US Steel Stock Price Outlook: US Steel Stuck In Industry Crisis

This article was written by Anna Latini, a Financial Analyst at I Know First.

This article was written by Anna Latini, a Financial Analyst at I Know First.

US Steel Stock Outlook

Summary:

- Better Is Not Enough Yet

- Why The Trump Administration Won’t Pull The Trigger

- I Know First Is Bearish On X Shares

The United States Steel Corporation (NYSE: X), more commonly known as U.S. Steel, is an American integrated steel producer with major production operations in the United States, Canada, and Central Europe. In 2014, the company was ranked as the world’s 15th largest steel producer.

U.S. Steel operates through three segments: Flat-Rolled Products, U.S. Steel Europe (USSE) and Tubular Products (Tubular). The Flat-Rolled segment includes the operating results of its integrated steel plants and equity investees in the United States involved in the production of slabs, rounds, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States. The USSE segment includes the operating results of U.S. Steel Kosice (USSK) and its integrated steel plant and coke production facilities in Slovakia. The Tubular segment includes the operating results of its tubular production facilities, primarily in the United States and equity investees in the United States and Brazil.

US Steel has been on a roller-coaster ride given the impact of foreign competition on one side and geopolitical factors on the other.

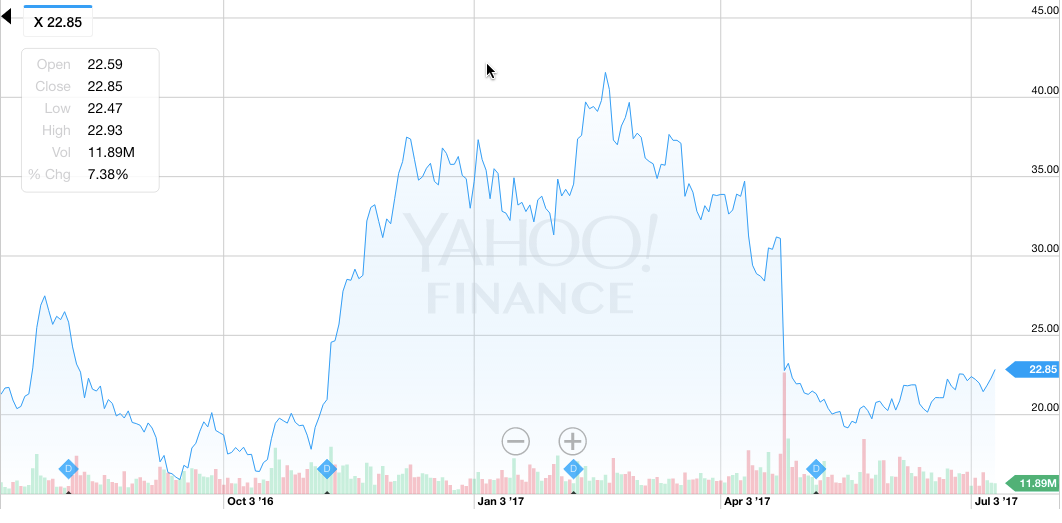

Source: Yahoo Finance

Better Is Not Better Enough Yet

The company’s Q1 2017 financial results released at the end of last March highlighted significant improvements due to favorable market conditions compared to the same period last year. However, EBIT was still negative and the company recorded a net loss of $111 million.

The company’s recent net sales was $2,725 million in the three months ending on March 31, 2017, compared to $2,341 million in the same period last year. The increase in sales for the Flat-Rolled segment primarily reflected higher average realized prices (up by $108 per net ton) partially offset by a decrease in shipments (down by 94 thousand net tons) due to operating issues at the Flat-Rolled facilities that did not let the company fully benefit from increased market prices. The rise in sales for the USSE segment was primarily due to higher average realized euro-based prices (increase of €143 per net ton) and an increase in shipments (of 105 thousand net tons), both as a result of lower imports. Higher sales for the Tubular segment primarily reflected more shipments (increase of 55 thousand net tons) as a result of improved market conditions.

Why The Trump Administration Won’t Pull The Trigger

Since Trump’s election, share prices rose for all the major North American companies in the industry, as the president promised restrictions in imports through trade protectionism. After almost doubling their price in November, going from $21 to $39, US Steel share price declined again and now settled at a low of $21.36 as concerns on the Trump’s administration ability to deliver his campaign policies.

Steel prices have fluctuated heavily in recent years from its decline in 2015 and recovering only in the second half of 2016 thanks to the Trump’s administration promises. The industry is, and has been, negatively affected due to oversupply in the market. An increase in production capacity in the United States, China and other countries has resulted in decreasing price as supply exceeds global demand. This has resulted in high levels of subsidized imports and dumping. Although US steel has been reporting such unlawful behaviors and at times it has obtained relief under US and international trade laws, this has not always been the case and will not always be either.

Furthermore, such subsidize is usually subject to annual automatic or discretionary review, that could result in rescission reduction. There is also a risk that international bodies such as the World Trade Organization or other judicial bodies in the United States or the EU may change their interpretations of their respective trade laws in ways that are unfavorable to the company.

President Trump’s efforts to revive the American steel industry has been his biggest avocations. The plan stands on the ability to impose tariffs on imports, and to do so, the president is trying to leverage on an obscure trade loophole in US law. The Trump administration is using a little-known provision in the Trade Expansion Act of 1962 to argue that if the US doesn’t have consistent access to materials essential for national security, it has the right to set up trade barriers in order to enhance domestic production of them. The White House is advocating that this could be the case for steel, a fundamental material for defense.

We are just a few days away from finding out what the administration is planning to do. However, if they actually pull this off, US allies will be the most negatively affected by the trade barriers. China would be affected. The country is not among the top 10 importers of steel in the US as the country is already subject to penalties for violating trade rules.

However, there are a few reasons why I don’t believe that the administration will pull the trigger. First, harming some of United States’ most important allies could result in retaliation from such countries, thus hindering the US economy and offsetting all eventual benefits from increased trade barriers in the industry. Second, it is not clear to what extent this strategy will increase jobs given that the industry is increasingly automated. Furthermore, higher prices will hurt profit margins in industries relying on cheap steel, such as the automotive and energy sectors. For each steel worker there are about 60 workers in steel related industries and I am sure the administration is wondering what would happen to them when their companies will face tighter margins.

I Know First Is Bearish On X Shares

As US steel share value depend heavily on the price of steel more than on issues under the company’s control, and as I do not see in the near future the possibility for effective higher trade barriers, I think US steel shares are still a sell in the medium term. If any alternative strategy will be implemented at all it will take time, thus my call on the company remains in line with the bearish algorithmic forecasts for now.

We recall that I Know First has delivered on this stock more than once. On February 18th 2017 our subscribers got a bullish forecast for X and indeed the stock gained more than 55% in the following 3 months.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above in order to feel confident about/trust the signal.