Sirius Stock Predictions: Why Sirius XM Is A Better Investment Than Spotify

This Sirius stock predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Sirius stock predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Apple, Amazon, and Google do not compete against Sirius XM’s core satellite radio broadcast business.

- Unlike online streaming-dependent Spotify, Sirius XM has an unthreatened growth driver from its satellite radio subscription service.

- Pandora also gave Sirius XM a huge presence in paid/ad-supported music streaming. I believe ad-supported radio shows and music streaming are long-term winners.

- Sirius is a profitable company that pays quarterly dividends.

I reiterate the March 2018 buy recommendation I made for Sirius XM (SIRI). Sirius XM touts an invidious position as the no. 1 satellite radio company. The refusal of cash-rich companies like Apple (AAPL), Amazon (AMZN), and Google (GOOGL), to challenge Sirius’ dominance in paid satellite radio subscriptions made SIRI the better long-term investment than Spotify (SPOT).

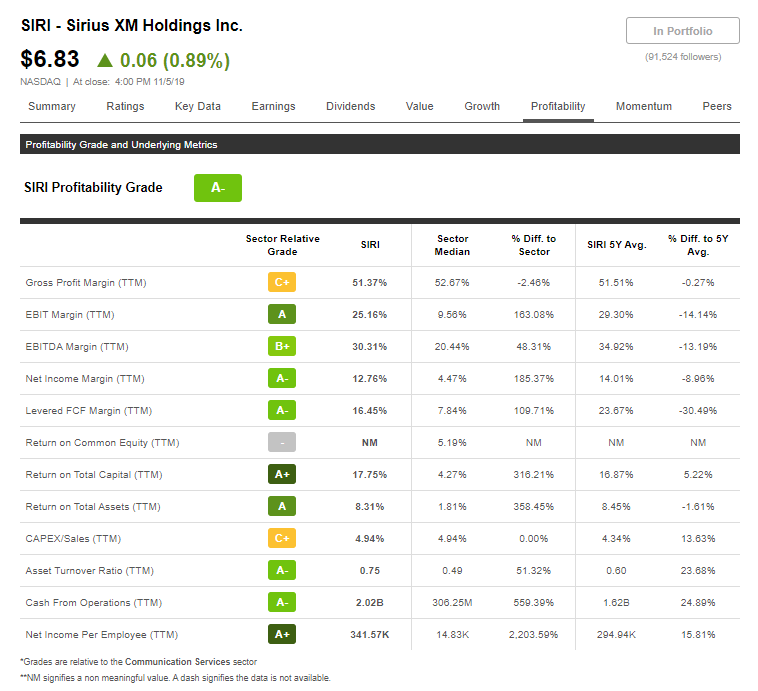

The almost-zero competition in subscription-only car/portable satellite radios should help SIRI maintain its TTM net income margin of more than 12%. Seeking Alpha’s proprietary Quant rating system gives SIRI an A- grade for its consistent profitability. No rating system can give SPOT a good profitability assessment at the moment.

Why Sirius XM Is The Superior Investment

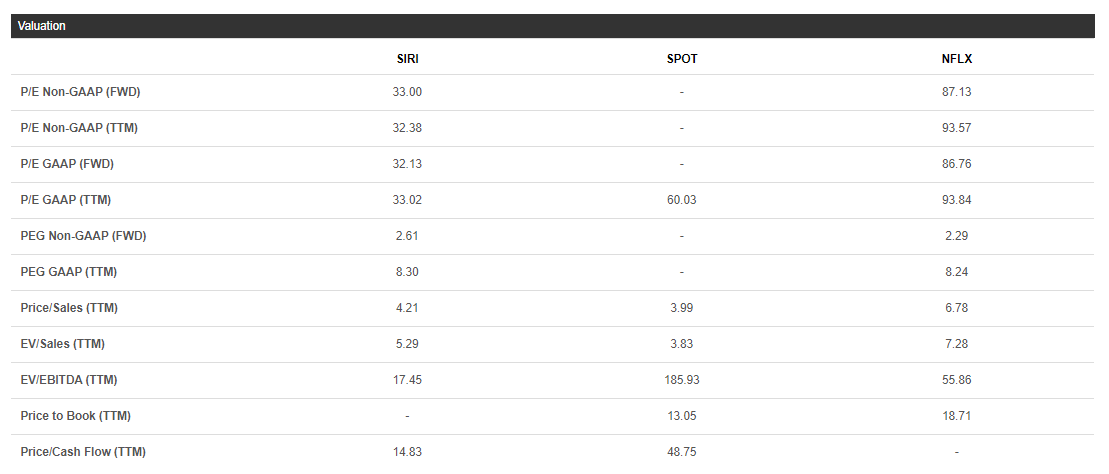

SIRI continues to trade at lower valuation than SPOT or NFLX. This is an aberration that eventually will get corrected. Sirius XM vaunts much higher gross and net income margins than Spotify and Netflix (NFLX). Producing original content for radio audience is obviously cheaper to do than Netflix movies/TV shows.

