Sandisk Stock Analysis: Even After Merger Arbitrage Opportunities Announced, SanDisk Still Remains an Attractive Long Term Buy

Reuben Bor is a Financial Analyst Intern at I Know First.

Reuben Bor is a Financial Analyst Intern at I Know First.

Sandisk Stock Analysis

- SanDisk is at a low point due to slowing PC Sales

- Continued innovation and adaption to the enterprise and cloud markets could present strong growth opportunities for the company

- Merger with Western Digital could prove to be profitable

- Q4 Earnings outperformed analyst estimates

- I Know First is bullish for the mid and long term on Sandisk

Introduction:

SanDisk Corporation is a global innovator in the digital storage space. Founded in 1988 by Eli Harrari, SanDisk was looking to replace hard disk drives with a more-efficient portable solution originally called “system flash”. In 1991, SanDisk sold their first flash-based hard disk drive replacement to IBM for around $50 a megabyte of storage. Today, almost everybody familiar with the concept of a computer is familiar with portable flash drives, or memory sticks, and through continued innovation the cost of flash storage has been driven down by nearly 100% to $0.001 a megabyte. Although, with the switch to cloud storage, people are not necessarily buying flash-drives as much as they used to, SanDisk has a versatile portfolio of products that can be found in almost every consumer electronic device from tablets to digital cameras, as well as a growing number of mobile embedded products and continued new launches for enterprise management.

SanDisk also operates solid-state drives for notebooks and computers. Shares of SanDisk were down over 22% in 2015, as PC Sales have been slumping, however, with the expected increase in demand for mobile storage and enterprise storage capacity and SanDisk’s commitment to innovative technology, slowed PC sales may not continue to be an impediment to growth in the future. SanDisk has a solid balance sheet and 4Q earnings that surpassed analyst expectations, as well as strong strategic alliances with both Toshiba and Supermicro, which allows them to remain competitive. With over 5,000 patents, SanDisk has a huge intellectual property portfolio. Furthermore, the announced merger between SanDisk and Western Digital has the potential to position the new entity as a dominant force in the flash space industry.

Organic Growth through New Technology:

Since 2016 began, SanDisk has had several breakthrough products. Their most popular product, the SanDisk Connect Wireless Stick has been improved to now contain 200 GB of capacity. The Consumer Electronics Association recognized the wireless stick, where it was awarded “innovation honorary” in its product category at the 2016 Consumer Electronics Show. Dinesh Bahal, vice president of product marketing at SanDisk explained to Businesswire, “With the explosion of content, people need more advanced storage solutions to keep up with the volume and quality of the photos, videos and files they’re creating on their mobile devices. Our goal is to deliver innovative, intuitive offerings that help them capture life’s great moments without worrying about storage limitations.” Furthermore, SanDisk has remained on the cutting edge of storage in the SSD space by introducing the SanDisk Extreme 510 Portable SSD, a high performance, durable and waterproof solid-state drive. The most notable of SanDisk’s new technologies is the new X400, which is the world’s thinnest one terabyte solid-state drive, which has been designed for faster start up, and longer battery life, features that SanDisk market research show to be the most important for consumers. These three new product launches alone indicate that they are committed to their core competence of researching and developing new and better storage solutions.

(Source: Business Wire)

Although, in the past 3 quarters of 2015 most of SanDisk’s revenue streams have declined, their enterprise SSD revenues have increased by an incredible 32% year over year! SanDisk is adapting to the trend of growth in enterprise SSD, and in August of this year, they announced that they would release CloudSpeed Ultra Gen II enterprise-grade SSD. This technology is targeted towards cloud service providers (CSP) and software-defined storage vendor environments (SDS). John Scaramuzzo, general manager of SanDisk’s Enterprise Storage Solutions division explained “As a trusted provider of flash storage solutions, SanDisk understands the critical need for cloud elasticity in order to raise customer service levels. With CloudSpeed Ultra Gen. II, CSP and SDS companies can provide an exceptional customer experience while reducing administrative overhead along with the number of servers and software licenses needed to support the transaction and analytical databases.” As SanDisk continues to innovate and adapt to the new landscape of the storage industry, they will continue to grow.

