SMSI Stock Prediction: Smith Micro Is A Bargain, Has 43% Upside Potential

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Smith Micro Stock Prediction

Summary

- Smith Micro’s stock has a YTD return of -25.5%. The 1 –for- 4 reverse stock split last year was not enough to stop the stock’s decline.

- A bearish sentiment since September 2016 has resulted in the stock again trading near the $1.0 price level, which is Nasdaq’s required minimum bid price.

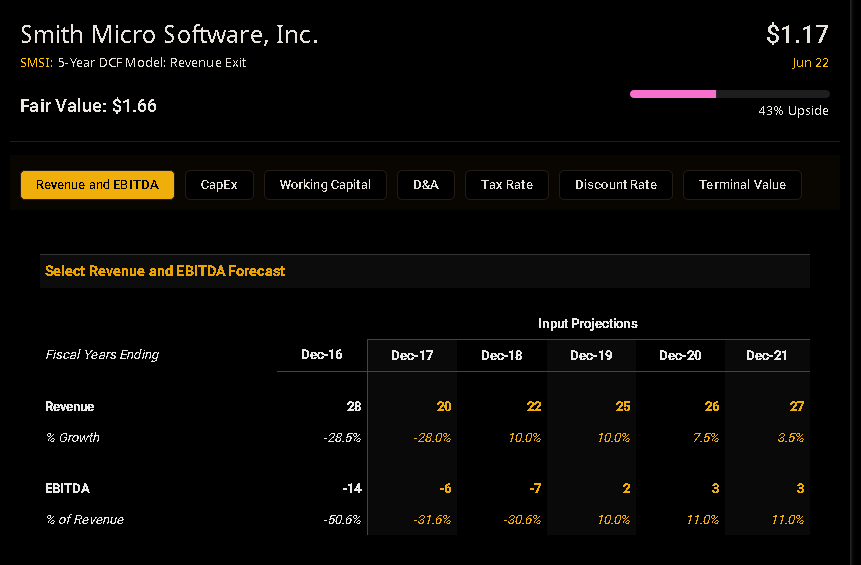

- My five-year DCF Revenue Exit model shows has 43% upside potential. Smith Micro’s shift toward mobile and enterprise software services will eventually pay off.

- Smith Micro should sell its graphics, animation and 3D consumer software products. If not, it should market them as software-as-a-service products.

- SMSI has very strong market trend 1-year algorithmic forecast from I Know First.

Smith Micro Software, Inc. (SMSI) is again in danger of being warned by Nasdaq. Due to six consecutive years of annual net losses, investors have punished SMSI down to $1.17. Smith Micro did a 1 for 4 reverse stock split last year because its stock traded below $1 last year. Nasdaq requires all listed companies to trade at a minimum stock bid price of $1.0.

Unless the newly appointed CFO finds new way to impress investors, SMSI could trade below $1.0 again. The stock already has a negative YTD performance, at –25.48%. After the reverse split last year, the stock traded initially at $3.20. Unfortunately, the management has failed to deliver any meaningful business results since Q4 2016.

(Source: Google Finance)

The near term fear is that Smith Micro will have to do another reverse stock split just to comply with Nasdaq’s $1.0 minimum stock price requirement. On the other hand, bargain hunters brave enough to look in to the future should go long SMSI now.

New CFO Might Notably Improve Smith Micro’s Enterprise Software Business

Going forward, I expect Smith Micro’s transition to enterprise and mobile management software services to eventually pay off 1 to 2 years from now. Smith Micro’s consumer graphics and animation software is obviously not doing well due to stiff competition from Adobe (ADBE) and Toon Boom Software. However, Smith Micro’s enterprise and mobile device management software products could eventually help the company return to profitability.

(Source: Smith Micro)

Smith Micro’s Firmware Over-the-Air (FOTA) is a very promising long-term product which could play well in to the new CFO’s enterprise marketing background. The new CFO, Timothy Huffmyer, has more than a decade of tenure at Black Box Network Services. Black Box designs and deploys data centers, contact centers, private LAN (Local Area Network) and WAN (Wide Area Network) infrastructures for enterprise customers.

Huffmyer definitely has a long list of enterprise customers which he could dial-up to sell Smith Micro’s mobile device management and enterprise software services.

