SPCE Stock Forecast: a New Age for Space Tourism

This SPCE stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This SPCE stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlight:

- SPCE’s stock has grown by 161.62% since May 2021

- The space flight on July 11th was successful and has become a big milestone for the industry

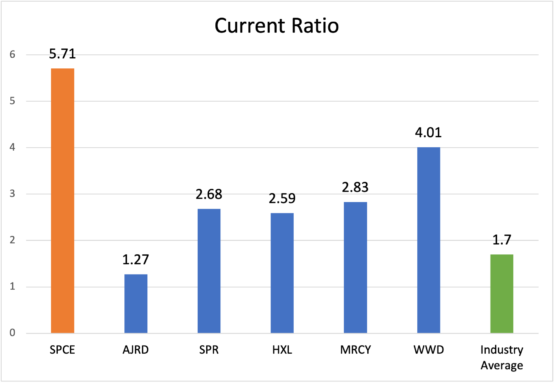

- Virgin Galactic has solid liquidity and solvency performances with a current ratio of 5.71 and equity-to-asset ratio of 0.56, outperforming 93% and 66% of companies in the aerospace industry

- The target price for SPCE will hit $70 for the coming year

Overview of Virgin Galactic

Virgin Galactic Holdings, Inc. is the world’s first commercial spaceline and vertically integrated aerospace company that develops human spaceflight for private individuals and researchers in the United States. It also manufactures air and space vehicles, flying commercial research, and development payloads into space and images in the design and development, manufacturing, ground and flight testing, and post-flight maintenance of spaceflight vehicles. The company is aiming to and actively making progress on transforming the current cost, safety, and environmental impact of space launch.

Win the Space Race with the First Fully Crewed Spaceflight

Virgin Galactic has been dedicated to technological innovation and creating exceptional customer experiences for space travel these years. According to Virgin Galactic’s Q-10 form, its research and development expenses have increased by 2.1 million for the three months ended March 31, 2021, around 6.1% more than this number calculated in 2020. This increase was primarily due to costs associated with developing the company’s space flight system, demonstrating its enlarging investments in technological advancements and devotion to realizing customer-friendly space vehicles.

(Figure 1: Research & Development Expenses March 2020 to March 2021)

All progress that the company made has brought it a step closer to its goal of the suborbital commercial program realization. On May 22nd, Virgin Galactic successfully launched its third test flight from Spaceport America, New Mexico. Following this success, the US Federal Aviation Administration has granted the company a commercial license to operate its spaceflights with passengers on June 25th, making Virgin Galactic the first company that is approved to fly passengers. This FAA approval has also driven SPCE stock price to hit $55.91 with a greatest-ever return of 38.9% within one trading day.

From the above graph, we can see that SPCE’s price has been volatile over the past few months. There was a price spike reaching $59.41 in February 2021 after the company reported its scheduling spaceflight test, but then the price began to drop due to the test delay announcement saying that the test needed to be postponed to May. However, as we just mentioned, the completion of Virgin Galactic’s third flight test and the FAA approval in May were huge achievements for the company. Hence, starting from May, the SPCE stock price has been continuously rising, obtaining a notable return of 161.62% since May 3rd till now.

Investors should also take notice of the exciting news just being announced. On July 11th, Virgin Galactic has successfully completed its test flight for Unity 22 Mission and landed safely at Spaceport America, which was also the company’s first spaceflight carrying a full crew of two pilots and four mission specialists in the cabin also including the founder Richard Branson. Building upon the success of the company’s three earlier test flights, this spaceflight focused more on cabin and customer experience. Furthermore, there is a lot of interest and potential out there for investors at this moment. The success of Virgin Galactic this time has been a huge milestone for a new era of space exploration and would promise more positive returns to investors now and in the future. Right now, given all successful performance demonstrated from test flights and efforts it has been devoted to, it is optimistic to project the company’s continuing intrinsic value and profitable long-term outlook. Amid all positive developments, the stock price’s potential increase seems very promising.

