Nvidia Stock Analysis: Tesla’s Autonomous Car Ambition Is A Long-term Tailwind For Nvidia

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Nvidia Stock Analysis

Summary:

- Nvidia’s stock price is lower this October after it posted 11.71% return in September.

- Profit-taking from institutional investors is likely why NVDA took a dip this month.

- Tesla’s recent decision to use Nvidia’s deep learning platform for its autonomous car project could attract buy-side investors to load-up on Nvidia’s stock.

- Nvidia has long-term benefits from Tesla’s autonomous car ambition. Tesla will buy the processors and sensors from Nvidia to create self-driving cars.

Nvidia’s (NVDA) shot up 11.71% in September. Profit-taking is likely why NVDA’s slid -3.05% this October. My gut feeling is that Nvidia could still produce another positive return this month. Tesla’s recent decision to replace Mobileye (MBLY) with Nvidia’s Computer Vision for its Tesla Autopilot program is a surprise development. Tesla and Mobileye used to be partners but are now in very public spat over safety issues on Tesla Autopilot.

Tesla’s dispute with Mobileye benefits Nvidia’s parallel computing-based computer vision. Mobileye ended its relationship with Tesla because it believed that Tesla Autopilot should not have a hands-free activation mode. Nvidia’s fully autonomous self-driving solution is what Tesla aspires for its ‘Tesla Vision’ project.

Tesla Vision will use Nvidia’s parallel computing platform, Nvidia CUDA Deep Neural Network (cuDNN) to realize its ambition to create true self-driving Tesla cars.

Source: Nvidia)

Tesla Will Have To Buy Thousands of Nvidia Drive PX 2 Supercomputers

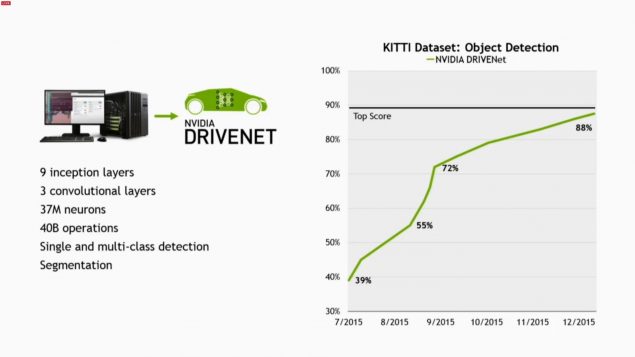

Using cuDNN 5 of course will require Tesla to buy Nvidia’s Drive PX 2 AI supercomputer for autonomous vehicles. If Tesla aims to build 100k self-driving electric cars per year, it will need to buy 100k units of the Nvidia Drive PX 2. Tesla’s ‘Tesla Vision’ project will have to use Drive PX 2 processor/boards to take advantage of Nvidia’s DriveNet and DIGITS – a deep neural network platform that comes with 9 inception layers, 37 million neurons, 3 convolutional layers and can process 40billion operations while offering multi-class and single object detections.

(Source: Nvidia)

Nvidia’s hardware and deep learning neural network is an end-to-end solution for self-driving cars. Tesla could just buy/rent Nvidia’s products and services to quickly take a lead in self-driving automobiles. Tesla can just concentrate on improving its manufacturing capability instead of it wasting resources trying to come up with its own end-to-end solutions for Tesla Autopilot.

Nvidia is a better ally than Mobileye for Tesla’s self-driving car ambitions. Nvidia is the runaway leader when it comes to GPU-accelerated artificial intelligence computers. With Nvidia’s backing, Tesla could beat Alphabet (GOOG) and Apple (AAPL) on the race toward making mass market semi-autonomous and fully autonomous self-driving cars.

In return, Nvidia will probably earn $500 million annually supplying Drive PX2 AI supercomputers to Tesla electric cars.

Other Firms Might Use Nvidia cuDNN

Tesla’s electric car rivals, General Motors (GM), Ford (F), Toyota (TM), Honda (HMC), and Nissan (NSANY) might also see the cost and time-savings in using Nvidia’s end-to-end solutions for self-driving cars. It will cost car companies hundreds of millions of dollars and many years to develop their own custom self-driving car platforms.

