Square Stock Prediction: Is Square Stock Too Expensive to Buy?

The stock prediction article was written by Tianyue Yu, Analyst at I Know First, Master’s candidate at Brandeis University.

The stock prediction article was written by Tianyue Yu, Analyst at I Know First, Master’s candidate at Brandeis University.

Summary

- The Seller ecosystem business growth will reach a plateau after the pandemic

- Further growth of Cash App will come in a long way

- Two-case DCF results indicate a target price up to $207

Be Cautious After Stock Price Hitting Historical High Driven by the Terrific Q3 Results

Square (SQ) stock price keeps the growing momentum after the third-quarter financial report was released. Q3 results supported bullish Square stock forecast with gross profit growth of 59% and adjusted EBITDA growth of 38% on a YoY basis, pushing up the stock price to a historically high level. It is also delighted to see that the gross payment volume (GPV) moved upwards generated by the Seller business, as revenue from higher-priced card-not-present transactions as sellers continued to shift their businesses to adapt to the COVID-19 outbreak.

However, the fall back of stock price afterward reflecting some concerns from investors. Square made several updates in the Seller ecosystem like launching Instant payments and On-Demand pay to take advantage of the companies’ unique needs during the COVID-19. At this point, I believe we should take a step back and look at the real development of the Seller business and the change in the competitive landscape that has been overshadowed by the disruption of the pandemic.

Take the Seller ecosystem as an example. As the Q3 shareholder letter shows, Square’s customer distribution is getting more concentrated on larger sellers, indicating a limited improvement in small business penetration. Although this trend partially because small businesses suffer from the pandemic, it is not good news for the company. Square product’s cheap and flexible features are more favorable to small companies. This market presence exposes the company to compete with big banks and tech giants.

After bringing a new debit card into the market, Square appeared to be a big threat to banks. As a response to the threat from PayPal and Square, JP Morgan launched QuickAccept allowing merchants to quickly take card payments through a mobile app or contactless card reader. This product is ahead of Square in terms of less transferring time without an extra fee. Google also relaunched its Google Pay app and jumped into the alternative payment competition. It remains uncertain how Square will perform under the furious competition, given banks and tech companies’ strong customer base advantage. As the influence of COVID-19 gradually faded, I predict that the Seller ecosystem will meet the bottleneck. Square will need further development to bring the financial number into the next stage.

Where is the High Growth of Cash App Heading?

As the current super App of Square, Cash App delivered striking operating results in the third quarter. This segment’s total revenue and the gross margin grew 574% and 212% on a YoY basis, respectively. Cash App also added a record number of new users in this quarter, bringing monthly active users to 33 million, getting close to Venmo’s 40 million users in Q2.

However, this strong Cash App performance highly depends on the popular concepts under the digital and “going online” trend under the pandemic. For example, the increase in bitcoin revenue accounts for 80% of this quarter’s total revenue growth. Given the volatile feature of bitcoin transactions, it is difficult for Square to keep the sector revenue growth at this high level in the future. Besides, while the revenue surged, the gross margin halved from around 40% to 20% because of the discounts and subsidies provided to merchants. In light of these issues, I predict that the Cash App’s performance in the short future will slow down.

In this case, where is the Cash App heading? Similar to merchant banks, Cash App’s long-term growth could come from two ways: increasing revenue per customer and enlarging the market share. The current average revenue per user is $62, compared with $15 in 2019. For reference, on average, Wells Fargo, JP Morgan Chase, and Bank of America generate roughly $880 in revenue per active digital customer per year. If Square could transfer the users who only use the free function to monetized users and increase the rate of monetization of Cash App, there will be great upside space of the sector revenue.

For the second way to enlarge the market size, it is necessary for Cash App to serve more high-net-users and keep updating application services. Since the application launched in 2013, Cash App has differentiated itself from its direct competitor, Venmo by developing advanced functions like equity and bitcoin investment. The fraction shares of stock purchase feature successfully attract many users to adopt more functions in the Cash App and generate a higher gross margin. I believe in Cash App’s growth potential as a well-positioned product. If the company could add any new dimension to the Cash App ecosystem, investors would be more confident with higher sustainable growth in sector profit in the post-pandemic world.

