Microsoft Stock Outlook: 3 Reasons To Go Long Microsoft

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Microsoft Stock Outlook

Summary:

- Microsoft may not catch up with Amazon on Infrastructure-as-a-Service. Investors are not happy that Azure is a far second to AWS on cloud computing infrastructure.

- However, I am listing here three good reasons why you should stay long MSFT.

- First, Microsoft is revising its Skype for Business collaboration app and is integrating LinkedIn on Office 365.

- Secondly, Microsoft and Facebook completed their 4,000-mile 160-terabits-per-second undersea cable in the Atlantic Ocean. This should ensure optimal delivery of Microsoft cloud services.

- Lastly, Microsoft is leveraging its Artificial Intelligence assets to build a new health care division.

Microsoft (MSFT) is having a hard time breaching the $80 price barrier. MSFT posted its latest 52-week high of $75.97 last September 18. However, this week experienced MSFT getting pulled down to below $73. I can attribute this running-out-of-steam flaw to Microsoft Azure’s inability to close the big gap between itself and Amazon (AMZN) Web Services.

Microsoft has enthusiastically matched the low-margin pricing approach of AWS (Amazon Web Services) and yet Azure remains a far second on cloud computing infrastructure. Azure is the fastest growing IaaS/PaaS brand but it still trails far behind AWS’s market leading share of 34%. Azure only has 11% share in global cloud infrastructure services.

The cloud infrastructure services industry generated $11 billion in Q2 2017 and is growing at 40% Year-over-Year (Y/Y). Amazon Web Services continue to take the lion share of this hyper-growth industry. Azure’s revenue is growing exponentially but it obviously operates on low margins.

Nevertheless, I am still endorsing Microsoft as a buy and hold forever investment. It pays decent dividends and it has successfully implemented its Cloud-First Strategy.

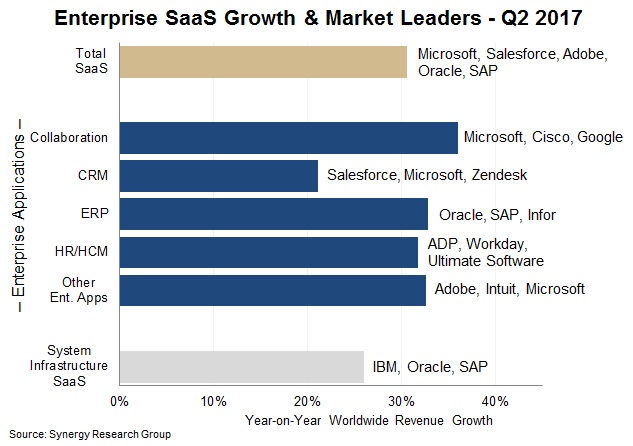

No.1 Reason: Microsoft Is The Dominant Leader in SaaS

Azure is struggling against AWS but Microsoft is now the runaway leader in Software-as-a-Service (SaaS). Since razor-thin-margin-specialist Amazon has no presence yet in SaaS, it is safe to say that SaaS is a higher-margin industry wherein Microsoft dominates. Robust growth in its software subscription business is why Microsoft is a buy-and-hold stock.

Unlike IaaS where every firm with lots of cash can easily build a server farm, SaaS require you to have industry-standard software products like Microsoft Office to do well. Its decades-old Office productivity and collaboration software is why Microsoft will forever dominate the $15 billion/quarter SaaS industry.

Thanks to Office 365, Skype, and other Microsoft apps, Nadella’s company’s cloud-sourced revenue is growing fast. Inclusive of Office 365/Skype/Dynamics subscriptions, Microsoft’s Productivity and Business Process division grew 21% Y/Y in Q4 FY 2018 to $8.4 billion. Office 365 now has 27 million paying subscribers.

The company’s decision to replace its Skype for Business under its new Microsoft Teams collaboration software product is smart. Consolidating SaaS products makes for more efficient marketing and after-sales servicing. Microsoft is also integrating LinkedIn inside its Office 365 software suite. Microsoft is now making LinkedIn the social network for employees.

All these recent consolidation moves reinforce Microsoft’s overall SaaS strategy.

No.2 Reason: Microsoft Has Faster Pipeline To Transmit Its Cloud Services

Microsoft’s cloud computing services, IaaS and SaaS, is global in scope. It therefore matters that Microsoft and Facebook (FB) has completed construction of their 4,000-mile undersea cable. This “Marea” internet data pipeline touts 160 terabits/second transfer speed.

Undersea cables like these allow Microsoft to operate its server farms/datacenters in America and still offer fast cloud computing services to European customers/subscribers. Microsoft and Facebook will share Marea but I think it’s fast/large enough to support these two web giants’ datacenters.

Protecting its big lead in SaaS requires Microsoft to have the best download/streaming service to its customers outside the United States.

