Quantitative Trading: Goldman Sach’s Partake In Quant Trading

The article was written by Jordan Klotnick, a Financial Analyst at I Know First. He graduated from Monash University with a Bachelor’s in Business – Majoring in Marketing.

The article was written by Jordan Klotnick, a Financial Analyst at I Know First. He graduated from Monash University with a Bachelor’s in Business – Majoring in Marketing.

Quantitative Trading

Summary

- Active vs Passive Investing and Management

- What is Quantitative Trading?

- Goldman Sachs Partaking in Quant Trading

- Competitors in Quant Trading

- Artificial Intelligence

- I Know First and Hedge Funds

Active vs Passive Investing and Management

Active investing is an investment strategy, which involves ongoing buying and selling by the investor. These investors purchase investments and constantly monitor their activity in order to bring in the most profit. A strategy used by day traders.

Passive investing is an investment strategy that looks to maximize returns in the long run by restricting buying and selling to a minimum. The idea is to elude fees and focus on long term investment to avoid frequent trading. Passive investing does not make quick gains, but rather attempt to build consistent and steady rate of return over time.

Active management uses the human element, such as a single manager, co-manager or a team of managers, to actively manage a fund’s portfolio. These managers rely on analytical research, forecasts and their own knowledge when making investment decisions.

Where, passive investment is associated with mutual, index, and exchange-traded funds (ETF) where a fund’s portfolio mirrors an industry or sector. This differs from active management as active management looks to beat the market with various investing strategies.

What is Quantitative Trading?

Quantitative trading is trading based on quantitative analysis, which relies on mathematical computations. It also relies on number crunching, which identifies trading prospects. Financial institutions and hedge funds generally use this type of trading. These transactions are usually large and involve purchasing and selling hundreds of thousands of shares and other securities. However, this type of trading is becoming more popular amongst individual investors.

Goldman Sachs Partaking in Quant Trading

Goldman Sachs Group, Inc. is a leading global investment banking, securities, and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Headquartered in New York and founded in 1869 the firm has offices in all major financial centres around the world.

In the past, Goldman Sachs hasn’t had much luck with quantum trading, keeping the company focused on hand picking trades. However, recently Goldman is beginning to reinvest into artificial intelligence hedge funds, in an attempt to secure a position as the top three funds in sales. The company aims to increase speed and efficiency within quantum trading, which has been the main driving force in the AI world. Therefore, Goldman Sach’s investment in AI is of utmost important. Although Goldman is utilizing artificial intelligence later than its competition, whom have already weeded out less successful AI systems, Goldman can catch up and perhaps surpass its competitors. No matter how advanced the other top AI hedge funds are, Goldman has been in the financial industry since 1869. Goldman has the experience and trust of its clients to compete with other AI companies.

Competitors in Quant Trading

Goldman Sach’s biggest competitors in the quantum-trading sector are Two Sigma and the Renaissance Technologies’ Medallion Fund. Two Sigma manages $40 billion in assets and relies on Deutsche Bank as their broker. The Medallion Fund manages $36 billion in assets and also uses Deutsche Bank, as well as, JP Morgan and Morgan Stanley as their brokers.

The leader in quantitative hedge fund investing is Renaissance Technologies. Founded by a mathematician named Jim Simons in 1982, he brought together many scientists to develop the Medallion Fund.

The Medallion Fund is shrouded in intense secrecy. Since it foundation, the profits from the fund are approximately $55 billion. The fund can produce profits in less time than the traditional funds run by billionaires. Such as Ray Dalio and George Soros, and it can produce these profits with less managing assets. The fund almost never loses and the max drawdown in the last 5 years equates to only half a percent. This is unheard of in the financial industry, not just pertaining to hedge funds. Competition-wise, there is none.

Simons is mathematical genius. He was a professor at MIT and Harvard and recipient of the Oswald Veblen Prize in Geometry. He is also the co-creator of the Chern-Simons theory. Institute for Defence Analyses employed Simons as a code breaker, where he passed through noise in order to find messages.

Though no company may match with Renaissance Technologies at this point, computers and researchers are catching up quickly. With billions of dollars flooding into the research and development of Artificial Intelligence and Self-Learning computers, financial firms will eventually catch up and possibly surpass the Medallion Fund. We’re already seeing the shift and the flow of money with Paul Tudor Jones as stated above.

Source: Bornrich Images

Employees at Renaissance receive an allocation of shares that they can buy if they decide. Also, part of each employee’s pay check is reinvested into Medallion, which equates to about a quarter of their salary. Employees also have to pay fees to the company, as much as “5 and 44” (5 percent of assets and 44 percent of profits).