Going forward, SPOT will continue to lose money. Apple Music and other competing online music/radio companies will eventually gain more subscribers to the detriment of Spotify. The bidding war over rights to stream third-party songs, news, podcasts, and other radio shows will cause increasingly higher overhead expenses for Spotify, Apple, and Amazon.

I doubt if Apple and Amazon are making a profit in their streaming radio/music segments. Like Spotify, Apple and other paid music streaming platforms are likely losing money (or just barely breaking even). Amazon is only using its cheap music streaming service to attract repeat e-commerce customers.

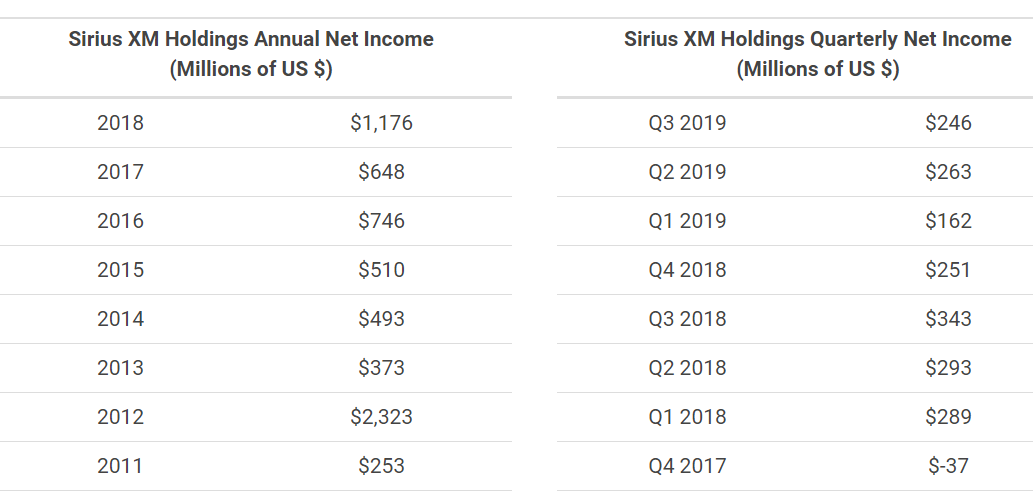

I repeat, you should go long SIRI because it continues to be profitable. Persistent profitability helps a company like Sirius XM become a decent dividend-payer. SIRI religiously pays quarterly dividends because it makes adequate profit.

SIRI currently has cheaper valuation ratios than SPOT or NFLX. They are all entertainment companies but only Sirius XM has an unchallenged moat with its satellite radio business. Unless Netflix or Disney (DIS) decides to disrupt Sirius XM’s satellite radio business, SIRI will remain the smarter long-term investment than NFLX or SPOT.

Further, Pandora is also a dark horse on the race over internet radio/music streaming. Sirius XM did not buy Pandora because it wanted to compete with Spotify or Apple Music’s subscription-based business model. Pandora became America’s no.1 internet radio because of its ad-supported approach to online radio broadcasting.

Pandora’s quarterly advertising revenue is now $315 million. This goes to show that paying monthly fees is not the only way for people to enjoy streaming music/internet radios. Monetizing non-paying listeners through advertising is an efficient alternative to Spotify’s business model. Pandora is like the online version of legacy AM/FM radio stations. They all thrive through audio advertising.

Debt Is Not A Crippling Headwind

Majority of anti-SIRI detractors always point out the large debt load. Sirius XM indeed is burdened by more than $7.9 billion in long-term debt. However, the company is generating quarterly levered free cash flow of almost $340 million. SIRI’s quarterly gross profit is $1.03 billion. Having a large debt is not a crippling handicap to a profitable company with a strong cash flow.

Sirius XM has more than 34 million paying subscribers. They are all diligent contributors to SIRI’s balance sheet. They contribute $2 billion/quarter to SIRI’s revenue stream. A long-term debt of $7.9 billion is a light burden when you can generate 50% gross profit on a quarterly revenue of $2 billion.

