Netflix Stock Predictions: Netflix Can Survive and Flourish Even Without Disney’s Content

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Netflix Stock Predictions

Summary:

- Disney has announced that it will stop licensing its movies to Netflix and will start its own streaming service in 2019.

- This revelation caused NFLX to drop more than 4% yesterday. A rival streaming service from Disney two years from is certainly a cause for concern.

- However, that’s two years from now. By that time, Netflix will have created its own library of original content so it can survive future competition from Disney.

- I therefore conclude that the bearish cloud over NFLX is not going to last long. The long-term growth story of NFLX is still intact.

- Netflix has already invested billions of dollars in original contents. It can also spend billions of dollars more to buy IP owners like comics publisher Millarworld.

Disney’s (DIS) announcement that it plans to stop licensing its movies to Netflix (NFLX) inspired investors to drive down NFLX’s by 4% yesterday. Disney said its movies including Pixar titles will only be available on Netflix until the end of 2018. Disney also intends to offer its own brand of video streaming service in 2019.

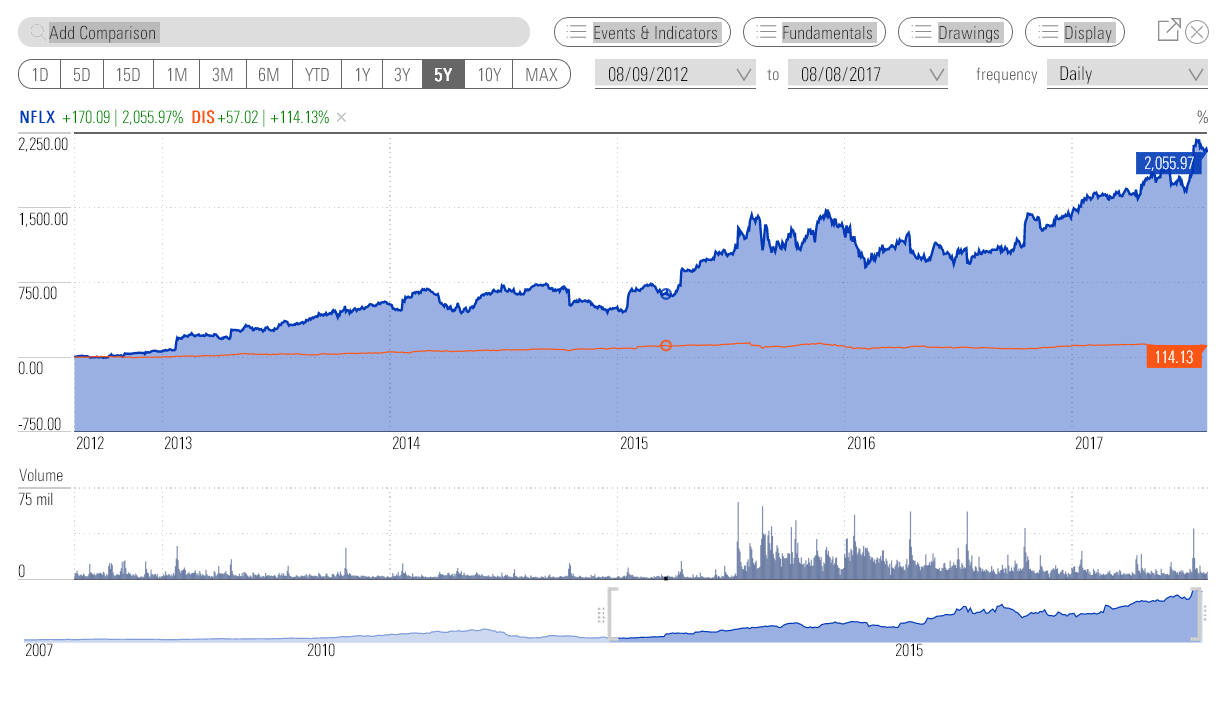

This is an understandable move from Disney. It wants a share of the paid streaming service industry to offset its declining cable channel assets like ESPN. Disney might be too late to the party. Netflix is already the 800-pound of subscription-only streaming. Netflix doesn’t make profits as much as Disney does but its stock is a long-running darling of investors. Momentum growth investors love Netflix, its 5-year return of +2,056% greatly outperformed Disney’s 5-year return of +114.13%.

(Source: Morningstar)

Why You Should Stay Long NFLX

The bearish reaction should not last long. Losing access to Disney movies and IP assets is not going to kill the growth story of Netflix. Two years from now, Netflix would be too well-entrenched to be disrupted by a Disney-branded paid streaming service. Two years from now, Netflix would have built up a huge library of its own original content.

Netflix is also a cash flow king. It can acquire other companies to enrich its original content library. Netflix recently bought the comics publisher responsible for the Kick-Ass and Kingsman movies. The founder of Millarworld, Mark Millar wrote several comic books for Marvel (a subsidiary of Disney). Millar wrote Old Man Logan and Civil War. Old Man Logan was made into a movie by Disney, Logan. Millar’s Civil War comic book for Marvel was also made into a movie, Captain America: Civil War. Netflix therefore acquired Mark Millar’s creative mind when it bought Millarworld.

