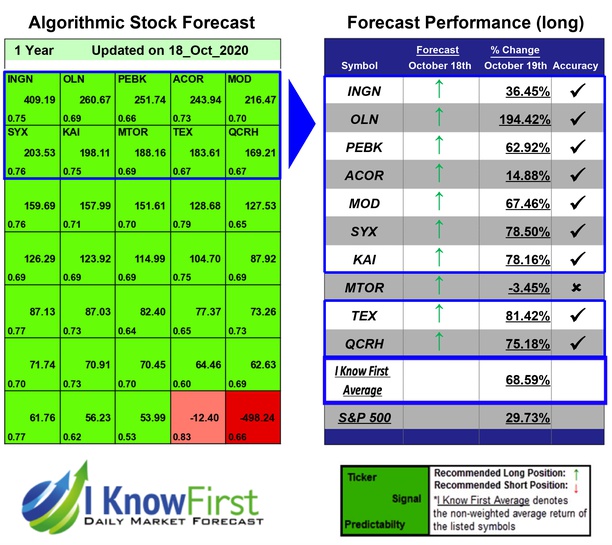

Small Cap Stocks To Buy Based on Big Data Analytics: Returns up to 194.42% in 1 Year

Small Cap Stocks To Buy

The Small Cap Stocks Package includes recommendations by the I Know First algorithm for small cap stocks to buy with a market capitalization of less than $1 billion:

- Top 10 Small Cap stocks to buy for the long position

- Top 10 Small Cap stocks to buy for the short position

Package Name: Small Cap Forecast

Recommended Positions: Long

Forecast Length: 1 Year (10/18/20 – 10/19/21)

I Know First Average: 68.59%

I Know First’s State of the Art Algorithm accurately forecasted 9 out of 10 trades in this Small Cap Forecast Package for the 1 Year time period. The greatest return came from OLN at 194.42%. Further notable returns came from TEX and SYX at 81.42% and 78.5%, respectively. The package had an overall average return of 68.59%, providing investors with a premium of 38.86% over the S&P 500’s return of 29.73% during the same period.

Olin Corporation (OLN) manufactures and distributes chemical products in the United States and internationally. It operates through three segments: Chlor Alkali Products and Vinyls, Epoxy, and Winchester. The Chlor Alkali Products and Vinyls segment offers chlorine and caustic soda, ethylene dichloride and vinyl chloride monomers, methyl chloride, methylene chloride, chloroform, carbon tetrachloride, perchloroethylene, trichloroethylene and vinylidene chloride, hydrochloric acid, hydrogen, bleach products, and potassium hydroxide. The Epoxy segment provides allyl chloride and epichlorohydrin for use in resins and other plastic materials, water purification, and pesticides, as well as for the manufacturers of polymers; liquid epoxy resins used in adhesives, paints and coatings, composites, and flooring; and converted epoxy resins and additives for use in electrical laminates, paints and coatings, wind blades, electronics, and construction. The Winchester segment offers sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, and industrial cartridges. The company markets its products through its sales force, as well as directly to various industrial customers, mass merchants, retailers, wholesalers, other distributors, and the U.S. Government and its prime contractors. Olin Corporation (OLN) was founded in 1892 and is headquartered in Clayton, Missouri.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.