NVDA Stock Forecast: Artificial Intelligence is Powering Demand for GPUs in the Next Generation of Automobiles

Zachary Shipman is a Financial Analyst at I Know First.

Zachary Shipman is a Financial Analyst at I Know First.

NVDA Stock Forecast: Artificial Intelligence is Powering Demand for GPUs in the Next Generation of Automobiles

Summary:

- Nvidia- Growth in Every Business

- Key Auto Industry Deals

- Further Expansion into Self-Driving Vehicles

- Conclusion & I Know First Algorithmic Prediction

Nvidia – Growth in Every Business

Nvidia Corporation (NVDA), was founded in 1998 by Jen-Hsun Huang, Curtis Priem, and Chris Malachowsky. The company focuses on personal computer graphics, graphics units, and artificial intelligence. Particularly, specializing in the specific markets of: Gaming, Professional Visualization, Datacenter, and Automotive. The company provides customers with processing units to power supercomputing for mobile gaming (including eSports), additionally autonomous robots, drones, and cars. Supercomputing is an integral component in high-level gaming, virtual reality, increasing application speeds for research simulation, and the future of self-driving vehicles.

Nvidia currently controls 17.5% of the market for GPUs (graphics processing unit). This makes them the second-largest player in the industry behind Intel (68.1% market share), but ahead of AMD (14.4% market share). However, the company is in the early stages of transitioning from a PC graphics chip developer to a leader of the future of artificial intelligence. Recently, Nvidia’s autonomous driving technology has emerged within the automotive sector. Nvidia gives automakers the capability to deploy self-driving vehicles using artificial intelligence technology. This provides an enormous opportunity for future growth.

At the conclusion of the first quarter of 2017, Nvidia reported revenue of $1.94 billion, up 48% from the year prior. Subsequently, year-over-year results show reason for optimism. Earnings are up 85%, reaching 85 cents per share. GAAP earnings are up 126% to 79 cents per share. Operating income is up 126% to $554 million. Datacenter sales are up 186%, GPU (graphics processing unit) sales are up 45%, automotive sales are up 24%, and lastly the gaming market revenue improved by 49%. Nvidia closed out 2016 holding a 17.5% GPU market share, reflecting a slight improvement over the results of the previous quarter. It was a fantastic year for Nvidia. In fact, the stock’s 225% return in 2016 made it the best-performing stock in the S&P 500 for the year. In comparison, Intel only saw a return of 8.76% in 2016.

(Source: NVIDIA)

Key Auto Industry Deals

Speaking in front of a large crowd in Berlin, Nvidia CEO – Jen-Hsun Huang announced Nvidia’s partnership with Bosch, while also detailing how deep learning is fueling an AI revolution in the auto industry. The collaboration with Bosch represents the first announced DRIVE PX platform using Nvidia’s forthcoming Xavier technology. Xavier technology can process up to 30 trillion deep learning operations a second while drawing just 30 watts of total power. That type of condensed power is enough to reach the point where a car can drive on its own without human intervention.

At an annual shareholders meeting Toyota President Akio Toyoda said that they would be more aggressive in expanding their self-driving and electronic car departments. As a result, Nvidia Corp announced a partnership with Toyota Motor Corp, a deal that provides future Toyota vehicles with artificial intelligence. Toyota Motor Corp is the second-largest automaker in the world. Eventually, the plan is for Toyota to release self-driving cars within the next few years. More importantly, this deal marks a large victory over Intel, Nvidia’s largest competitor.

Additionally, Nvidia already has products servicing over 10 million cars worldwide. They are publicly working with Audi, Mercedes-Benz, Volvo, Tesla, ZF, and now Bosch and Toyota. Notably, Nvidia has partnered with Tesla since the early production of the Model S. Currently, all Tesla vehicles are equipped with Nvidia’s latest computing technology that provides full self-driving capabilities.

