The Qatar Crisis: A Game Changer For Crude Oil Prices?

This article was written by Harry Chiang, a financial analyst at I Know First.

The Qatar Crisis: A Game Changer For Crude Oil Prices?

Summary:

- What is Happening With Qatar?

- How Did We Get Here?

- America & the Middle East: Complex Political Relations

- Qatar’s Role in OPEC & Oil

- Where Does the Oil Market Go From Here?

- I Know First’s Prediction Regarding Oil

What is Happening With Qatar?

Last week, several governments in the Middle East suddenly cut off diplomatic ties with Qatar. Saudi Arabia, the UAE, Yemen, Egypt, the Maldives, and Bahrain were the first to individually announce the abrupt diplomatic severance. The eastern government of Libya, Mauritania, and Senegal all quickly followed. As of the 10th of June 2017, these governments have ordered withdrawal of their ambassadors from Qatar. Furthermore, and perhaps more worryingly, they have imposed trade and travel bans on Qatar. All GCC countries involved have ordered their citizens out of Qatar.

In addition, Saudi Arabia, the UAE, and Bahrain have given Qatari visitors and residents two weeks to leave their countries. This has been threatening to tear many families apart. The governments formed this blockade on the basis of accusing Qatar of funding and supporting terrorism. Saudi Arabia in particular has been outspoken about its disapproval of Qatar’s involvement with the Hamas and other similar organizations. The four main Arab states involved have stated that they will be closing air and sea transport links with Doha. Riyadh has been at the forefront of this, recently closing its land border with Qatar.

In response, Qatar’s National Human Rights Committee has issued a statement calling these moves ones that constitute human rights violations. The Committee further added that the siege of Qatar constitutes international human rights crimes. American, Russian, and Turkish diplomats have all called for dialogue over the Qatar-GCC dispute. They cite the need for negotiations rather than other methods of resolution.

Last Tuesday, the Pakistani Prime Minister headed to Riyadh in context of the “situation among GCC countries”. Pakistan’s lower house of Parliament also expressed “deep concern”. It called on all parties “to show restraint and resolve all differences through dialogue”.

Other countries have expressed concern about Qatar’s ability to survive in such isolation. Qatar is heavily dependent on Gulf neighbors for food imports to feed its 2.5 million strong population. The majority of this population consists of expatriates. Migrant workers compose 86% of the population and 94% of the workforce.

However, Qatari Finance Minister Al Emadi has released statements reassuring the public. He stated, “Our reserves and investment funds are more than 250% of GDP…there is no reason that people need to be concerned about what’s happening or any speculation on the Qatari riyal…we are extremely comfortable with our positions, our investments and liquidity in our systems.”

Repercussions have already been felt around the world because of the Qatar crisis. The Doha Index tumbled 7.1% last week, according to Reuters. The Qatari riyal has been falling against the dollar due to cited worries of capital outflows. Standard & Poor’s downgraded Qatar’s debt by one notch from AA to AA- as the Qatari riyal fell to an 11-year low. The shipping behemoth Maersk has been unable to transport in or out of Qatar. The shipping constraints from the crisis have also rerouted multiple shipments of oil and gas to and from the Gulf. This is already causing reverberations in many local energy markets.

How Did We Get Here?

Truly understanding the entire GCC-Qatar conflict requires a much deeper study in to Middle Eastern relations. There have been several writers who generally agree upon the contributors in this particular conflict. The key to understanding the speculation and questioning of this abrupt political move is to look at timing.

In April 2017, Qatar struck a deal with the Sunni and Shi’ite militants in Iraq and Syria. The purpose of this deal was two-fold. The first was securing the return of 26 Qatari hostages who had been kidnapped by Shi’ite militants. The second was attempting to convince Sunni and Shi’ite militants in Syria to allow humanitarian aid and the safe evacuation of civilians in the area. While negotiating with these groups was already viewed as controversial by many, it was the final bargain which was reportedly the most provocative.

According to the Financial Times, Qatar paid $700 million to Iranian-backed Shi’a militias in Iraq. A further $120-$140 million was paid to Tahrir al-Sham. Finally, Qatar paid $80 million to Ahrar al-Sham. This April deal reportedly angered many, such as Saudi Arabia. Saudi Arabia and other countries have already previously criticized Al Jazeera and Qatar’s relations with Iran. There has also been a history of accusations regarding Qatar’s funding of terrorist organizations.