Simons began buying and selling commodities. Based on fundamentals, he made his bets, relying on variables such as supply and demand. He began to work with a team of cryptographers and mathematicians, in order to look for patterns. These included Elwyn Berlekamp, Leonard Baum, Stony Brook, Henry Laufer and James Ax. With this team of scientists, they came up with models gradually.

The scientists began to develop their own in-house programming language for the models. The code that is used for the fund includes several million lines, a source close to the company says. Astrophysicists have played a huge role at Renaissance and are part of the reason the Medallion Fund is so successful. The astrophysicists screen “noisy” data regularly and have become adept at it, which is exactly the type of scientific data analysis that the Medallion Fund needs. String theorists are also major figures in the company.

Artificial Intelligence

It used to be that if one wanted a computer to carry out an action they would have to program it to do that specific action. This took an excruciating amount of time as we would have to tell the computer to do exactly what we wanted it to do and it was unable to carry out an action, which we were not able to do or to tell it to do. Programs had no independent intelligence and could not make decisions by themselves.

In 1956, computer gaming pioneer, Arthur Samuel, wanted his computer to be able to beat him at chequers. Samuel then programmed his computer to play against itself thousands of times to the extent that the program accumulated sufficient knowledge of the game. By the 1970s, his program was proficient enough to challenge and beat the masters. Arthur Samuel is therefore credited with being the pioneer of artificial intelligence (AI).

I Know First and Hedge Funds

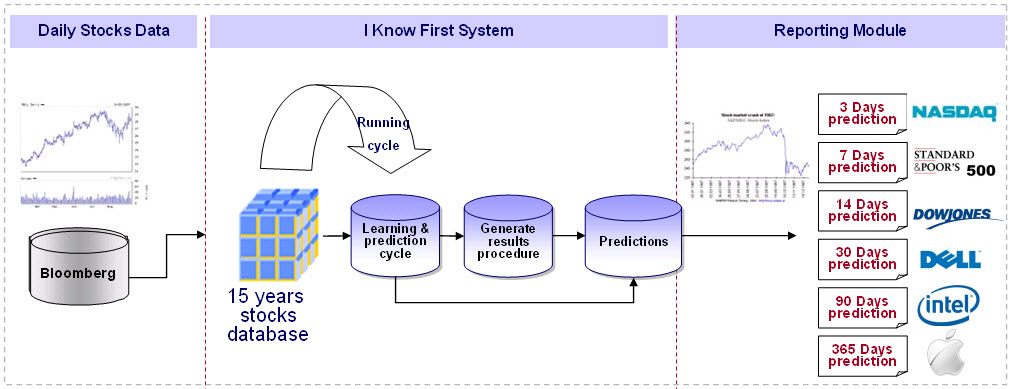

I Know First predicts a growing universe of over 13,500 securities for the short, medium and long term horizons daily by applying Artificial Intelligence and Machine Learning techniques to search for patterns and relationships in large sets of historical stock market data. Through its self-learning ability and flexible multi-layered neural networks structure, the algorithm is able to learn from, adapt to and evolve together with continuously changing markets. It offers an independent, objective and unique perspective on the financial markets and doesn’t rely on any human derived assumptions or traditional theories and models that often do not hold (any more).

The results of intense learning and prediction cycles are aggregated into two indicators per time frame: signal and predictability. While predictability indicator helps to identify and focus on the most predictable assets, the signal is used to define and rank the trades and is related to the magnitude of expected return.

The applications of the algorithmic AI-based forecasts are multifold, and use empirical prices of the stock market to create daily predictions.

The scalability of the algorithmic predictive system allows I Know First to offer custom forecasting solutions to hedge funds and other financial institutions, so they can identify the best opportunities as discovered by the self-learning algorithm within the investment universe of their interest. Further, the solution can be used as a decision support system in form of an algorithmic screen integrated into client’s investment process in order to confirm or reject investment ideas before the execution.

Moreover, I Know First develops and back-tests systematic trading strategies, which are used in partnerships with, hedge funds and other asset managing entities. These strategies are rules-based and utilize algorithmic forecasting indicators mentioned above in order to rank and select the trades as well as time the execution. The type of strategies varies, including mean-reversion logic and more trend focused approaches, all generating high positive alpha while keeping beta in the 0.3-0.8 range, yielding overall high risk-adjusted returns. The strategies can be used in partnership with I Know First to launch hedge funds, mutual funds or other investment vehicles.

Conclusion

Quant trading is far becoming a much larger and popular way of trading. Gaining traction with one of the largest banks, Goldman and Sachs. The company will have no trouble gaining speed within the AI trading segment. They have been around for over 100 years and increasing in popularity.