues To Outperform

SBUX is proving to be positioned where it deserves to be. We recorded well above average and predictable Same Store Sales, strong developed and emerging market unit development at 8% a year, margin enhancement through growth in CAP and Channel Development, and strong FCF generation. SBUX Americas represents 70.8% of 2Y15 segment operating income and posted strong and in-line comps of 8% including 9% in the US. Food was 3% to comp, for the first time ever, with food currently representing 20% of sales. Overall comps were balanced as same store traffic rose 4%, despite a 4.3% increase in America’s system store count, and ticket rose 4% as well. Assuming the current ~32x C16 EPS multiple can hold on C17 ($2.27), this would be a ~$73 stock. However, even 30x is close to the top-end of Starbucks’ modern trading history and this $67 is our 2Y16 Year End price target. It’s a core large cap growth holding with no fundamental reason to lighten positions and we believe fundamentals justify a continued Overweight rating.

EMEA profitability blew past mid-teens margin targets as the company’s licensed driven business model is clearly working. Comps were 5% and operating income of $53.1m. Despite the segment has made significant progress driving margins higher, at 13.8% in 2Y15 in comparison to 9.2% in 2Y14, through tighter company store operations and increasing licensing ownership mix at 69% of the system in comparison to 54% four years ago. We believe comps of 4% and operating margins of 15.3% in 2Y16E to be an achievable target.

Reduced Turnover, Driving Real ROI at Store Level

SBUX reduced turnover is driving direct comp outperformance. While this is not surprising, the fact that SBUX has reduced turnover from already low levels in this economic cycle is surprising. The labor market has tightened significantly for customer facing, engaged individuals like those that Starbucks has cultivated. To combat this, Starbucks has given wage increases, meal benefits, educational opportunities including ASU online, and transportation benefits. According to the company, this decline in turnover is 3 points over the past month. It’s rare to see a turnover decrease at this point in an employment cycle, and it is attention to its Partners that has allowed Starbucks to differentiate itself in everything it does.

Source: Google Images, worldsanpics.co.uk

Quick Update On The Loyalty Program

As most of you know, “Stars as currency” is a developing theme where Starbucks sells its stars to brands such as Spotify, Lyft, and New York Times that have a customer or employee base that would appreciate Starbucks’ food and drink as recognition for their loyalty. (12 stars needed to receive a free drink) The program is proving to be effective and has increased customer loyalty and acquisition since inception. This should prove to be highly relevant across different regions and demographics.

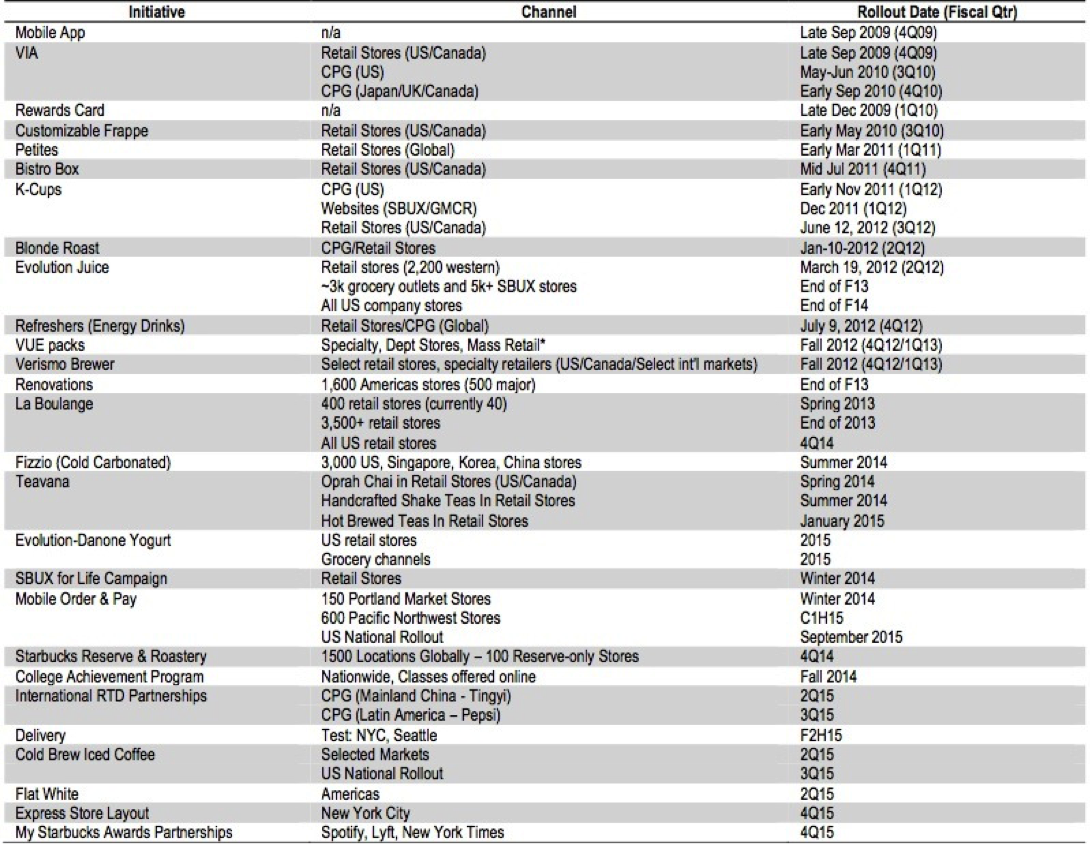

New Initiatives

Many initiatives are either new or developing such as “mobile order & pay” which is now in over 7,500 company stores and was completed at the end of September. It is truly impressive that the brand’s US company store format now seems geared to add $1-1.5b+ sales a year to its ending $11.9b 2Y15 revenue base, all at $5 per transaction. Channel development returned to strong growth in 4Q15 with a 15% gain in operating income representing 16.2% of segment operating income. Segment margins came in at 43.2%. The company now expects lower commodities across the complex; despite the fact the company was not buying during the 2Y14 and 2Y15 coffee price spikes.

Image Below Show’s The New Initiatives Taken By Starbucks

Source: Company Data

Investment Thesis:

In our opinion, many cost drivers such as: lower coffee, labor controls, growth of CPG margin and Europe restructuring. Are matched with sales drivers such as: US growth in total employment, food/beverage innovation, CPG, and store growth. These events should drive earnings up by at least ~15%-20%, allowing the stock to maintain a premium multiple. Our price target for Year End 2Y16 is 67$. Our target price is based on a 30x C17E EPS of $2.27. We maintain our bullish view for Starbucks.

Risks to Price Target

- Reversal of positive domestic comp trends

- Weaker than expected international results

- Higher than expected coffee and dairy costs

- Worse performance than expected in the CPG business, specifically in single serves and packaged coffee

Conclusion

The new initiatives taken by Starbucks will help them grow, and keep them updated in a world where technology is king. Starbucks prides itself of having a great management team, which will help with the execution of the new plans. Based on our fundamental analysis of the stock, in addition to our algorithm’s prediction for it, we believe SBUX to be a long core investment.