Tencent Stock Price Prediction: Why You Should Go Long Tencent Before 2017 Ends

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Tencent Stock Price Prediction

Summary

- Tencent’s wise decision to port a mobile version of its League of Legends PC MOBA game is paying off big time.

- Honor of Kings (also known as King of Glory) is a Chinese mobile version of League of Legends and App Annie says its May 2017’s top-grossing game.

- Honor of Kings was already generating gross sales of 2 to 3 billion Yuan earlier this year. This mobile game could generate $2 billion in FY 2017.

- Tencent’s Fantasy Westward Journey RPG is also the world’s fifth top-grossing mobile game. Tencent’s subsidiary Supercell’s games, Clash Royale and Clash of Clans are No.4 and No. 6 respectively.

- TCTZF touts a very bullish one-year algorithmic forecast from I Know First.

As per the Chinese version of App Annie’s May 2017 report, Tencent (TCTZF) was still the runaway leader in mobile games revenue. Honor of Kings, the Chinese mobile port of League of Legends PC MOBA game was the top-grossing app in May. It leads in combined global Android and iOS sales.

This is the first time that a Chinese mobile game was acknowledged as the world’s most profitable. Honor of Kings has grossed more money than Pokemon Go, Clash of Clans, Clash Royale, and Game of War.

(Source: Tencent)

The blockbuster May 2017 revenue performance of Honor of Kings is important indicator of its continuing success. This mobile game was already posting 2 to 3 billion yuan in monthly gross sales earlier this year. Converted to U.S. dollars, that’s $299.77 million to $439.55. If this game’s momentum continues, Tencent investors can expect Honor of Kings to deliver at least $2 billion this FY 2017.

Tencent was so happy with Honor of Kings that it gave a 100 million yuan ($14.64 million) bonus to the 30-person development team who created it. The head of the Honor of Kings development team also got a $40 million bonus last year. In short, Tencent is making so much money from its brave decision to create a copycat mobile version of its League of Legends PC MOBA game.

I urge investors to go long on TCTZF right now before 2017 ends. Come January I expect the stock to deliver 10 to 20% return. Honor of Kings’ $400 million +++ monthly gross is only from China. This could even go higher once the English version, Strike of Kings is done with its soft-launch beta testing in Europe.

Further, let us not forget that Tencent also operates its industry-leading Android app store in China. Honor of Kings’ gross sales in China therefore goes fully inside Tencent’s coffers. Tencent only has to pay 30% commission to Apple (AAPL) iTunes app store in China.

Other Mobile Games Are Also Top-Grossing

Aside from Honor of Kings, Tencent’s other China-only title, Fantasy Westward Journey, was the No.5 global top-grossing iOS/Android game. Supercell, a subsidiary of Tencent, also has two top-grossing games, Clash of Clans and Clash Royale. The chart below is from App Annie and it covers the global mobile apps industry last May 2017.

(Source: App Annie)

Tencent is also the Chinese publisher of Candy Crush Saga, the no.9 ranked top-grossing mobile game. Having 5 of the 10 top-grossing mobile games fortifies Tencent’s big lead in mobile games revenue. Honor of Kings definitely helps Tencent keep ahead of its rival NetEase (NTES). As far as I know NetEase has yet to release a mobile MOBA (Multiplater Online Battle Arena) game.

(Source: App Annie)

The continuing strong revenue performance of Honor of Kings, Fantasy Westward, Clash of Clans, and Clash Royale should help Tencent deliver record Q3 and Q4 2017 revenue and earnings. Income from mobile apps has always been the engine behind Tencent’s quarterly revenue growth for the last four years.

As you can see from the chart below, TCTZF’s price also congruently grew along with its double-digit revenue growth. It might be prudent to invest in TCTZF right now while it still trades below $40. My 12-month price target for Tencent is $43. I expect Honor of Kings to help Tencent garner $12 billion in games-related revenue in FY 2017.