Conclusion

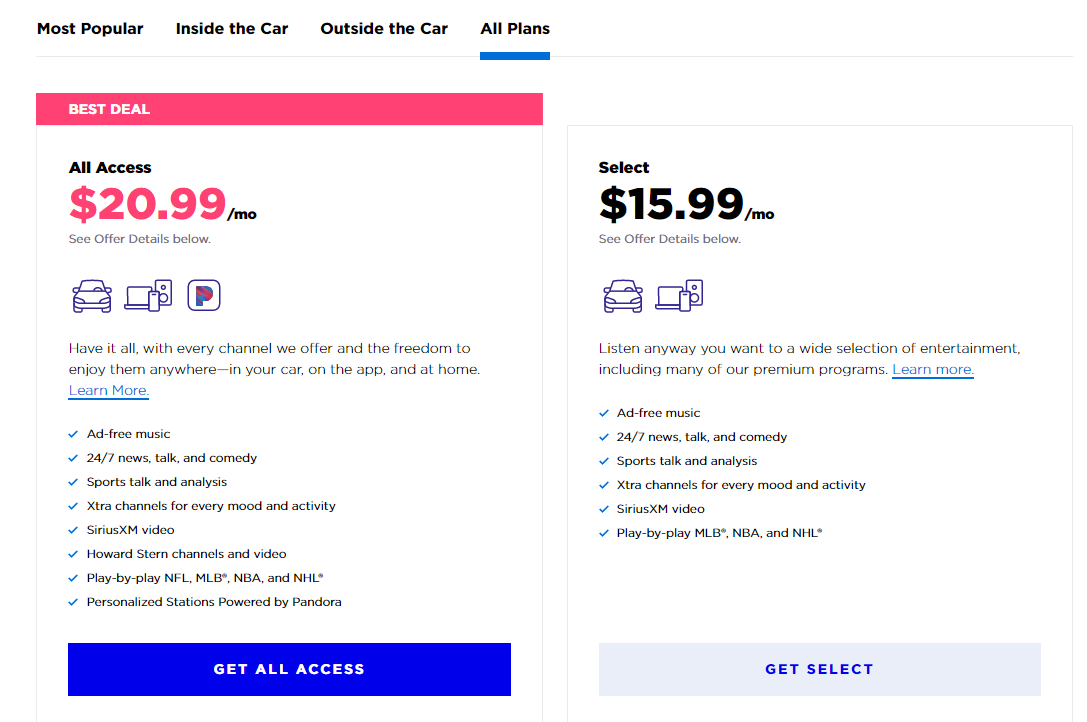

The long-term prosperity of Sirius XM is well assured because there’s near-zero threat to its satellite radio business. Internet radios and online streaming are not as useful/reliable because they rely on fast internet speed. In the U.S. and other developed countries, satellite signal will remain the de facto standard for in-vehicle radios. The ‘connected car’ concept is actually better served through satellite signals, not through 4G or 5G internet subscriptions. The argument that 5G cellular/internet connections can supplant satellite broadcasting is fallacious. The high cost of 4G/5G data plans means few people will consider wasting their monthly data allocation on internet radios. Sirius XM offers affordable unlimited entertainment (in-car, mobile app, home PC) for $20.99 or $15.99.

Take note that $20.99/month plan also bundles video entertainment. Going forward, you should evaluate SIRI’s future based on its potential platform for streaming videos. Sirius XM has grown beyond its old audio-only approach to entertainment. Satellites can deliver audio and video entertainment more efficiently and cheaper than internet-based platforms.

Sirius XM’s stock has a very bullish one-year algorithmic market trend score from I Know First. The I Know First’s AI stock algorithm also touts a very high 0.76 predictability score over SIRI’s one-year market trend.

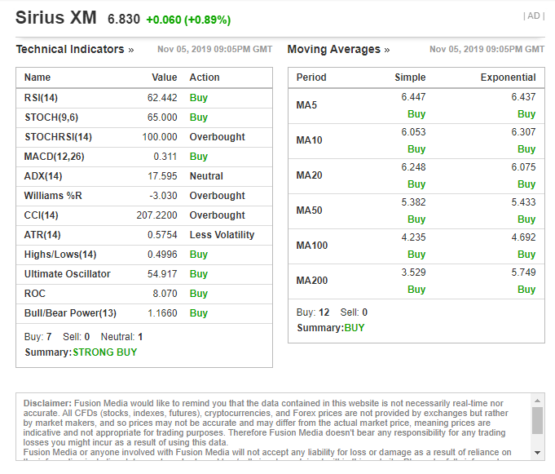

Analysis of monthly technical indicators and moving averages trends also say SIRI is a buy right now.

Past I Know First Success With Sirius Stock Predictions

I Know First has been bullish on Sirius Stock in past predictions. On March 4, 2018, the I Know First algorithm issued a bullish 3 months forecast for SIRI with a signal of 40.34 and a predictability of 0.58, the algorithm successfully forecasted the movement of the SIRI’s shares. After 3 months, Sirius shares rose by 12.70% in line with the I Know First algorithm’s forecast. See chart below.

This bullish predictions for Sirius stock was sent to the current I Know First subscribers on March 4, 2018.

I Know First Stock Predictions

Here at I Know First, our stock algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock forecasts, gold price predictions, currency forecast and, trade ideas for different stock exchanges. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our algorithmic trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

Please note-for trading decisions use the most recent forecast.

To subscribe today click here.