Saudi Arabia, in particular, is heavily critical of the Qatari state-funded media network Al Jazeera. This is a media network accused of promoting and inciting terrorism. This latest set of complicated political maneuvers, accompanied by other timely occurrences, was likely one of the catalysts for the blockade.

America & the Middle East: Complex Political Relations

Hundreds if not thousands of publications deal with this subject. Researchers struggle to easily explain it. However, in the context of the Qatar crisis, there is a very particular facet of this political relation that many have highlighted.

In May earlier this year, President Trump visited Saudi Arabia. This visit spurred a flurry of social media activity on the President’s part. In particular, Trump urged Muslim leaders to take a stronger stance against extremists and criticized Qatar for supporting terrorism.

This is simultaneously counterpointed by the neutral stance displayed by many other faces of the American government. US Secretary of State Rex Tillerson was also on the visit to Saudi Arabia, but is calling instead for the blockade to be lifted. He is also asking Qatar to open to discussions about its involvement with terrorism. As aforementioned, this is supported by many other international diplomats who want to engage in discussion to resolve this problem.

Despite this conflicted front, Trump’s recent public support of Saudi Arabia likely emboldened the government to take action on a long history of conflict. The German Foreign Minister, although optimistic about the possibility of improving the situation, has warned of the dangers of possible war resulting from this situation.

In response to all these accusations, Qatar has paid $2.5 million to the law firm of a former attorney general to audit its efforts at stopping terrorism funding. Qatar did this as a gesture of reconciliation. There are hopes that this will be a symbol of Qatar’s willingness to reform and discuss their complex situation with other governments.

Overall, there is much speculation as to the causes of this latest political maneuver. Despite all the theorized explanations, it is impossible to ignore that this conflict is having very real consequences globally.

Qatar’s Role in OPEC & Oil

Most investors worry about Qatar’s role in the energy industry. Qatar originally discovered its oil potential in 1940, in Dukhan Field. Qatar has since based its economic growth and status very strongly on its petroleum and natural gas industries. Furthermore, Qatar is along one of the most important shipping routes in the world, and is the world’s largest exporter of liquified gas. Hence, there is naturally some worry about what this blockade will do in the energy industry, specifically that of oil.

Saudi Arabi’s Minister of Energy, Industry and Mineral Resources, Khalid A. Al-Falih has stated that the isolation of Qatar will not impact the price of oil much. He has further stated that “Qatar is a member of the OPEC organization and is a signatory of the 24 member agreement that has just been extended…We trust that they will continue to abide, but their overall contribution in terms of the cuts is rather insignificant in the overall scheme of things.”

He is referring to the OPEC deal signed last month. This was an agreement that OPEC would extend the 1.8 million-barrel-a-day cut to oil output by nine months, through March 2018. This was after the November deal failed to fully clear a global oversupply in oil, which has been keeping prices relatively low. In other words, OPEC, which produces a third of the world’s oil, has agreed to produce less oil in an attempt to bring the global price of oil up again. Some non-OPEC producers have also signed on to the deal.

Qatar has since confirmed that the current circumstances in the region will not affect its commitment. The Minister of Energy and Industry, Dr. Mohamed bin Saleh al-Sada, has stated that the recent developments will not prevent Qatar from “honoring its international commitment” of cutting its oil production as per the agreement. He further stated that, “Qatar is committed to the Vienna agreements that were reached end of last year and were recently extended to the end of March 2018”.

Analysts have stated that oil exporters’ recent decision to extend cuts in crude output by nine months up to March 2018 may help them battle a global glut after seeing the commodity price halve and revenues drop sharply in the past three years.

Where Does the Oil Market Go From Here?

After a peak at a price of around $54 in April, crude oil is currently back down around $46, dipping even lower than at the start of May. Although the last few days have seen the prices creep slowly upwards, there are a few reasons why in the long term oil might resist OPEC’s efforts and remain at around $50.

Firstly, despite Qatar’s reassurances, the market is still cautious about OPEC’s ability to keep under-producing. Should the agreement fall through for some reason, there will be an excess of oil supply. This global oversupply will drive prices even lower and keep oil prices at this point, or perhaps lower them even further. Hence, this recent blockade is a negative indicator regarding the bullish potential of crude oil.