Tesla’s new enthusiasm for Nvidia’s cuDNN could start a chain reaction wherein GM, Ford, and other car firms also starts considering Nvidia for their self-driving car projects. China’s Faraday Future is also using Nvidia’s cuDNN and Computer Vision for its upcoming electric vehicles.

The prospect of Nvidia becoming the go-to solutions provider for all major car markers is very inspiring. Five or ten yers from now Nvidia’s stock could quadruple if it could sell 1 million units of its Drive PX 2 AI supercomputers for self-driving cars. The base price tag for the Drive PX 2 is $15,000.

Tesla buying 100k units of the Drive PX 2 already translates to a potential annual windfall of $1.5 billion for Nvidia.

Conclusion

Nvidia’s big lead on GPU-accelerated deep learning computers makes it the clear leader in self-driving car technology. Long-term growth investors should keep adding NVDA to their portfolios. It is my fearless forecast that it will be Nvidia, not Mobileye, who will become the de-facto leader in end-to-end solutions for self-driving cars.

Nvidia’s intrinsic value as a long-term investment is very easy to understand. IHS Automotive estimates that 21 million autonomous cars will be sold by Year 2035. Annual sales of self-driving cars be 600,000 by Year 2025. My bullish outlook for NVDA is also supported by its positive long-term algorithmic forecast from I Know First.

Smart investors may want to wait for a cheaper entry-point on NVDA. I Know First has negative short-term, 1 month and 3- month, market trend forecasts for Nvidia’s stock. The deep learning neural network of I Know First expects NVDA to drop in price within the next three months. However, it expects the stock to go higher than its current price now within the next 12 months.

Analysis of the long-term technical indicators and moving averages are also very favorable for Nvidia’s stock.

I Know First Past Success With NVDA

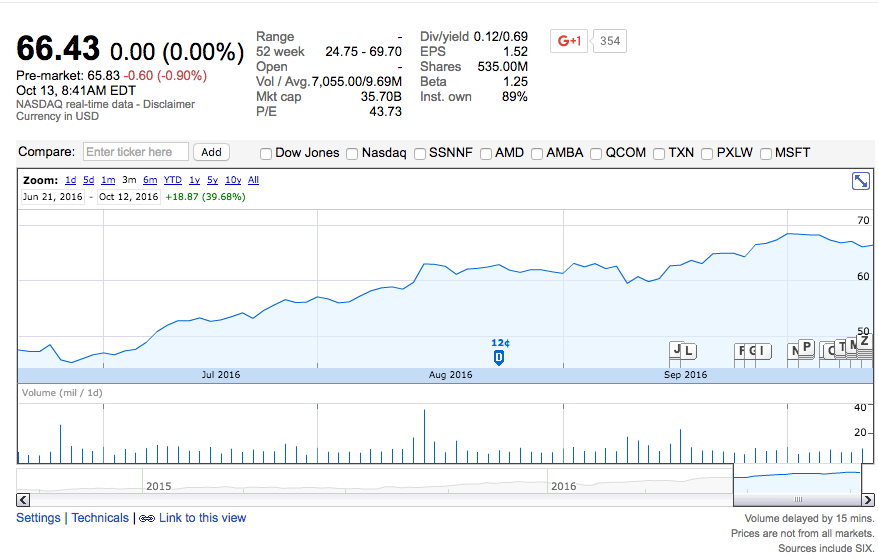

I Know First has been bullish on NVDA in past forecasts. On June 22nd, 2016, an I Know First analyst wrote a bullish article regarding NVDA, in according with in accordance with our state of the art algorithm. Since then, NVDA shares have been up almost 39.68% to date.

This forecast was sent out to I Know First subscribers on June 21st, 2016. To subscribe now click here.

This forecast was sent out to I Know First subscribers on June 21st, 2016. To subscribe now click here.