Consumer Shift to Mobile Usage Is Also Favorable to Smith Micro’s 4D App Studio Services

Another potential long-term tailwind for Smith Micro is its 4D App Studio. It’s a new premium service that helps companies quickly create mobile apps to better connect with their customers. 4D App Studio is a one-stop-shop solution for companies who wants to create or rework their current apps for mobile commerce and consumer relationship development.

(Source: Smith Micro)

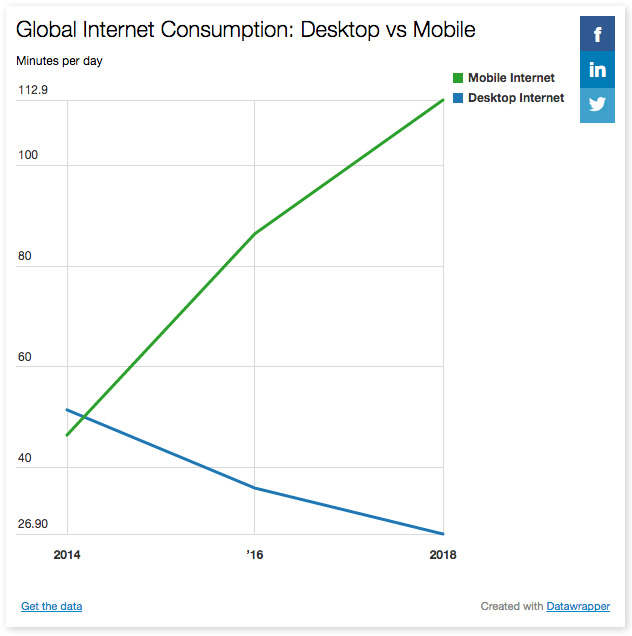

Smith Micro’s move to get involved in enterprise mobile app development is timely and judicious. People are now spending more time on their mobile devices than on PCs. As you can see from the chart below, people now spend more than twice their time on mobile internet. Small and large companies who want to survive will all have to create their own mobile apps.

(Source: digiday.com)

Large companies could probably afford their own in-house team for mobile apps design, live operations, and maintenance. On the other hand, small and medium businesses will likely see the advantage of paying for Smith Micro’s 4D App Studio services. Smith Micro can help a company design, develop, deploy, and maintain their mobile apps for a monthly/annual fee.

More often than not, outsourcing enterprise tasks like mobile apps development and maintenance is more cost effective.

Further, I also suspect that the new CFO will find it more beneficial to find a buyer for Smith Micro’s consumer software products. He can use the potential sales proceed to finance an intense marketing plan for Smith Micro’s enterprise software products.

AutoDesk (ADSK) or Corel Corporation could be highly interested to acquire Smith Micro’s crown jewel, Moho Pro. Moho is the second-best 2D animation software for professionals. It is better than Adobe’s Animate CC, and almost as good as Toon Boom’s Harmony. My valuation is Moho Pro can be easily sold for $10 or $15 million to AutoDesk.

If not, Huffmyer can also transform Moho Pro into a software-as-a-service (Saa) product. Instead of selling boxed/download copies of Moho Pro 12 for $399.99 each, he could rent it out for $14.99/month to animators. Adobe rents out Animate CC for $19.99, Toon Boom Harmony Advanced is $34/month.

It is my firm belief that Smith Micro could revive its dying consumer graphics business if it shifts to the SaaS business model. Adobe and Autodesk’s success in SaaS should have taught Smith Micro that selling pricey boxed software is an outdated business practice.

Final Thoughts

I truly feel that SMSI is unfairly being punished. Smith Micro deserves a higher valuation than $1.17. My 5-year Discounted Cash Flow Revenue Exit model hinted that SMSI has 43% upside potential even if FY 2017 again post another -28% YoY decline.

(Source: finbox.io)

Below are the Terminal Value and Discount Rates I used.

(Source: Finbox.io)

My bullish endorsement for SMSI is also supported by the stock’s great one-year algorithmic forecast from I Know First Research. The AI-enhanced market trend forecast expects SMSI to produce a positive return after 12 months to investors who go long now.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

Past I Know First Success With SMSI

I Know First has been maintaining its bullish forecast of SMSI, such as its bullish article published on January 7th, 2015. The stock had been experiencing modest growth for several weeks prior to this forecast. It was estimated that this was due to the stock being oversold. In this time 7 day time frame, SMSI achieved an impressive return of 78.57%.

This bullish forecast for SMSI was sent to I Know First subscribers on January 7th, 2015. To subscribe today click here.