(Source: ycharts.com)

Final Thoughts

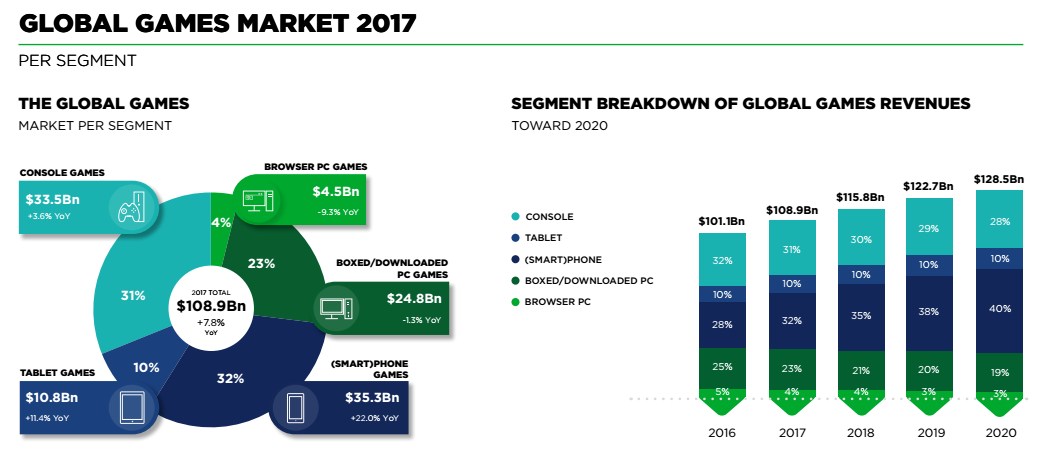

The strong focus on mobile games is a very strong tailwind for Tencent. Newzoo’s latest gaming report revealed that smartphones and tablets will continue to be the growth drivers for video games. Honor of Kings, Clash of Clans, Fantasy Westward Journey, and Clash Royale will therefore continue to deliver 9-figure gross sales each to Tencent for many years to come.

Any person interested to invest in the video games industry ought to add Tencent to their long-term portfolios. Tencent is still the best bet on video games. Unlike other declining industries like Hollywood movies and PC hardware sales, making and selling video games continues to be a growing venture.

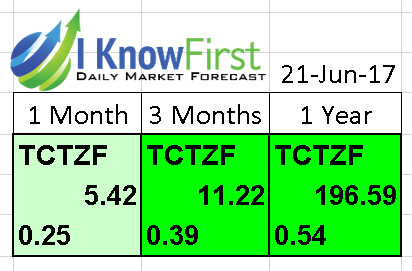

My go-long recommendation for Tencent is of course supported by its positive market trend algorithmic forecasts. The stock picking genius machine learning algorithms of I Know First gives TCTZF a very bullish one-year market trend score of 196.59. The 1-year predictability factor score is also high, 0.54.

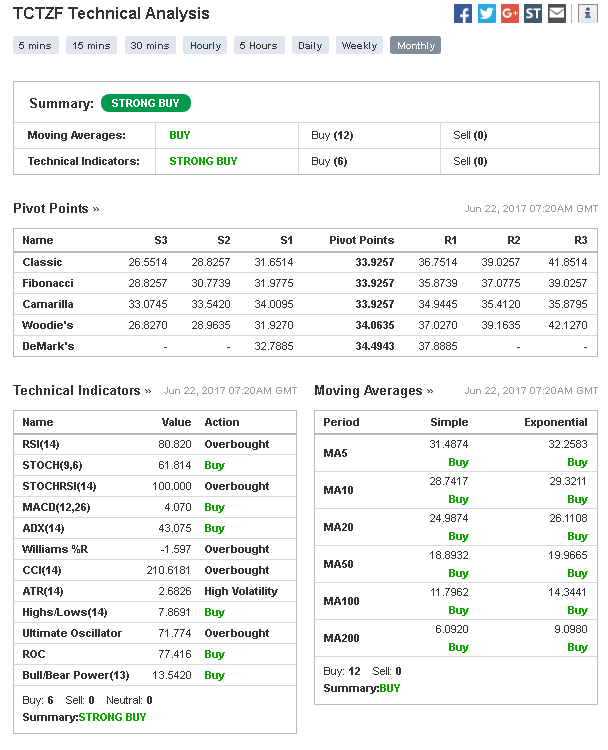

Analysis of important monthly technical and moving averages indicators also agrees with the bullish algorithmic forecast of I Know First for Tencent.

(Source: Investing.com)

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Past I Know First Success With TCTZF

I Know First has been maintaining its bullish forecast of TCTZF, such as its bullish article published on June 5th, 2016. In this time 1 year time frame, TCTZF rose by 58.08%, marking a large win for the algorithm.

(Source: Yahoo Finance)

This bullish forecast for TCTZF was sent to I Know First subscribers on January 5th, 2016. To subscribe today click here.