(Source: Wikimedia)

Further Expansion into Self-Driving Vehicles

The auto industry is in the midst of an automation-driven revolution. New technologies such as Connected Cars and Advanced Driver Assistance Systems are introducing design complexities that are pushing IT infrastructure to its limits.

Going forward, cars will be controlled by sophisticated algorithms powered by artificial intelligence (AI) learning. Nvidia recently partnered with Here, whereby they provide Here with technology to improve their HD Live Map. HD Live Maps are a key component in the functionality of a self-driving vehicle. Nvidia will provide vehicles with an end-to-end solution for building neural networks, as well as the deployment of that network within the car. Live mapping will update terrain changes in real-time for the purpose of optimizing personal safety and efficiency. Furthermore, this technology has the potential to reach many consumers based on its wide range of value.

Interestingly, analysts predict that the number of cars with autonomous capabilities will rise to 150 million by 2025. Huang projected that Nvidia would deliver technology that would allow for a self-driving car to operate with minimal human intervention by 2018.

Presently, the line between automakers and technological companies is merging. In fact, global automakers are increasingly trying to expand their research and development budgets, while also investing heavily in technology companies.

The automotive industry will significantly increase, as consumers look towards on-demand mobility services, customization and improved road safety. Automakers could revolutionize travel in terms of convenience and efficiency. It is imperative that Nvidia remains a major supplier in the auto industry market, to ensure that they cash in on a potential global boom.

Conclusion & I Know First Algorithmic Prediction

NVDA is coming off an impressive 2016, and it does not appear that they have any intention of slowing down. Recently, they have locked up key deals with Bosch, Toyota and Here. These deals provide an abundance of optimism for the future of Nvidia. Global automakers are turning the corner on artificial intelligence technology. Toyota has admitted that they were late to the party, and now they are committing to invest heavily in AI. Presumably, large investments will continue to pour into the technological auto sector. Nvidia is set up advantageously to capitalize on an artificial intelligence boom.

Lastly, Nvidia remains a strong company by diversifying across the Gaming, Professional Visualization, Datacenter, and Automotive markets. This allows the company the flexibility to gamble on the AI powered vehicle industry while it is still in its infancy. This flexibility facilitates the process of reaching their financial upside. Nvidia has been making leaps in all of their sectors, but it is possible that they are still due for a future breakthrough. Ultimately, the automotive industry may provide the greatest eventual payoff for Nvidia.

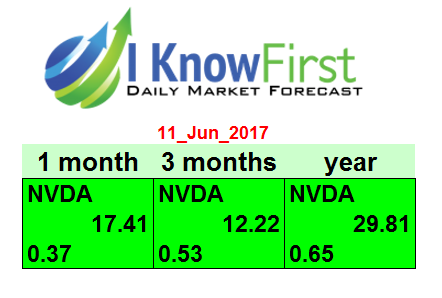

My bullish outlook for Nvidia is also supported by its positive algorithmic forecasts from I Know First . The algorithmic prediction for Nvidia suggests that it is optimal to invest long-term. The stock’s one-year algorithmic market signal is 29.81. Additionally, the forecast suggests a predictability factor of 0.65. Nvidia remains a strong contender for potential growth.

I Know First Past Success with NVDA

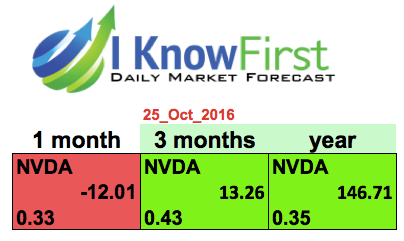

I Know First has been bullish on NVDA in past forecasts. On October 25th, 2016, an I Know First analyst had written a bullish long-term analysis of NVDA in accordance with our state of the art algorithm. Since then, NVDA has risen about 110.6% to date.

This bullish forecast on NVDA was sent to the current I Know First subscribers on October 25th, 2016.

(Source: Nasdaq)

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.