However, many argue that the focus here should not be on the Middle Eastern oil. Although OPEC is an extremely player in the oil industry, there have been recent changes in the market. America is slowly dominating the industry and gaining a more prominent role. Oil stockpiles in the United States surged by 3.3 million barrels this month, confounding analysts’ estimates for a 3.5 million-barrel decline. This is part of the reason why oil prices have recently seen such a sharp drop.

Reports indicate that US oil production could rise to a new high of around 10 million barrels a day. This brings America to second only to Saudi Arabia in oil production. This is possible because US shale producers have completely revolutionized the oil industry over the past couple of years. New techniques have allowed the US to massively step up its oil production levels. This led the decline since 2014 from $100 a barrel to around $30 last year.

Over the last three years, the price of oil has fallen by 50%, from more than $100 per barrel to less than $50. This has led a problem with Saudi finances. The prices have pushed the government’s budget balance from a surplus of 30% of GDP 10 years ago to a forecast deficit of 17% of the GDP by the International Monetary Fund.

If American oil production continues at this rate, then regardless of the OPEC extension agreement, oil prices will struggle to rise significantly and fixedly above the $50 range. The oversupply of global oil, made possible by American production, will mean that there will be an excess pushing prices down, preventing them from reaching previous heights.

I Know First’s Prediction Regarding Oil

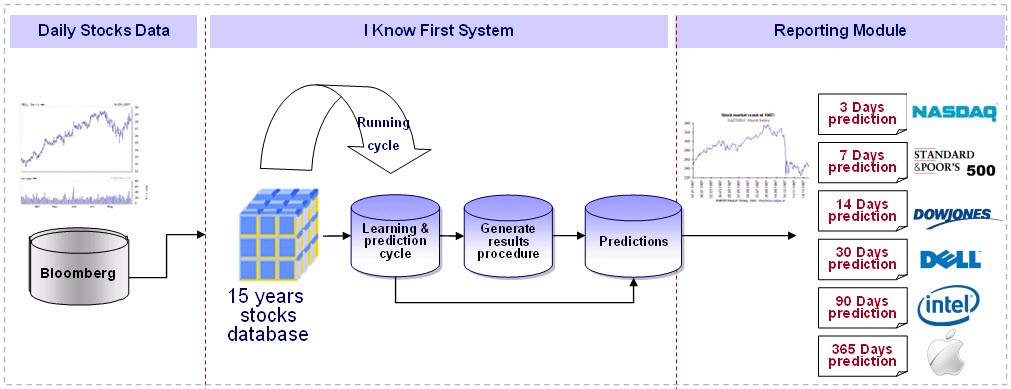

I Know First’s predictive algorithm uses years of data to learn and predict market movement. Currently, I Know First is holding a bearish outlook on crude oil. The diagram below for the prediction on the 27th of June 2017 illustrates this. The algorithm predicts with increasing certainty that the movement for crude oil’s prices will be downwards. For the 3 month horizon, I Know First’s algorithm has a signal strength of -9.68 and a predictability of 0.65.

I Know First’s Background in Predictive Algorithms & Finance

I Know First is one of the Fintech companies which is using this technology to focus on the financial market. The company trains its machines on years of data to increase market profits for its clients. It is cited as one of Bank Innovation’s “5 Israeli Startups You Should Be Watching.” The company’s CTO Lipa Roitman developed this predictive system based on genetic algorithms. Open AI based its improved Atari Challenge machine on genetic and biological algorithms as well. It beat the record set by Google’s Deep Mind by 23 hours. Based on 15 years of historical data and current market data, I Know First’s system can identify patterns and predict future shifts in stock share prices over 6 different time horizons.

The basis of this is unsupervised learning. Each day, as new data is recorded, the system adjusts its own heuristics and learns from its successes and failures. Hence, I Know First’s system is constantly improving and becoming more accurate.

Conclusion

There are a lot of complex geopolitical factors playing in to the current price of oil. However, despite possible speculation, it is all too early to say entirely for certain what the result of this Qatar crisis will be. There are indicators that the price of oil will remain similar, and that Qatar’s impact will be absorbed by other big factors involved.