Sector Rotation Strategy And AI: Match Made In Investment Heaven?

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.It is no secret that bigger institutional investors are not really known for high risk tolerance. After all, going all aggressive with the millions and millions of your clients’ funds is akin to putting your best suit on as you head to play soccer with your friends – it is a statement (a fashion statement, at least), but in life would your life be that better with that wonderful suit ruined? That is unlikely, and even less likely is the prospect that the investors would be happy with losing their money due to things going horribly wrong. Thus, the Big Boys Club can be reasonably expected to opt for strategies that do not come equipped with major risks, and among them is an approach that is known as Sector Rotation – and this is what we will be looking at today.

What Is Sector Rotation?

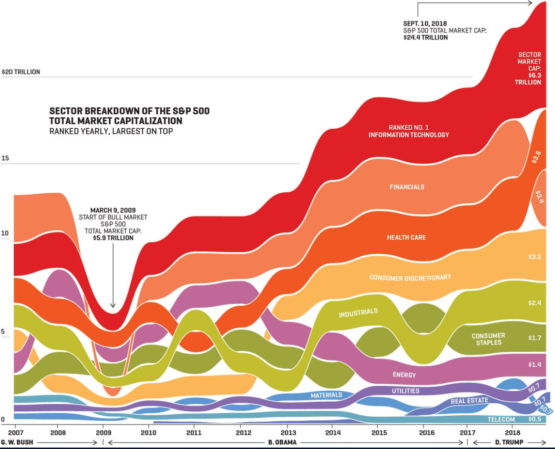

In its essence, pure and simple, the Sector Rotation strategy is based on the idea that in any given time period, some sectors in any given economy perform better than others, investment-wise, growing higher and generating better returns. The next logical step from this point, of course, is to invest in the top performers and try to avoid investing in those lagging behind. After all, money attracts more money, and Wall Street has as much love for the winners as it has spite for the losers, right?

Now, the next step would be to keep an eye on your portfolio and make sure you re-balance it every now and then to make sure your funds are allocated in line with the aforementioned idea; in other words, you want to keep your money is with those showing the strongest performance. Thus, when you have to re-balance your portfolio, you sell off some (or all) of the assets and invest the money, beefed up with the gains from your top performers, into the assets that you have picked for your updated portfolio.

How often is every now and then, you may ask? The answer depends on a whole variety of factors, including your risk tolerance, the assets you are investing in and the current state of the market. As an example, however, you can develop a reference system that would be based on the stocks’ position in regards to their respective golden and death crosses, or any other indicators that you would find relevant, or just pick a timeframe that serves your interests and wallet.

The wallet is an important factor here, because, as you have already guessed, this strategy suggests a relatively high amount of extra expenses. Moving your funds from one sector to the other means paying out a hefty sum in transaction fees to the brokers. That is why sector rotation as a strategy is more aligned towards the aforementioned big institutional investors rather than retail investors.

The increased dragdown also means that the portfolio manager has to be as certain that the next move will bring in the high yield as it is humanly possible. This does make sense – if you have to dish out the fees and such, the investment had better be worth it! This is where the low risk tolerance also comes into play, of course, because the stocks imploding on you, again, just add up to your losses, sitting tightly next to the dragdown on a balance sheet that does not really have too much to do with balance anymore.

So how does the investment expert make sure that the next move is the right one? Through rigorous research of market data and a lot of strategizing. Now, however, there are other tools that they can rely upon, tools honed by some of the best technology that our high-tech era can offer.

AI-Driven Trading Strategies

As we noted in the previous section, Sector Rotation is largely about crunching the numbers to pick out the best moment for re-balancing and then doing the same to identify the best sectors to move into. Thankfully, in our this day and age, there is a technology that is amazingly good with all that involves complex statistical inferencing – and that, of course, is the artificial intelligence.

Now, when it comes to machine learning and AI, statistics, rather than an actual higher cognitive function, is what we are primarily dealing with. The essence of the modern AI is going through a large dataset with a specific task in mind, picking out the models and formulas that describe the patterns present in it, and running new data through these formulas, mainly to predict things or classify things. While a random forest would be very different from a deep neural network in terms of their technicalities, the core idea would still be the same – you feed a huge dataset to the algorithm to train on and then give it new data to work with.