Two-case Scenario DCF Results Show Upside Potential of Square Stock Price Forecast

I ran the DCF valuation under two different cases. Under the first case, there is no significant development on the Square company level in the next twelve months, and the performance basically depends on the macro trend and industry performance. Under the second case, I assume that Square increases the monetization rate of Cash App and generate above $70 revenue from each user. All the cost of revenue and working capital will change accordingly.

First Scenario Results: Target Price $181

In the first case estimation, because of the absence of progress at the company level, I made the following revenue assumptions based on the macro trend in the market.

Seller Sector Revenue

I use gross payment volume (GPV) as the starting point of the Seller revenue estimation in different segments. The GPV number bounced back slightly in the third quarter because the optimistic prospect of COVID-19 in Q2 triggered the reopening trend. However, given the worsening pandemic condition in the US recently and a cyclical GPV drop in Q1, I estimate that GPV in the next two quarters will keep weak.

(Source: New York Times)

Based on the GPV estimation in the table below, I calculate the revenue of the hardware segment and transaction revenue of the Seller product accordingly. The key drivers of the revenue here are the contactless hardware sales and the transaction fee of the card-no-presence business, both of which will thrive under the COVID-19 situation, offsetting some of the negative impacts.

Cash App Sector Revenue

The Cash App revenue consists of two big parts: subscription revenue from Instant Deposit and Cash Card and Bitcoin transaction fee. For the subscription revenue, I predict that the Cash App user number will keep increasing because of the high demand for mobile payments and the revenue per user will maintain the present level. The Bitcoin sector revenue basically echos the forecast of bitcoin market capitalization growth.

First Scenario DFC results give a target price at $181. This price indicates that the macro trend can’t support further stock price upside to Square after the price almost doubled in the past year. If the company won’t deliver any big development in the next year, the stock price will gradually adjust back to the intrinsic value.

Second Scenario Results: Target Price $207

Under the second scenario, I assume Square could successfully improve the revenue per user of Cash App from $62 to above $70 in 2022. This progress will significantly influence the subscription and service-based revenue, leading to a 5% increase in total revenue in the following years. The cost of revenue and other relevant items also change accordingly. Under this circumstance, the target price is $207, higher than the current stock price.

Final Thoughts on Square Stock Forecast

Square company stock topped a historical high recently, resulting from the out-of-expectation stunning performance of the Q3 financial result. After accelerating throughout the whole year, the stock price is gradually convergent to the analysts’ target price.

I predict that the stock price will experience a mild increase or adjustment in the next several months, depends on the financial results and the company’s strategy for next-step development. My prediction for SQ is backed by positive prediction results from I Know First. In the long-run, I believe that Square’s well-positioned business pioneered the digital trend. As my second scenario implies, investors could wait for further break-through development of the products or strong momentum of gaining customers to start a new booming cycle of the stock price.

Past Success With Square Stock Forecast

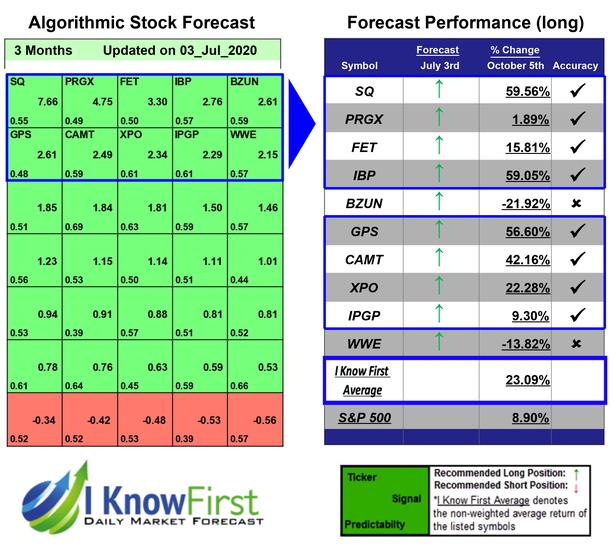

I Know First has been bullish with its SQ in the past. On October 5, 2020, the I Know First algorithm issued a bullish forecast for SQ stock price and recommended SQ as one of the best transportation stocks to buy. The AI-driven Square stock forecast was successful on a three-month horizon resulting in around a 60% gain since the forecast date. See the chart below

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.