A Bullish Outlook for Applied Materials in 2018 – Driven by AI Advancement and Strong Demand

The article was written by Vladimir Zaslavsky, a Financial Analyst at I Know First.

The article was written by Vladimir Zaslavsky, a Financial Analyst at I Know First.

Applied Materials, Inc. (AMAT) Stock Forecast for 2018

“We have great momentum and we’re confident that in 2018 we can deliver strong double-digit growth across our semiconductor, display and service businesses.” ~ Gary Dickerson (CEO, Applied Materials)

Summary

- AMAT achieves record results in 2017

- Increasing demand in multiple sectors

- AMAT is uniquely positioned to drive its growth

- I Know First bullish stock forecast for AMAT based on artificial intelligence

Applied Materials, Inc. (NASDAQ:AMAT) is an American corporation that supplies equipment, services and software to enable the manufacture of semiconductor (integrated circuit) chips for electronics, flat panel displays for computers, smartphones and televisions, and solar products. The company also supplies equipment to produce coatings for flexible electronics, packaging and other applications. The company is headquartered in Santa Clara, California, in the Silicon Valley.

Currently, the firm is divided into four major divisions: Silicon Systems, Applied Global Services, Display, as well as Corporate and Other. Applied Materials also boasts a venture capital leg – Applied Ventures LLC.

(source: Yahoo Finance)

Applied Materials experienced strong momentum over recent quarters – recording record revenue and earnings throughout the fiscal year 2017. The phenomenal performance has been reflected in the stock price, which surged by approximately 65% over a one-year period.

Ending 2017 on a high note, Applied Materials recorded quarterly revenues in the fourth quarter, at $3.97 billion, marking a 20% year-over-year jump. Adding to the impressive top-line growth, the company realized a 63% expansion of its bottom-line over the year, reaching $0.91 per share. Sales soared by 34%, reaching $14.54 billion, Applied Materials posted full-year earnings of $3.17 per share and an operating income of $3.87 billion.

CEO Gary Dickerson stated, “Fiscal 2017 was a record-breaking year for the company. We have great momentum and we’re confident that in 2018 we can deliver strong double-digit growth across our semiconductor, display and service businesses.”

The company’s impressive rally has predominately been driven by an escalating demand for chips used in cloud-based platforms, artificial intelligence tools, augmented/virtual reality devices, autonomous cars, advanced driver assisted systems (ADAS) and the Internet of Things (IoT) related software and hardware.

Furthermore, the success can also be attributed to its traditional semiconductor business, which is expanding due to important design wins in the CVD and PVD tools markets. according to the latest report of World Semiconductor Trade Statistics (WSTS), semiconductor revenues climbed 20.6% year-over-year to $408.7 billion in 2017. Applied Materials is also positioned to benefit as industries shift from LCD to OLED.

Whilst semiconductor makers like Applied Makers have at times traded at a discount due to industry downturns, Ian Mortimer, co-manager of the top-performing Guinness Atkinson Global Innovator Fund, has predicted that the surging relevance of artificial intelligence will increase the consistency in demand for semiconductors.

CEO Gary Dickerson stated, “This is the most exciting time in the history of the electronics industry. AI will transform entire industries over the coming years, creating trillions of dollars of economic value, and Applied is uniquely positioned to deliver the innovative materials needed to enable next-generation memory and high-performance computing.”

Applied Materials is positioned to continue growing as AI and the Internet of Things become more prevalent than ever. Demand for data processers, memory, wireless communications and sensors will increase with the artificial intelligence revolution. Further, management of Applied Materials, for their September 2017 quarterly earnings calls, indicated that they expect to see strong growth in 2018 as memory makers ramp up capacity.

Applied Materials is positioned to continue growing as AI and the Internet of Things become more prevalent than ever. Demand for data processers, memory, wireless communications and sensors will increase with the artificial intelligence revolution. Further, management of Applied Materials, for their September 2017 quarterly earnings calls, indicated that they expect to see strong growth in 2018 as memory makers ramp up capacity.

Applied Materials has approximately $2 billion of orders in its Display segment. The recent surge in Display revenues is driven by large format TVs and increased demand for OLED displays. Indeed, average screen sizes for mobiles and TV’s have increased with time, and continue to grow. Subsequently, Applied Materials is able to capitalize on this trend as its customers are optimizing larger factories to accommodate production and investing in new Gen 10.5 capacity. Additionally, the demand for OLED displays is on the rise. It is forecasted that two-thirds of new smartphones will incorporate OLED displays by 2021, and manufactures are accelerating their investment to accommodate the growth. Applied Materials has established the leading position in thin-film encapsulation which enables OLED smartphones.

As the market becomes more complex, Applied Materials is uniquely positioned to drive its growth.

Valuation

In terms of value, Applied Materials is currently trading at 13.50x earnings – a discount compared to the S&P 500 average (15.69x earnings) and the “Semiconductor Equipment” average (17.82x earnings). The P/S and P/B ratios are also below the industry average. Furthermore, the company’s cash flow growth rate is more than double the industry average, and will enable Applied Material to invest in new technologies, and industries – including AI.

Analyst Coverage

A number of analysts, polled by Nasdaq, shared their views on AMAT’s current momentum. Of 15 analysts surveyed (including JP Morgan Securities, Morgan Stanley and Deutsche Bank Securities), 13 advise “Strong Buy,” whilst the remaining advise investors to “Buy” or “Hold.” A strong buy recommendation indicates that the shares are currently undervalued.

I Know First Algorithmic Bullish Forecast for AMAT

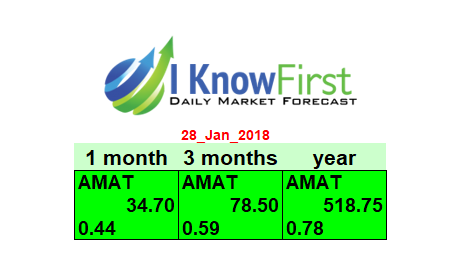

My positive outlook on AMAT in 2018 resonates with I Know First’s forecast. I Know First currently maintains a bullish stance on AMAT for 2018 with signal strength 518.75 and predictability 0.78 for the 1-year forecast.

Past I Know First Success with AMAT

I Know First Algorithm has previously predicted the stock movement for AMAT such as in this forecast from August 2nd, 2016 to August 2nd, 2017. The forecast showed a bullish signal of 336.44 and a predictability of 0.66 and achieved a return of 64.54% in 1 year.

I Know First Algorithm Heat-map Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.