UNP Stock Analysis For 2017: New Achievements Starting the New Year

This article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

This article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

UNP Stock Analysis For 2017

Summary

- Union Pacific Corporation (UNP) Stock Analysis For 2017

- I Know First Algorithm Bullish Forecast For UNP

Union Pacific Corporation (UNP) Stock Analysis

Union Pacific Corporation, incorporated on February 3, 1969, operates through its principal operating company, Union Pacific Railroad Company. Union Pacific Railroad Company links approximately 20 states in the western two-thirds of the country by rail, providing link in the supply chain. The Company’s business mix includes agricultural products, automotive, chemicals, coal, industrial products and intermodal. The Firm operates from West Coast and Gulf Coast ports to eastern gateways, connects with Canada’s rail systems and serves approximately six Mexico gateways. The Firm is a Class I railroad operating in the United States. The Company’s network includes approximately 32,080 route miles, linking Pacific Coast and Gulf Coast ports with the Midwest and Eastern United States gateways and providing several corridors to Mexican gateways. It owns approximately 26,060 miles and operates on the remainder pursuant to trackage rights or leases. It serves the western two-thirds of the country and maintains coordinated schedules with other rail carriers for the handling of freight to and from the Atlantic Coast, the Pacific Coast, the Southeast, the Southwest, Canada and Mexico. Export and import traffic is moved through Gulf Coast and Pacific Coast ports and across the Mexican and Canadian borders.

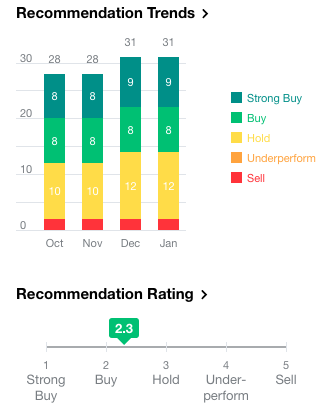

On December 30, 2016 CNP traded 631,900 shares. Since May, UNP has gone up 26.82%; however, the stock has recently been on a downtrend from it’s high on December 28 at $105.91 down to $103.74 on December 30, 2016. UNP plans on releasing its earnings report on January 19 with expectations of $1.32 per share which is 0.76% up from last years respective quarter. If UNP reaches this figure, profits will stand at $1.08 billion. There are 22 analysts currently covering UNP and out of 22, 13 assign UNP with a buy rating, 1 analyst rates UNP at a sell rating and 8 analysts rate UNP at a hold rating which equates to 59% positive feedback from analysts.

On December 30, 2016 CNP traded 631,900 shares. Since May, UNP has gone up 26.82%; however, the stock has recently been on a downtrend from it’s high on December 28 at $105.91 down to $103.74 on December 30, 2016. UNP plans on releasing its earnings report on January 19 with expectations of $1.32 per share which is 0.76% up from last years respective quarter. If UNP reaches this figure, profits will stand at $1.08 billion. There are 22 analysts currently covering UNP and out of 22, 13 assign UNP with a buy rating, 1 analyst rates UNP at a sell rating and 8 analysts rate UNP at a hold rating which equates to 59% positive feedback from analysts.

On December 23, the Federal Railroad Authorities made an agreement with Union Pacific Railroad to improve their inspection and safety procedures. This will include an increase in track maintenance, better training of employees, as well as more frequent and thorough inspections. The reason that the Government intervened and had to force this agreement upon UNP was a result of the Mosier, Oregon derailment. The investigation into the derailment showed that there were faulty bolts on the track that caused the incident. The Federal Railroad Authorities require UNP to inspect the track twice per week as well as waking track inspections four times every year.

Despite the derailing, UNP received its second Commission on Accreditation for Law Enforcement Agencies’ (CALEA) accreditation for its Response Management Communications Center (RMCC). CALEA is the authority on public safety agencies which includes law enforcement and emergency centers. In order to receive the accreditation, policy and procedures, administration, operations and support services need to comply with regulations. In order to receive accreditation the railway needs to pass enrollment, self-assessments, on-site assessments, commission reviews and decisions as well as complying with all CALEA standards Retrieved from UNP. The first accreditation was received by RMCC was in 2013 and in order to continue operating under the accreditation, RMCC must renew in 2020.

I Know First Algorithm Bullish Forecast For UNP

I Know First currently maintains a bullish stance on UNP with signal strength 255.03 and predictability 0.79 for 1 year forecast.

In the past I Know First was also bullish on UNP. This bullish forecast on UNP was sent to current I Know First subscribers on December 22, where UNP had a signal of 102.48 and a predictability of 0.68. UNP reached 42.91% in returns.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Conclusion

The new year is upon us and Union Pacific seems to be holding strong with its renewed emergency communications and new safety procedures. The stock price is going up along with its new achievements and as the algorithm predicts, will inevitably continue climbing throughout 2017.