Netflix Stock Predictions: Strong International Subscriber Growth Is Why Netflix Is A Buy

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

NFLX Stock Predictions

Summary:

- As one of the famous FANG stocks, Netflix enjoys a stratospheric valuation when compared to other technology tickers.

- Like Amazon and Facebook, Netflix is a growth-driven company. In spite of stiff competition, FANG stocks managed to establish themselves as long-term leaders in their chosen line of business.

- Unlike Amazon though, Netflix has made a successful global expansion. Its international subscriber count is now larger than in the U.S.

- This is a very strong reason to stay or go long NFLX. International expansion will keep this company’s strong growth momentum.

- NFLX has positive near-term and long-term algorithmic forecasts from I Know First.

Almost two months ago, I made a buy rating for Netflix (NLFX). The stock dipped and lingered below its May price levels during June and most of July. It never bothered me because I know I’m right with my buy recommendation. Last week, NFLX shot up high enough to deliver a +19.75% return on my May 25 rating for NFLX.

Predicting Netflix’s stock movement is so easy. More often than not, NFLX will shoot up in price every time the company reports a notable growth in its population of subscribers. Netflix’s shares jumped over 10% last week after it reported better-than-expected number of new subscribers.

(Source: Google Finance)

Yes, sir. As a privileged member of the famous FANG club, Netflix is treated like a royalty by the investing community. It doesn’t matter much to retail or institutional investors if Netflix delivers lower-than-expected quarterly EPS and revenue numbers. NFLX will likely always enjoy lofty valuation of 230x P/E as long as it can show quarterly increases in its subscribers.

The Strong Reason To Go Long NFLX

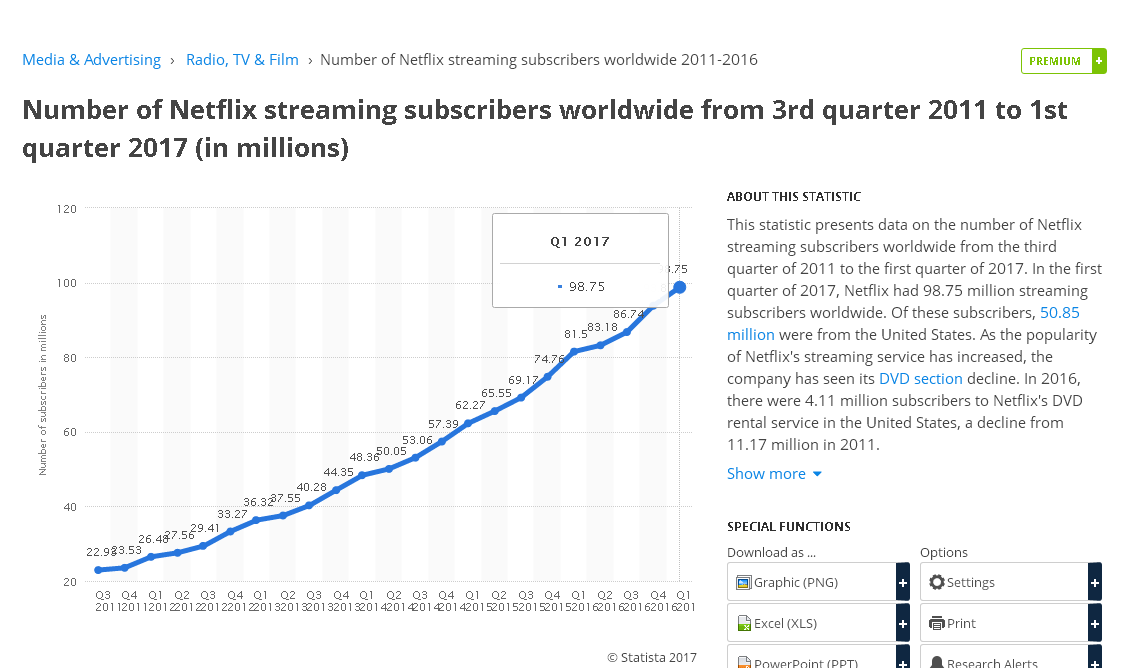

The five-year +1,512.82% performance of NLFX is of course 100% due to its massive growth in number of subscribers. The Premium chart below from Statista is not updated yet because it ended in Q1 2017. However, the beautiful uptrend growth in subscribers illustrates clearly why NFLX enjoys stratospheric valuation.

Now I’ll show you another chart which should tell you the main thesis of this article. Please study the highlighted part.

The best or the strongest reason to invest in NFLX right now is that it now touts more international streaming subscribers. As of Q2 2017, Netflix has 52.03 international subscribers – greater than the 51.92 million U.S. subscriber base. Further, Q2 numbers show that Netflix gained new 4.14 million international customers. This beats the net addition of 1.07 million subscribers in the U.S.

Netflix has a massive growth potential. It only has more than 103 million subscribers. Its FANG co-member, Facebook (FB) touts 2 billion monthly active users. Going forward, I expect Netflix to end up with 200 million paying customers around the world within the next three years.

If you think Netflix is super overvalued right now, wait until it reports 150 million and 200 million subscribers.

Why Netflix Is Having An Easy Time Expanding Globally

I have an easy explanation why Netflix can add 4 million new international subscribers every quarter. Netflix has successfully recruited wireless/broadband service providers to subsidize a free Netflix subscription inside their postpaid and prepaid cellular/landline/DSL plans.

In the Philippines, Globe Telecom subsidizes a free six-month Netflix subscription if people will sign-up for a two-year phone or broadband LTE service. The carrier-subsidized approach of Netflix on international markets is why it has lower revenue from its international streaming subscribers. It has to offer carriers discounts, it cannot charge Globe Telecom the full $9.99/month.

Netflix Philippines also offers 1 month free and every plan is a month-to-month basis, no-long term commitment subscription package. Since I have a terrible DSL and Globe LTE connection (they are not ideal for HD video streaming), I am a happy customer of the PHP 370 ($7.40) monthly plan. The 480p resolution of the $7.40 plan is already satisfactory to me.

(Source: Netflix)

Conclusion

Taking a position in Netflix right now is risky. However, I am very confident that it will continue to deliver better-than-expected quarterly net additions to its subscriber base. Investors will also continue to rally behind NFLX because of this. If you didn’t gamble on NFLX before, do it now and be patient. Wait for the quarterly earnings report and watch how NFLX will shoot up higher again.

The positive near-term, medium-term, and long-term algorithmic forecasts for NFLX from I Know First support my bullish call for Netflix. One year from now, the Artificial Intelligence-enhanced stock picking computers of I Know First expects NFLX to trade higher than its current price right now.

Further, analysis of monthly and weekly technical indicators also backs my buy rating for NFLX.

Past I Know First Forecast Success with NFLX

I Know First has made accurate predictions on NFLX in the past, such as its bullish article published on February 14th, 2017. In the article, it explains that Netflix has created its own “cult following” that will continue to grow as time passes. During the 5+ month period starting on February 14th, 2017 until now (July 18th, 2017), NFLX shares have increased by 31.66% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Google Finance: NFLX)

This bullish forecast for NFLX was sent to I Know First subscribers on February 14th, 2017. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.