Furthermore, SanDisk is dedicated to remaining competitive in the field of 3D-NAND, the newest, and most advanced form of flash memory. Essentially, 3D NAND uses a multilayered cell structure to provide larger and faster storage. Samsung is currently the undisputed leader in 3D NAND, having been the first to introduce the technology and with more resources than SanDisk. However, in an effort to compete SanDisk has teamed up with Toshiba to create the 32GB 3-bit-per-cell 48-layer 3D NAND flash chips that will offer double the amount of storage as the next densest chip.

Inorganic Growth and SanDisk, Western Digital Merger:

With the turbulent inorganic growth in the storage space, as a result of the decline in PC sales, SanDisk along with its peers, Western Digital, Seagate Technology, and NetApp Inc. have been slumping. The flash memory market is very commodity-like, in that a company’s performance are more heavily defined by intense price competition than other spaces of the technology sector. Basically, whoever can offer the most storage at the best price will win. Having already discussed how SanDisk is still in a position to grow organically, by introducing new technology and adapting to new demands, such as a focus on the cloud based storage and enterprise storage; SanDisk is also in a position to grow through other means.

First, it is important to note, that for 27 years SanDisk has been a leader in flash memory technology, both in terms of cost and innovation. This has allowed them to create a very strong portfolio of intellectual property, and in the past 3 years, SanDisk has generated $1.1 billion in revenue through license and royalty agreements. Furthermore, SanDisk has an established joint venture for obtaining raw materials with Toshiba. The nature of this relationship means that about three fourths of SanDisk’s costs are denominated in Japanese Yen. Given SanDisk’s exposure to the Yen/Dollar relationship, the increased strength of the dollar and Japanese stimulus could lead to increased margins for SanDisk.

In October of this year, Western Digital announced their intentions to acquire SanDisk at a 10% premium to SanDisk’s stock price at the time of the announcement. With a market share of about 45%, Western Digital is currently the market leader in hard disk drive space, a $30 billion market that it has few growth prospects over the next five years. The solid-state drive market is about $14 billion dollars, and it is expected to grow at a rate of 12-13% between 2014 and 2019. This explains Western Digital’s willingness to pay such a premium. The terms of the merger are a little bit complicated. In September, Western Digital announced their plans to sell a 15% stake for $3.78 billion to the Chinese company, Unisplendour Corporation Ltd. If the deal between Western Digital and Unisplendour goes through, Western Digital will pay $85.10 in cash as well as 0.0176 shares of Western Digital for each share of SanDisk. However, if the deal with China does not go through, Western Digital will pay will pay $67.50 in cash and 0.2387 shares of Western Digital for each share of SanDisk. The deal between SanDisk and Western Digital would need to pass a vote of the shareholders of both companies as well as be approved by the SEC and antitrust regulators.

President and CEO of SanDisk, Sanjay Mehrotra explained in a press release, “Western Digital is globally recognized as a leading provider of storage solutions and has a 45-year legacy of developing and manufacturing cutting-edge solutions, making the company the ideal strategic partner for SanDisk. Importantly, this combination also creates an even stronger partner for our customers. Joining forces with Western Digital will enable the combined company to offer the broadest portfolio of industry-leading, innovative storage solutions to customers across a wide range of markets and applications.”

J.P Morgan analyst Harlan Sur explained in a note that the combined Western Digital and SanDisk entity is a good strategic move and that they could be a “Powerhouse” in the storage market, especially considering “SanDisk’s attractive flash memory assets including strong enterprise (SAS/SATA/PCIe), client and retail product portfolio.”

Benchmark Research analyst Mark Miller predicted that the merger could propel Western Digital’s stock price to $100 as a result of cost savings and future projected earnings.

Aaron Rakers of Stifel Nicolaus explained that “we do believe Western Digital + SanDisk combination creates a powerful portfolio-rich company that controls key layers of innovative differentiation – from the media layer to the differentiation that has proven increasingly important in controllers and firmware features / functionalities.”

Pacific Crest analyst, Monika Garg, calls SanDisk/Western Digital her favorite idea of 2016. She says in a note “We believe the deal makes strategic sense for both companies and would be very accretive. The combined entity should generate significant cash flows and would create a formidable vendor in the solid-state-drive (SSD) space. Per our estimates, after 12 to 18 months, the combined entity could generate more than $10.60 in EPS and more than $3.33 billion in cash flows.”