I expect Mark Millar to come up with more heroes-themed stories to fortify Netflix’s library of original content. By 2019, Netflix will probably have enough heroes-themed stories to offset the loss of broadcast rights to Disney and Pixar movies.

(Source: Millarworld)

Two years from now, Netflix’s empire would cover most countries of the world. The multi-billion spending on original content programming is a long-term tailwind for Netflix. Original TV shows and movies definitely help attract and retain the loyalty of paid streaming subscribers. Exclusive, original shows are Netflix’s aces. It has the winning hands right now when it comes to premium online streaming.

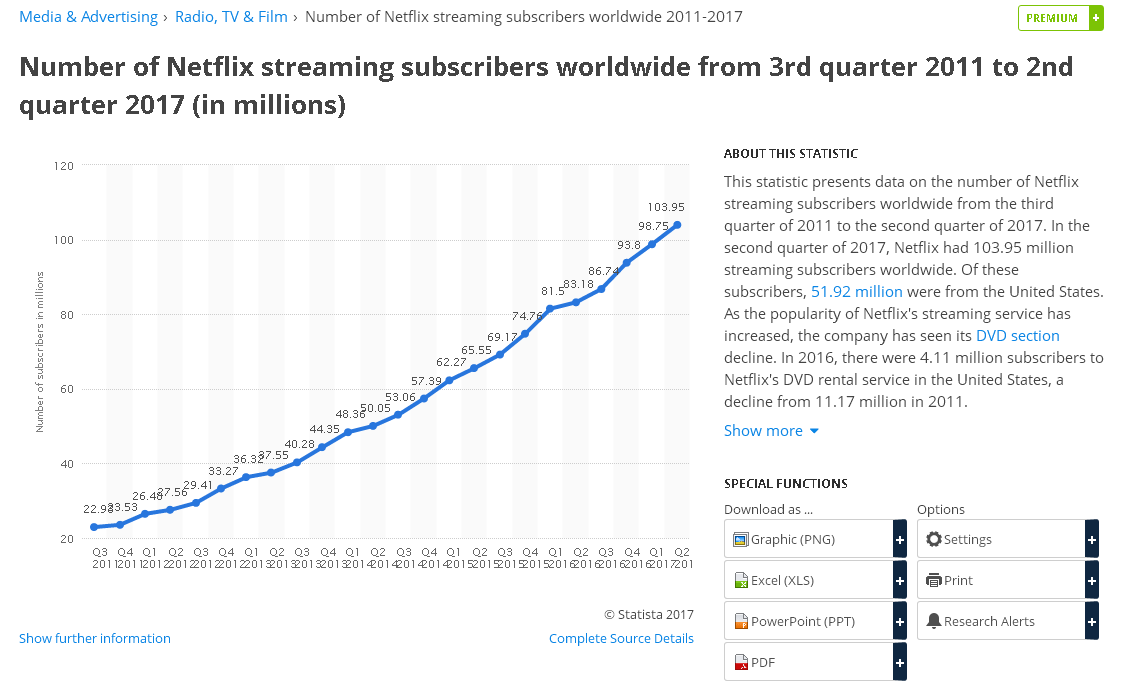

As a result of Netflix’s willingness to spend up to $6 billion in original content, it now touts more than 103 million subscribers.

(Source: Statista)

It will take years, maybe even a decade, before Disney can catch up with Netflix. The bigger long-term risk is actually imposed on Disney, not Netflix. Disney’s 2019 launch of its own competing online streaming service will likely undergo an acid test check from investors. Any weakness in Disney’s future online streaming could probably provoke negative reaction from the market.

Conclusion

I rate both DIS and NFLX as buy. However, I am confident that NFLX will do better in the stock market for the next three years. In spite of its huge library of Intellectual Properties, Disney was too late in riding the boom of online streaming. It relied too much on cable channel assets like ESPN. Netflix was smart enough to license broadcast rights of Disney and Pixar movies to build its empire.

In other words, Netflix is the visionary company. Disney is the slow, reactionary firm that is now only realizing the true potential of global subscription online streaming services. If Disney’s 2019 launch of its own online streaming fails or struggles, the future scenario is it could be compelled to buy or merge with Netflix.

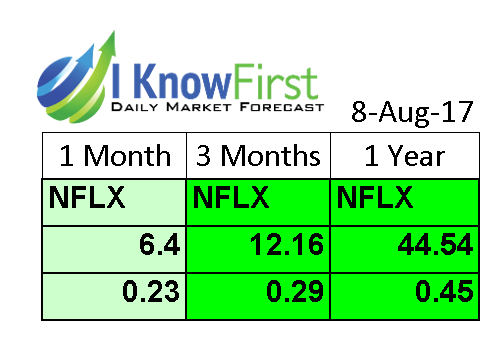

I Know First still has positive near, intermediate, and long-term algorithmic forecasts for NFLX.

Past I Know First Forecast Success with NFLX

On September 15th, 2016, I Know First made an accurate prediction on NFLX published in the form of a bullish article. In the article, it explains how Netflix has been exceeding analyst expectations in their earnings report. In addition, international growth has been a major contributor towards Netflix’s rise. During the approx. eleven month time period, NFLX shares increased by 83.86% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Google Finance)

This bullish forecast for NFLX was sent to I Know First subscribers on September 15, 2016. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.