Stock Price Valeant: Step by Step, Out of the Pit

This article was written by Mingyue Liu, a Financial Analyst at I Know First.

Stock Price Valeant: Step by Step, Out of the Pit

“Medicine really matured me as a person because, as a physician, you’re obviously dealing with life and death issues, issues much more serious than what we’re talking about in entertainment. You can’t get more serious than life and death. And if you can handle that, you can handle anything.” (Ken Jeong)

Summary

- Debt divestiture through debt redemption and non-core business sales

- Organic growth bolstered by potential launch of new drugs

- Other tailwinds that may weigh on the company’s growth

Business Description

Valeant Pharmaceuticals International, Inc. is a multinational specialty pharmaceutical company engaged in the development, manufacture and marketing of pharmaceutical products primarily in the areas of dermatology, neurology, gastrointestinal disorders, and eye health therapeutic classes. The company’s portfolio has approximately 1,800 products. Valeant markets its products in the US, Canada, Europe, the Middle East, Latin America, Asia Pacific and Africa. It is headquartered in Quebec, Canada.

The company operates through three segments: Bausch + Lomb/International, Branded Rx and US Diversified Products. Bausch + Lomb/International is one of the world’s largest suppliers of eye health products, including contact lenses, lens care products, medicines and implants for eye diseases. In FY2016, this segment reported revenues of $4,607 million, accounting for 47.6% of the company’s total revenue. The Branded Rx segment consists of sales the Salix product portfolio, which was the largest independent gastrointestinal specialty pharmaceutical company in the world as of March 2015. In FY2016, this segment accounted for 32.5% of the company’s total revenue. Valeant’s US Diversified Products segment consists of a wide range of products, including medical device products in the areas of neurology and certain other therapeutic classes, aesthetics and generic products. In FY2016, the US Diversified Products contributed to 19.8% of the company’s annual revenue.

Geographically, the company classifies its operations into fourteen segments, namely US and Puerto Rico, Canada, China, Japan, Egypt, Mexico, France, Australia, Russia, Germany, Poland, Brazil, UK, Other Europe, Asia, the Middle East, Latin America, Africa and other. In FY2016, US and Puerto Rico segment accounted for 64.6% of the company’s total revenues, followed by Canada with 3.3%; China with 3.1%; Japan with 2.4%; Egypt with 2.0%; Mexico with 2.0%; France with 1.9%; Australia with 1.8%; Russia with 1.7%; Germany with 1.6%; Poland with 1.4%; Brazil with 1.1%; UK with 1.1%; Other Europe, Asia, the Middle East, Latin America, Africa and other with 12.0%.

Step By Step, Out Of The Pit

Life has been extremely tough for VRX, stock price of the once pharmaceutical giant, old darling of Wall Street Journal, plunged from up to $250 in mid-2015 to $8.5 at the beginning of this year. Over 95% of the company’s market value had evaporated as a result of its unreasonable price hikes, serious financial reports manipulation, and odd relationship with Philidor, a specialty pharmacy. It seems like Valeant was disgusted overnight by its investors, individual and institutional.

However, it’s time to once again take a look at the company.

VRX had done a lot to get rid of the old scandals, including naming a new CEO, financial reconstruction, risk management, and development and launch of new drugs.

First Step: Financial Reconstruction

Right after stepping up as Valeant’s CEO, Joseph C. Papa set the goal to chip away $5 billion of debt load to free the company’s cash flow.

January 9, Valeant reached an agreement with a Chinese conglomerate to sell Dendreon Pharmaceuticals, a company focusing on cancer immunotherapy, for $819.9 million in cash.

July 10, the company announced to pay down $811 million of its senior secured term loans using net proceeds from the Dendreon transaction.

Source: www.vaccinenation.org

July 13, Valeant announced to redeem on August 15 the remaining $500 million Senior Notes due in 2018, signing a totaled $4.8 billion debt reduction since 1Q16.

Upon this loan repayment, the company’s total debt load will be reduced to $27.19 billion.

On July 17th, 2017, the company announced that it has entered an agreement to sell Obagi Medical, a professional skin care company for $190 million in cash to a Chinese fund.

Source: www.aesthetispa.com

Proceeds from this transaction will be used to further pay down debts, which can potentially help to exceed VRX’s initial commitment. The company may be interested in stripping its whole US Diversified Products business, which is estimated to be a total of $7.5 billion. Chipping away the non-core and/or underperforming businesses can help the company refocus on niche market. In the long run, this can be a very positive thing.

The effort toward debt redemption seems to be understated by the market. Some analysts argued that the debt amount is still significant, at $27 billion, and thus impact of the $5 billion debt divesture is insignificant. It is safe to say that you can never think too much of financial flexibility. What really matters regarding debt is the pressure it forces on the company’s cash flow. Valeant is on track to chip the debt to such a level that the company will not be faced with significant debt maturities and mandatory amortization requirements through 2019. Thus, this stage I achievement is important, giving it the flexibility and time to plan how it want to address its debt position and make investments going forward. No doubt, the company can continue refinancing its debt to push the maturities further beyond where they are today.

Second Step: Launch of New Products

Valeant has a strong focus on its R&D capabilities. The company has consistently increased its R&D investment, increasing to $421 million for 2016 from $334 million for 2015. The increase was driven by the focus to maximize the value of the company’s core segments. As a result, VRX enjoys a sustainable product pipeline, as shown in the following graph.

Source: TD Securities Inc.

