Sirius Stock Predictions: Why You Should Raise Your Bets On Sirius XM

This Sirius stock predictions article is written by Motek Moyen Research, Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Sirius stock predictions article is written by Motek Moyen Research, Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- I reiterate the buy recommendation I made for Sirius XM’s stock last November 5.

- Before COVID-19 came around, SIRI posted a 52-week high of $7.40 last February. Trust me, this stock is a great bargain whenever it trades below $6.

- Sirius XM and Pandora are enjoying a tailwind from this global pandemic. Satellite radio and streaming music entertain people while they work or learn from home.

- Consider the dip in SIRI’s stock price as a cheaper buy-in window. Sirius XM is a profitable company that is also a leader in its industry.

- The recent acquisition of Simplecast fortified Sirius XM’s podcasting empire. There are now over 155 million American podcast listeners.

We are now underwater on Sirius XM (SIRI). This satellite radio leader’s stock has yet not yet fully recovered from its lows during the pandemic sell-off last March. Nevertheless, I still restate the buy recommendation I gave SIRI last November 5. Before the COVID-19 pandemic came about, SIRI posted a 52-week high of $7.40. If it were not for this pandemic, investors would still be trading SIRI at above $7 or even above $8.

More investors will likely add to their SIRI position when they realize that this global pandemic is actually a tailwind for Sirius XM. The new normal or work-from-home and learn-from-home means more people are subscribing to satellite radio and streaming music/podcasts. Listening to music while working from their home offices enhances the productivity of employees. Furniture making or video editing is also not too tiring when you are listening to satellite talk shows or podcasts. No thanks to COVID- 19, I’m highly confident that SIRI deserves a 1-year price target of $7.50.

The more people that are forced to stay, learn, and work from home ultimately boosts the paid subscriptions of Sirius XM. Yes, SIRI’s management withdrew its 2020 guidance due to COVID-19. I’m still optimistic that Sirius XM will wrap up fiscal year 2020 with $7.70 billion in revenue and $0.27 in annual EPS. Let us use a forward P/E ratio of 28.5 and we can guesstimate that SIRI should be worth $7.68.

Buy SIRI While Its Still Cheaper Than Its Peers

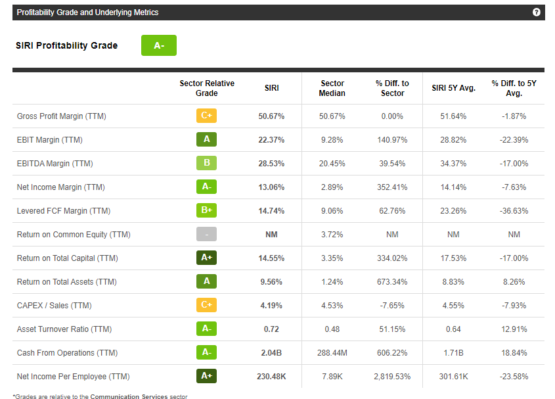

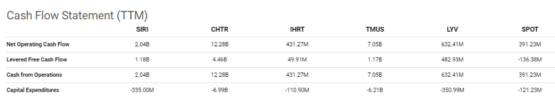

Sirius XM’s stock is a buy because this company is heavily into paid subscriptions. Strong recurring revenue guarantees the long-term profitability of Sirius XM. The best quality of SIRI has always been its profitability. SIRI’s TTM net income margin of 13.06% is 352.41% higher than the Communications Sector’s average of 2.89%. The paid subscriptions business model of Sirius XM helps it achieved a TTM Return on Total Capital of 14.74%. SIRI also touts a TTM Cash from Operations of $2.0 billion. The chart below illustrates that SIRI should be valued well above its sector peers.

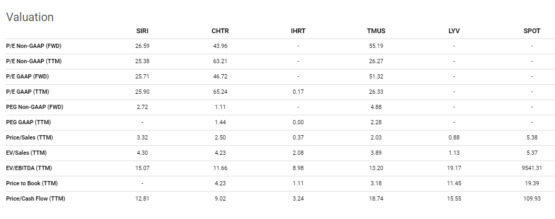

The much better profitability of Sirius XM convinced me that its stock still deserves higher valuation. Based on the chart below, SIRI has lower appreciation from investors when compared to Tencent Music (TMUS), Spotify (SPOT) or Charter (CHTR). The TTM Price/Sales of SIRI is just 3.32. This is lower than SPOT’s 5.38.

The relative undervaluation of SIRI against some of its peers should be exploited. SIRI will eventually rise in price after most investors realize that Sirius XM has better profit margins/performance than TMUS, SPOT, and CHTR. It is always better to buy stocks when they are still relatively undervalued.

Sirius XM and Pandora tout better ARPU than Spotify. The chart below says Sirius XM’s ARPU is $13.95, and Pandora, $6.85. Spotify’s ARPU is only $4.72.