Virgin Galactic: The First Bird of Space Tourism

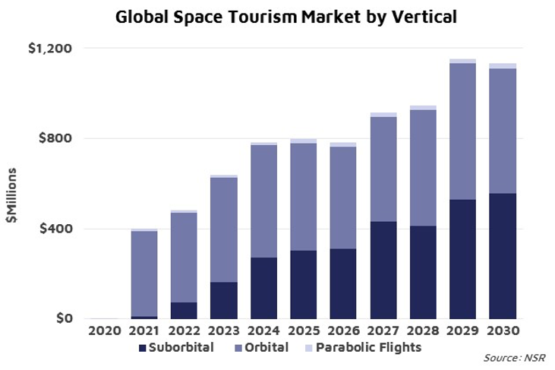

Nowadays, many companies are making progress and pushing forward the development of commercial space exploration. With rapid innovation and technological advancement, reaching the stars is no longer merely a dream. It is full of possibilities now and is turning into a potential field that many investors may feel very interested in. According to data from NSR, NSR forecasted that the opportunity for this market would reach an accumulative revenue of $7.9 billion from 2020 to 2030, and the suborbital segment that Virgin Galactic falls in will rise rapidly and attain nearly half of the revenue opportunity in 2030.

Given the encouraging outlook projected in the space tourism market, Virgin Galactic also has huge potential growth as a pioneer in the suborbital sector. Now, we can also take a look at its financial performance and see what are the financial advantages that make it a vanguard in the industry.

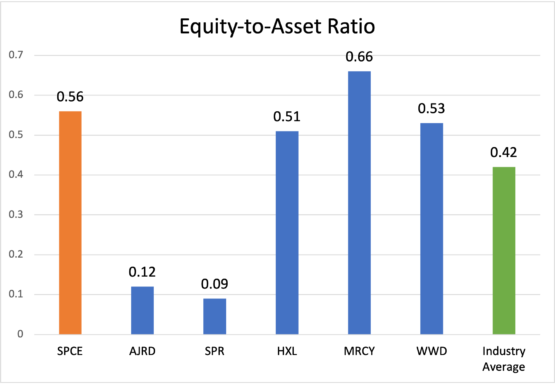

According to GuruFocus, Virgin Galactic had $616.63 million in cash and zero debt as of March 2021, which illustrates the company’s high liquidity that can potentially cover and guide it through the testing phase. In addition, we can also select a couple of comparable companies of Virgin Galactic in the Aerospace & Defence industry and the overall industry performance to demonstrate some unique qualities that Virgin Galactic outperforms. These companies include Aerojet Rocketdyne Holdings Inc (AJRD, USD), Spirit AeroSystems Holdings Inc (SPR, USD), Hexcel Corporation (HXL, USD), Mercury Systems Inc (MRCY, USD), and Woodward, Inc. (WWD, USD).

Based on data from GuruFocus, SPCE has a current equity-to-asset ratio of 0.56, outpacing the industry average by 0.14. Although SPCE does not have the most notable equity-to-asset ratio among all rivals we selected, this value is still higher than 66% of companies in the aerospace industry, indicating a decent amount of Virgin Galactic’s assets owned by investors as opposed to debt and a good long-term solvency position.

(Figure 2: Equity-to-Asset Ratio)

Moreover, from the graph below, SPCE has a striking current ratio of 5.71, being the top one among all other companies we chose, and is around 3 times larger than the industry benchmark. This value is also ranked higher than 93% of the companies in the industry, indicating Virgin Galactic’s high liquidity and operational efficiency.