Notably, the company dedicated additional resources to enhance its dermatology and gastrointestinal product portfolios, with a significant portion associated with the testing and attaining regulatory approval for Siliq (brodalumab), which is indicated for the treatment of moderate to severe plaque psoriasis in adult patients. In February 2017, the Food and Drug Administration (FDA) approved the Biologics License Application (BLA) for Siliq. The company plans to launch this product in 2H17.

At the beginning of this year, VRX announced the success of Phase III trials of IDP-118, a halobetasol propionate and tazarotene lotion designed for the treatment of plaque psoriasis. The company is positive about the potential launch of this new drug, while most of the existing treatments have adverse effect. It is believed that the IDP-118 would probably be launched through 2018, partly avoiding the cannibalism against Siliq.

Other key catalysts to Valeant’s organic growth include, but not limited to, Vyzulta. Vyzulta (latanoprostene bunod ophthalmic solution) 0.024% is a nitric oxide-donating prostaglandin F2-alpha analog designed as a therapy for open-angle glaucoma patients. This drug demonstrated both high efficiency and solid safety profile in Phase II and Phase III trials. It is expected to be well-positioned to capture the $1.6 billion, according to Valeant’s estimate, Prostaglandin-analog glaucoma treatment market.

Possible Tailwinds

Political environment may work out for pharmaceutical companies. It is no secret that President Trump is not a fond of the drug industry. He has more than once tweeted about his dissatisfaction about the drug companies, and announced that he will force the drug price way down. However, the pattern has been recognized by investors that stocks fall immediately after President Trump’s tweet, but eventually recover once investors realize that he may just be publicly posturing as a negotiating ploy.

Though tumbling, there is still a chance that Obamacare may eventually become Trumpcare. If the Senate’s healthcare bill navigates the long path to becoming a law, the legislation can potentially be positive for pharmaceutical companies because of various fees and taxes elimination.

Recovery of Customer Confidence. Of the 21 analysts currently covering VRX, 13 suggest HOLD position, 3 suggest BUY position, indicating an increasing preference toward the company. Besides, a number of hedge funds and research companies adjusted higher their outlook for VRX, including Deutsche Bank, Financial Architects, Chou Associates Management, and Norges Bank.

Interesting growth opportunities for Bausch + Lomb in Asian market On Jul 6, Bausch + Lomb announced the introduction of its AQUALOX® contact lenses, the first new innovation in the bi-weekly contact lens category in half a decade, to the Japanese market. The company has moved one step further after introducing AQUALOX® to 25 countries.

According to the most recent research released by World Health Organization, over 600 million Chinese people are near-sighted, over 70% of the middle-school, and above, students are myopic.

To conclude, Asian market is very promising for Valeant, especially its Bausch + Lomb segment, and the company is on the right track to capture it.

Risk management efforts. Pharmaceuticals have consistently under great pressure due to the high risk of drug development. VRX management’s strategy is to reduce exposure to patent risks. The company plans to share more of the risk with partners for development programs and to invest in approved products that have eclipsed the regulatory hurdles. Focusing on niche markets also help to avoid the competitive markets that big pharma dominates.

Conclusion

I believe the company is making a significant effort to crawl out of the pit, and by far it has been making great progress. I hold BULLISH outlook for VRX, bolstered by better financial structure, promising new drugs, profitable political environment, improving investor confidence, interesting growth opportunities in Asia, and reduced R&D profile. My expectation resonates with I Know First forecast based on the algorithm.

Past I Know First Previous Success with VRX

On June 13, 2017, I Know First published bullish forecast on VRX. Since then, the stock price has soared by over 44.14%, showing another success of I Know First algorithm in forecasting stock movement.

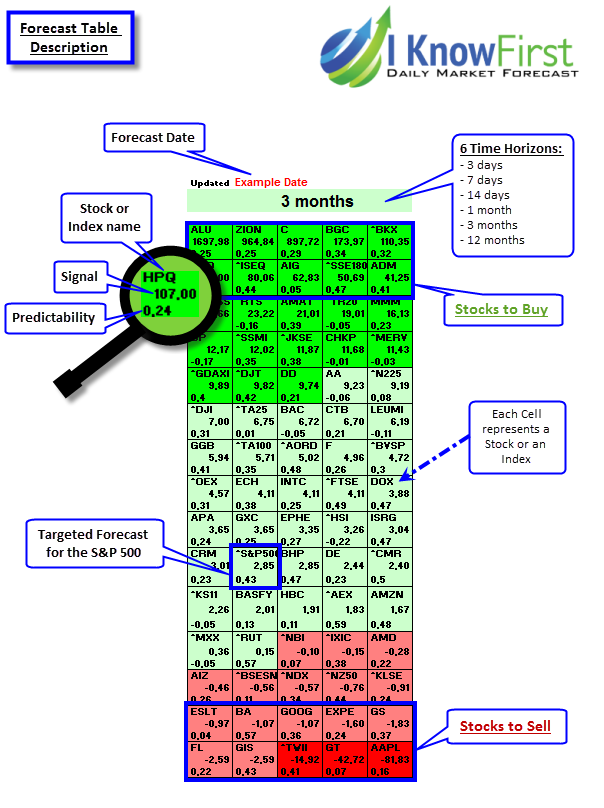

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go. (positive = to go up = Long, negative = to drop = Short position). The signal strength relates to the magnitude of the expected return. We use the signal strength for ranking purposes of the investment opportunities. Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. It allows the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.