With the AI hype resonating across businesses and industries, it is no wonder that the finance sector has picked it up as well. AI is used to accomplish a wide variety of tasks in this sphere, ranging from preventing credit card fraud to helping the customers manage their income and spending. But perhaps the most exciting (and challenging) task for AI to take on is investment advice, with machine learning utilized to model the market dynamics and pick out the most lucrative investment options.

One of the ways to do so is to look at the markets in a holistic fashion, viewing them as complex and chaotic dynamic systems, which can be thrown off-balance even by relatively small events. This approach, rooted in the so-called chaos theory, an interdisciplinary field of study looking into the aforementioned chaotic systems, is well-adjusted to pick up the trading signals lost in the market noise. For examples, look no further than the proprietary AI developed and trained by the Israel-based I Know First company. Trained on a historical dataset covering 15 years of trading, it can model and predict the price dynamics for more than 13,500 financial instruments for time horizons ranging from 3 to 365 days. Its output is delivered as an easy-to-interpret heatmap with 2 numerical indicators: signal, demonstrating the asset’s performance relative to the other stocks on the forecast, and predictability, which demonstrates how well the algorithm has predicted the asset’s dynamics in its prior forecasts.

Sector Rotation Strategy And AI Tools

So how do we utilize the power of advanced AI tech to make sure our bet is always on the winning horse? Well, the whole affair is pretty simple and straightforward, to the point where it can be completely automated to exclude a human wealth manager.

The key is in the two aforementioned indicators – signal and predictability. With these averaged across the 11 GICS sectors, one can easily acquire an estimate of how every individual sector is going to perform. Alternatively, the forecasts for sectoral ETFs can be used as a pretty similar benchmark, with even less calculation included. This is our step 1: in line with the idea of betting on the winners, we identify the most lucrative areas.

Step 2, if we want to be thorough about it, is to pick the ratio for allocating the funds between the areas that we have identified. A variety of methods can be utilized here. For example, we can use our numeric benchmarks for sector performance, whether we are looking at the ETF forecasts or averaged predictions for individual stocks in a given universe, as weights to define the exact distribution of funds among the top 3 sectors. Or among the top 5 sectors, if we want a more diversified portfolio. Or we can be less fancy about it and just split the funds in a 34%-33%-33% ratio among the top 3 sectors, that is also a possibility.

Step 3, then, would be to place the bets on the most promising financial tools within the areas that we have picked out. If we want to work with individual stocks, the idea would be to pick out the assets that have the highest signal and are predicted to move in the same direction as the sector itself. Among these, we will select the ones with the highest probability scores, to make sure our investment does not fall prey to the AI’s hiccup. And then, we split the funds allocated to this area among them, once again, using their respective signal and predictability indicators as weights for calculating the ratio. With the ETFs, which suggest lower risk and lower returns, things will go pretty much the same way.

Finally, step 4 is to figure out our pattern for rebalancing. With I Know First forecasts available for a wide range of time horizons, the most straightforward option would be re-balance our portfolio, going through steps 1 to 3 each time, with every new weekly forecast. This timeframe would be a compromise between our desire to react to the ever-changing market and the fact that pretty much any predictive AIs would be more efficient when working with longer periods, because there is more of a seasonal pattern to work with. Or, alternatively, we could work out a benchmark that would be based on the moving average, as suggested earlier, or on the changes in the forecasts themselves.

Needless to say, we can easily add step 5 and put a human investment manager in charge of things, whether just to greenlight the AI’s decisions or use them as a suggestion rather than a guideline for action.

But with that said, we have conducted multiple trials of an algorithm based on the approach outlined above, and in every case, it would consistently beat the S&P 500, which was used as the benchmark for a trial. The algorithm was able to beat the benchmark while dealing both with the individual stocks and the ETFs.

This ultimately proves that the AI technology and AI-driven decision-making enhancement tools can be a major boon for the institutional investors looking for ways to improve their sector rotation strategizing. Furthermore, it can also be of use to retail investors looking to replicate the strategy, since the dragdown inherent to the strategy can be absorbed by the persistent increase in returns, if compared against the S&P 500 index