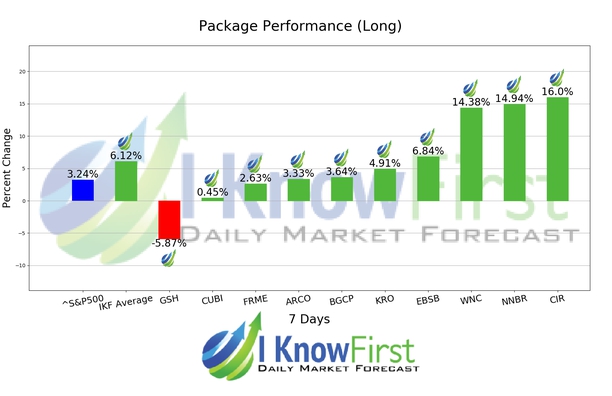

Small Cap Stocks Based on Deep Learning: Returns up to 16.0% in 7 Days

Small Cap Stocks

The Small Cap Package includes recommendations by the I Know First algorithm for small cap stocks to buy with a market capitalization of less than $1 billion:

- Top 10 Small Cap stocks to buy for the long position

- Top 10 Small Cap stocks to buy for the short position

Package Name: Small Cap Forecast

Recommended Positions: Long

Forecast Length: 7 Days (7/14/2020 – 7/21/2020)

I Know First Average: 6.12%

9 out of 10 stock prices in this forecast for the Small Cap Forecast Package moved as predicted by the algorithm. The greatest return came from CIR at 16.0%. Additional high returns came from NNBR and WNC, at 14.94% and 14.38% respectively. The Small Cap Forecast package had an overall average return of 6.12%, providing investors with a premium of 2.88% over the S&P 500’s return of 3.24%.

CIRCOR International, Inc. (CIR) designs, manufactures, and markets engineered products and sub-systems used in the oil and gas, power generation, aerospace, defense, and industrial markets worldwide. The company operates in two segments: Energy, and Aerospace and Defense. The Energy segment offers a range of flow control solutions and services, including valves, such as severe and general service control valves; engineered trunion and floating ball valves; and gate, globe, and check valves, as well as automatic re-circulation valves for pump protection. This segment also provides instrumentation fittings and sampling systems comprising sight glasses and gauge valves; liquid level controllers and switches, needle valves, pilot operated relief valves, plugs and probes pressure controllers, pressure regulators, and safety relief valves; and pipeline pigs, quick opening closure, and pig signalers. It offers its products and services to end-user customers, such as oil companies, power generation, and process industries, as well as engineering, procurement, and construction companies through direct sales, sales representatives, distributors, and agents. The Aerospace and Defense segment manufactures electromechanical, pneumatic, and hydraulic fluid controls; and actuation components and sub-systems. This segment’s products are used in commercial and military aircraft, including single and twin-aisle air transport, business and regional jets, military transports and fighters, and commercial and military rotorcraft, as well as serves unmanned aircraft, shipboard applications, military ground vehicles, and space markets. This segment provides its products under various brands, such as CIRCOR Aerospace, Circle Seal Controls, Aerodyne Controls, CIRCOR Bodet, CIRCOR Industria, and Hale Hamilton. CIRCOR International, Inc. (CIR) was founded in 1999 and is headquartered in Burlington, Massachusetts.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.