Sirius Gets More Serious on Podcasting

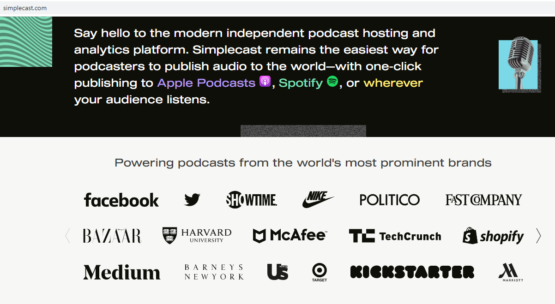

SIRI is a buy because it is getting more aggressive on podcasting. The recent acquisition of podcast analytics Simplecast will greatly enhance SIRI’s podcast strategy. Simplecast flourished as the go-to subscription-only platform for podcast management and analytics. Many internet big shots like Facebook (FB) and Twitter (TWTR) are current customers of Simplecast. The podcasting industry is a growth driver for Sirius XM and Pandora. Podcasting is now a $1 billion/year industry. It is growing at 30% CAGR and it will be worth $1.6 billion by 2022.

Going forward, Sirius XM will strongly monetize the subscription business of Simplecast. Providing big companies and ordinary people an all-in-one podcast management + analytics platform is an excellent source of new revenue. Many people are now making good money from podcasting. Around 90% of podcasts fans also listen at home. Podcasting is therefore the ideal entertainment while there is an ongoing pandemic.

Podcast entertainment is very popular in America. More than 155 million Americans listen to podcasts. This number is still growing. It makes perfect sense for Sirius XM to be more aggressive on podcasts. Advertising-supported and paid subscription-only podcasts could boost SIRI’s quarterly revenue to $2.1 billion.

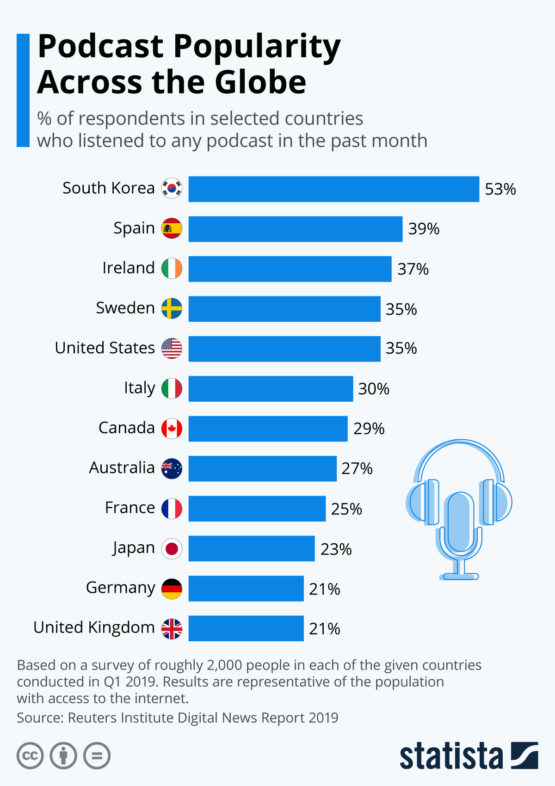

Further, the podcasting phenomenon is global. The United States actually is not the top country when it comes to podcast audience. South Korea tops the global list for having the most podcast listeners. Simplecast can help Sirius XM grow its international customers through podcast services. As of now, Pandora is currently SIRI’s strongest international expansion vehicle. The more subsidiaries that could increase its international revenue, the better it is for Sirius XM.

Conclusion

The relative undervaluation of SIRI makes it a strong buy. Sirius XM is a very profitable company that leads in paid satellite radio services. It also owns Pandora which gives SIRI a big paddle going upstream in the music streaming industry. Sirius XM has a very strong cash flow. It is always safe to invest in cash flow king companies like SIRI.

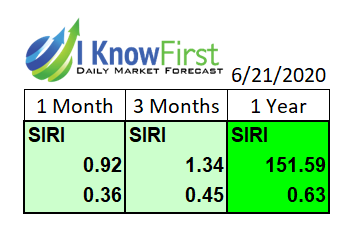

You should also go long on SIRI because it has a bullish strong Sirius stock predictions from I Know First. My 1-year PT of $7.50 for SIRI is thanks to the optimism of I Know First for Sirius XM.

Automated analysis of monthly technical indicators also produced a buy recommendation for Sirius XM’s stock. Go long on SIRI and hold it for a year. You will not regret it.

Past I Know First Success With Sirius Stock Predictions

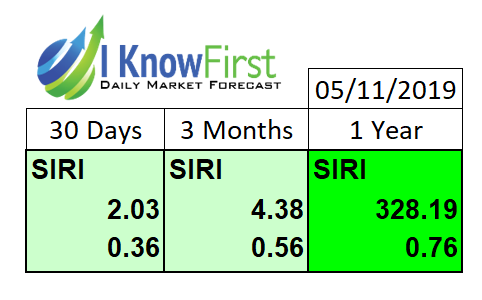

I Know First has been bullish on Sirius Stock in past predictions. On Nov 05, 2019, the I Know First algorithm issued a bullish 3-months forecast for SIRI with a signal of 4.38 and a predictability of 0.56, the algorithm successfully forecasted the movement of the SIRI’s shares. After 3 months, Sirius shares rose by 5.91% in line with the I Know First algorithm’s forecast. See chart below.

Here at I Know First, we use our stock forecasting software to produce AI stock prediction for over 10,500 assets, for example aggressive stocks, S&P 500, etc. Now that online trading platforms are getting popular amongst investors, we also provide forecast on best stocks on Robinhood. We have our currency predictor for currency forecast, gold algorithm for gold forecast, and in particular, we offer Apple stock forecast. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.