No.3 Reason: Microsoft Is Expanding To AI-Enhanced Healthcare

The investment on artificial intelligence is paying off well for Microsoft. Bing and Cortana are great examples of Microsoft’s advances on artificial intelligence. Microsoft is putting up a healthcare division based on its artificial intelligence software/technology.

Providing doctors and patients a cloud-based 24/7 health monitoring system using AI software is a future expansion move for Microsoft. The global digital health market was worth $179.6 billion. Transparency Market Research estimated that this industry will grow at a CAGR of 13.4% until 2025. Eight years from now, digital health will generate global revenue of $536.6 billion.

It is not far-fetched to expect Microsoft expanding from renting out Office 365 software to renting Health365 software that monitors people’s health stats 24/7. Microsoft Teams could be expanded to a Microsoft Health Collaboration SaaS.

Conclusion

I am long MSFT. I will keep holding on to it. This article presented three valid reasons why should go long on Microsoft. I hope they were convincing enough. Microsoft is not a going to lead in IaaS but it will certainly remain a long-term leader in SaaS. Taking the pole position on a higher-margin cloud computing business is key to Microsoft’s prosperous future.

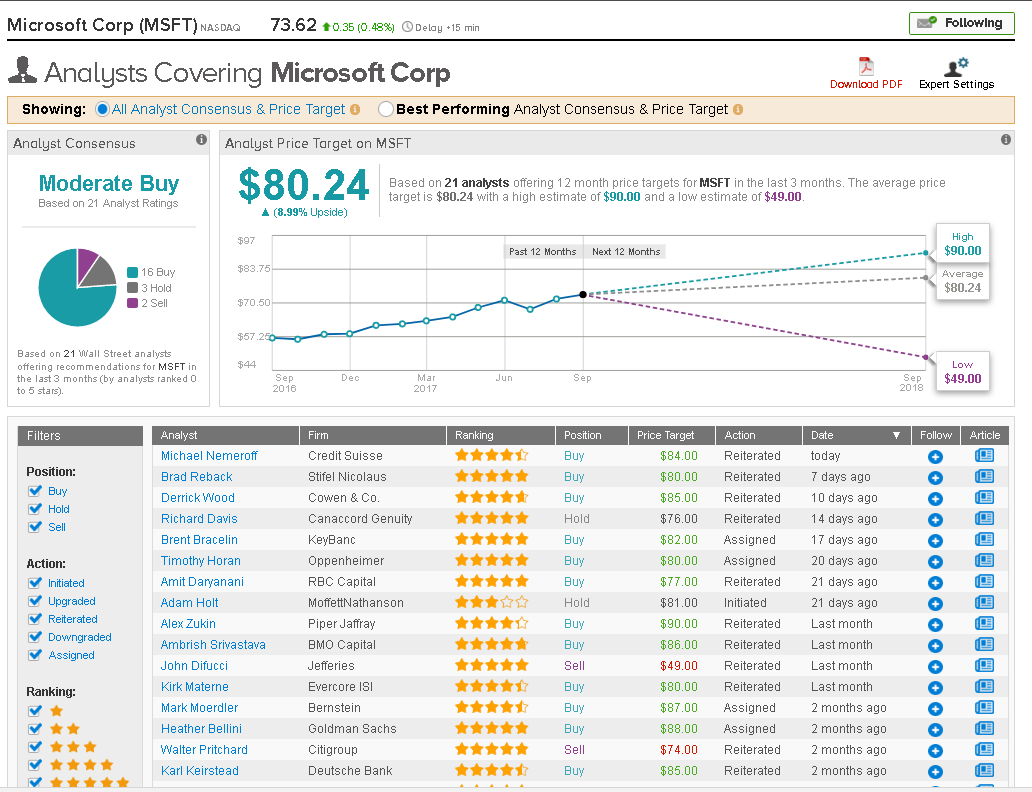

My buy rating for MSFT is backed by its positive near and long-term algorithmic forecasts.

My 12-month price target for MSFT is $85. This is higher than the average 12-month PT of $80.24 made by TipRanks-tracked Wall Street analysts.

(Source: TipRanks)

Past I Know First Forecast Success with MSFT

I Know First’s algorithm has made accurate predictions on MSFT in the past, such as its bullish article published on August 17th, 2016. In the article, it explains that Microsoft is desperate to keep the Windows 10 Mobile hardware franchise alive because the smartphone is the new computer. Xiaomi could become a key partner toward Microsoft keeping Windows popular among people who now prefer to use smartphones over desktop computers/laptops. Since the August 17th, 2016 forecast, MSFT shares increased by 27.14% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Yahoo Finance: MSFT)

This bullish forecast for MSFT was sent to I Know First subscribers on August 17th, 2016. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.