SanDisk 4Q Revenue:

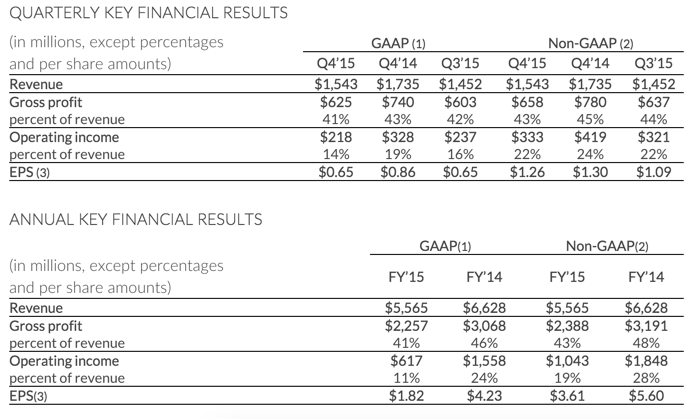

Sandisk released their fourth quarter and 2015 fiscal year results on January 27th, 2016. For the fourth quarter, SanDisk reported revenue of $1.54 billion, although this is a 6% increase from previous quarter. The annual revenue for 2015 was $5.56 billion dollars, down 16% from 2014. On a GAAP basis, Net income for the fourth quarter was $135 million, or $0.65 a share, slightly higher than the net income for the third quarter of $133 million. The company paid $28.1 million in fees for their merger with Western Digital. Adjusted earnings were $1.26 a share, which outperformed the Wall Street consensus projection of $0.89 a share.

In the press release, SanDisk president, and CEO Sanjay Mehrotra said “I am pleased to report an excellent fourth quarter finish to 2015 driven by strong performance in enterprise and retail, We made substantial progress in the second half of 2015 in reinvigorating our portfolio, improving our product execution and expanding our customer engagements. We also achieved an important milestone in beginning our multi-year conversion to 3D NAND, with first retail product shipments and initial OEM customer sampling in the fourth quarter.”

(Source: SanDisk Investor Relations)

Conclusion:

SanDisk experienced a huge spike in price from under $50 at the end of September to a high of $78 on October 28th, as a result of the merger announcements with Western Digital. Trade volume indicates that many investors are probably not looking at SanDisk for the long term. The stock has slightly leveled off, closing at $70.65 on February 1st. Given the complicated terms of the merger, mainly the fact that a deal between China and Western Digital needs to go through in order for SanDisk holders to get a larger cash amount, it is understandable that investors who are looking to quickly benefit from the merger are skeptical. However, investors that are interested in taking a long-term look to SanDisk may see an opportunity here. SanDisk has been a market leader for over 20 years and has been very proactive in adapting their product portfolio to the meet the new demands of cloud based and enterprise storage. Therefore, investors should not be discouraged by the slowing of PC sales. SanDisk has strong partnerships with other leading tech companies such as Toshiba, which will allow them to remain competitive. Finally, SanDisk has a strong balance sheet and although, along with all of their peers, earnings have been significantly down since last year, this past quarter has showed many positives, especially growth within enterprise storage.

Forecast

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database and utilizes it to predict the flow of money across 3,000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

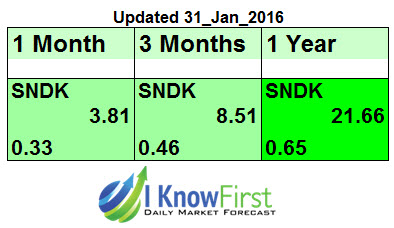

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First offers unique data points through a 100% empirical predictive model for the capital market. The algorithm produces forecasts with a signal, indicating the direction and strength of the predicted asset’s price movement, and a predictability indicator, which serves as a prediction quality measure. Our heat map forecast tables provide instant views on best market opportunities. They serve as a decision support system or an idea generator in the form of investment signals. Also provideing customers with the foundations needed to form their own quantitative trading strategies, such as our swing-trading model.

The Algorithm has a Bullish signal of 3.81, 8.51 and 21.66 and predictability of 0.33, 0.46 and 0.65 for SNDK in the 1 month, 3 months and 1 year time horizon.

Previously I Know First’s Algorithm predicted the stock movement of Sandisk in this Tech forecast from 25th of May 2015, for a 3 month period. The SNDK signal was -43.61 and predictability of -0.01 managing to get returns of 30.92% in three months time.

Also in this Top 10 S&P500 Forecast from the 21st of October 2014, for a 1 month period SNDK had a strong signal of 94.32 and predictability of 0.29 managing to bring returns of 19.89% as the algorithm correctly predicted.