(Figure 3: Current Ratio)

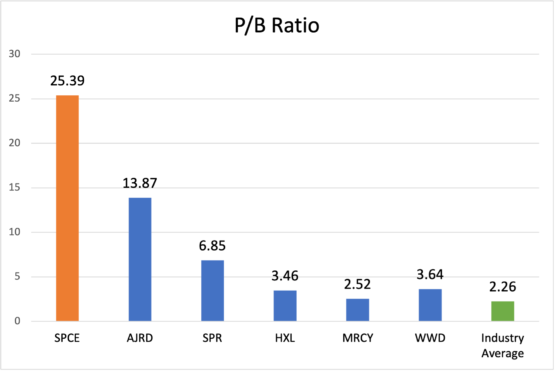

Furthermore, SPCE has a current P/B ratio of 24.52, which is overvalued compared to its peers and industry benchmark of 2.26. However, based on Figure 5, we can also consider this ascending P/B ratio from December 2019 as an indicator for its potential growth. Despite the overvalued P/B ratio displayed, SPCE should still be considered as a good investment based on our analysis earlier.

(Figure 4: P/B Ratio)

(Figure 5: SPCE P/B Ratio)

SPCE’s Targeted Stock Price Hit $70 in 2022

Since May 2021, SPCE’s stock price has been steadily rising and outpaced its three moving averages (the purple line is MA-50, the pink line is MA-100 and the blue line is MA-200) and the MACD curve also went above and crossed zero, illustrating that its short-term average outstripped the long-term average. Besides, if we take a closer look at the MACD line in July, it turned downward and crossed below the signal line, which corresponds to the price slumps that occurred recently. In the long-term perspective, SPCE’s stock price shows an overall upward trend and the volatilities do not appear to disrupt this potential increase.

My target price for SPCE in 2022 will hit $70 with a return of 32.85% and may go beyond depending on the company’s further technological development. Therefore, it is significant to put the growth of Virgin Galactic into the long run and consider it as a growth stock to buy as it is beneficial for investors over time.

Conclusion

Virgin Galactic has strived to create the safest and best customer space tourism experience through the operation of new generation space vehicles. We need to highlight the successful full-crewed flight on July 11th being encouraging news for investors and a huge milestone for the whole space tourism industry. More notably, Sir Richard Branson declared that Elon Musk – the owner of Virgin Galactics’s rival space exploration company SpaceX has also paid a $10,000 deposit to reserve a seat for a future Virgin Galactic’s flight as Sir Richard taking part in this full-crewed space flight.

Furthermore, given all the success Virgin Galactic has achieved and speculative perspectives in the suborbital space tourism industry, we can focus on its long-term development and consider it as a growth stock for the coming new age of space tourism. From I Know First’s forecast above, SPCE has positive signals and high predictabilities for all the long-term forecasted horizons from 1 month to 1 year, which serves as a sign for its price uptrend. We can also see a strong signal of 324.07, proving again its strong-buy position as a long-term investment.

Past Success with SPCE Forecast by I Know First

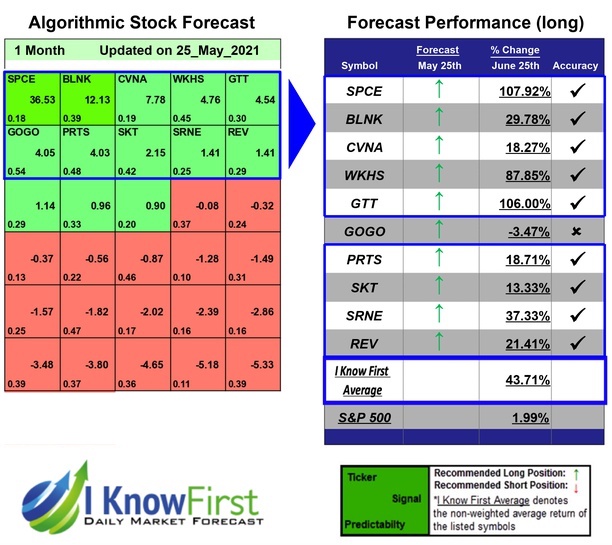

On May 25th, 2021, I Know First’s High Short Interest Stocks package on a 1-month time horizon had correctly predicted 9 out of 10 stocks that made explosive upside price changes and generated great returns. SPCE stock forecast was one among the top 10 recommended long-position stocks that achieved a notable return of 107.92%, which has successfully outperformed the S&P 500 benchmark (1.99%) by 105.93%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.