SIRI Stock: Sirius XM Has 20% Upside Potential

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

SIRI Stock

Summary

- SIRI’s stock price has largely been flat this year.

- This is in spite of the fact that Sirius XM has better ROA and ROI ratios than its industry peers.

- Sirius XM is still profitable in spite of Apple’s entry in subscription-based music streaming.

- Satellite radio still works without the need for costly mobile data subscriptions.

- I Know First Algorithmic signal is currently bullish on the SIRI stock for the long term

The mere fact that Sirius XM (SIRI) is still adding new paying subscribers (and making a profit) after Apple (AAPL) released its own paid music service tells me that SIRI should belong to any long-term value investor’s portfolio. The business model of Sirius XM is resilient and will keep on growing in spite of the rise of online streaming music.

The most obvious advantage of Sirius over Apple Music, Pandora (P), and Spotify, is that satellite radio will still work even without 3G or 4G signal. During the first 3 months of 2016, Sirius added another 465,000 new paying customers. It now has 30.1 million subscribers (up 8% Year-over-Year). SIRI’s management is guiding for 1.6 million new net subscribers for 2016.

Sirius XM has a loyal base of customers and it has little competition in satellite radio broadcasting. I therefore think the stock market has been unfair to SIRI. The stock price has been largely flat this year. It might be a good time to go long on SIRI now while it trades below $4.

(Source: Google Finance)

Sirius is Growing Even Against Apple

Apple Music only has 13 million subscribers. This is in spite the fact that there are now more than a billion active iOS devices in the planet. The fact that Sirius XM’s iOS app still received around 100k downloads means many iPhone/iPad owners are also paying subscribers of Sirius.

The sad truth is that Apple might have to keep lowering its Apple Music fees before it could even match the loyal customer base of Sirius XM. Apple Music was never an existentialist threat to Sirius XM.

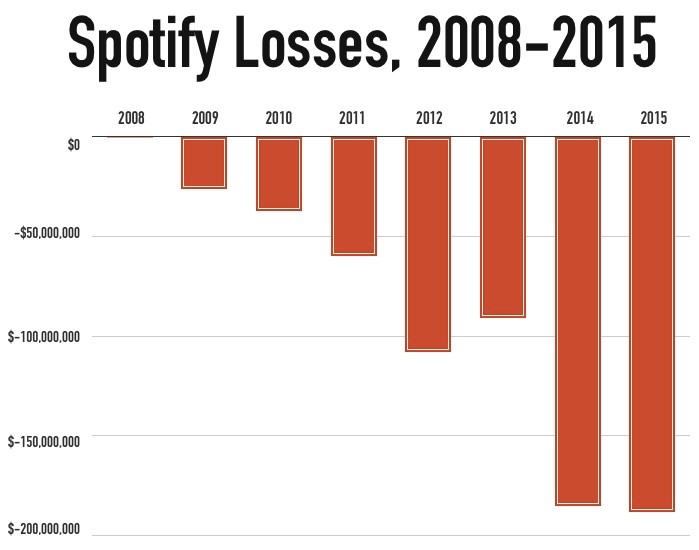

Pandora is still a money-losing company that still relies mostly on ad revenue, rather than from paid subscriptions. Sirius XM’s core strength has always been its fanatic adherence to never introduce ads on its service. Spotify has 30 million paid subscribers and yet that British firm is still a money-losing company. Spotify’s annual losses have been growing over the years that its business model is already doubtful.

(Source: Digital Music News)

I am firmly confident that even non-Americans will embrace the inherent advantage of having a cheap $9.99/month satellite radio service. Sirius XM will find willing customers here in the Philippines. Spotify is very popular here in the Philippines but there are millions of us who wish to have satellite radio.

Satellite TV is already available here in my country and we are willing to pay $19.99 every month just to free from annoying TV ads. We also want an ads-free satellite radio service like Sirius XM. The Philippines is a country of more than 7,000 islands. Spotify doesn’t work in areas where there are no DSL/3G/4G signals.

SIRI is Better Than Its Peers

There are five expert analysts at Tipranks who all have strong buy recommendations for SIRI. These analysts have a median 12-month price target of $4.77 for Siri. They are convinced that Sirius XM’s stock has more than 20% upside potential.

(Source: TipRanks)

We should heed the wisdom of these highly-paid Wall Street Analysts. They also share my bullish sentiment for SIRI. I could explain this Wall Street love for SIRI by emphasizing another key advantage of Sirius XM. A check on my getaom.com account revealed that SIRI has notably better Gross/Operating Margins and ROI/ROA ratios than its peers.

Please study the comparative chart below from getaom.com. SIRI is clearly a better quality for long-term investing because of its superior ROA ratio (more than double the industry average) and Profit Margin compared to its peers.

Final Thoughts

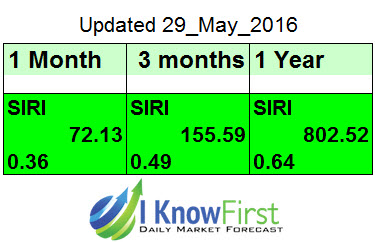

Investors who want a stable long-term growth investment opportunity should consider adding SIRI to their portfolio. Satellite radio without annoying ads will always find legions of paying customers in America, Canada, and Europe. My buy endorsement for SIRI is also supported by the extremely favorable algorithmic forecasts from I Know First.

SIRI has a one-year signal score of +802.52. The predictability factor is also very high, 0.64. It means the machine-learning supercomputers of I Know First are very confident that SIRI’s stock price will go much higher than $4 this year.

In addition, the I Know First Algorithm has predicted in the past the bullish performance of SIRI stock movement like in this Stocks Under $5 forecast showing a signal of 5.86 and predictability of 0.48 achieving a fantastic return of 15.68% in 3 Months.