Micron Technology Inc: Long Way To Go

This article was written by Mingyue Liu, a Financial Analyst at I Know First.

Micron Technology Inc: Long Way To Go

In order for the United States to do the right things for the long term, it appears to be helpful for us to have the prospect of humiliation. Sputnik helped us fund good science – really good science: the semiconductor came out of it. (By Bill Gates)

Summary:

- Micron Technology Inc. SWOT analysis

- For those who are new to semiconductor industry–Understand Micron’s Business

- Rationale Behind The Bearish Forecast for MU

Micron Technology Inc. (NASDAQ: MU) was founded in 1978 and headquartered in Idaho, U.S. It is one of the world’s leading providers of advanced semiconductor systems. The company specializing in providing DRAM, NAND flash; 3D XPoint™ memory and other products, which accounted for roughly 54%, 40%, and 6% of total revenues of 2016, respectively. The top 3 customers of Micron Technology include: Kingston (10%), Intel (8%) and HP (9%). The company divides its business into four units:

- CNBU (Compute and Networking Business Unit) includes memory products sold into compute, networking, graphics, and cloud server markets. This segment accounts for 37% of the total revenue of FY 2016, yet experienced an operating loss.

- SBU (Storage Business Unit) includes memory products sold into enterprise, client, cloud, and removable storage markets. SBU also includes products sold to Intel through our IMFT joint venture. This segment accounts for 26% of FY2016 revenue, yielding a net operating loss.

- MBU (Mobile Business Unit): Includes memory products sold into smartphone, tablet, and other mobile-device markets. 21% of the total revenue was generated by this segment. This segment reported an operating income for FY2016.

- EBU (Embedded Business Unit): Includes memory products sold into automotive, industrial, connected home, and consumer electronics markets. This segment represented 16% of the total revenue with a reported operating income. This is the only segment that has consistently reported net operating income, with roughly 40% of total revenues of automotive memory market.

Micron Technology Inc. SWOT Analysis

Strengths:

- Micron has partnered with Intel to form IM Flash Technologies, in which the two design, develop, and manufacture NAND Flash and share the output in proportion. The creation of such partnership is in the hope of gaining edge over peers and competing with major players such as Samsung.

- Micron has a good market position in DRAM market, with 29% of the total market revenue for FY2016, second only to Samsung, who holds over 40% of the market share.

Weaknesses:

- Overall, Micron Technology is a second-tier player, who is incapable of successfully competing with major players such as Samsung. Samsung accounts for about 42% of total memory shipments, and holds considerable clout among smaller peers such as Micron, Hynix, Toshiba, and SanDisk. In the NAND Flash market, Micron only has a 3.3% market share.

- Cash Flow Generation: Weak cash flow from core business. Morgan Stanley forecasts decreasing operating cash flow over the next five quarters, indicating lack of confidence in the company’s core business. Micron reported for FY2016 a shortage of over $2.2 billion to meet required capital investment and debt repayment using cash flow generated from core business. Morningstar Equity Research projected a gap of $340 million for FY2017, which is consistent with Morgan Stanley’s expectation.

- Return on Total Capital Employed (ROTCE): Highly volatile. Micron experienced notable return on capital for FY2014 and FY2015, reaching 24% and 19%, respectively. However, ROTCE dropped significantly to less than 1% for FY 2016.

Opportunities:

- Success of a company in semiconductor industry is largely dependent on the ability to capture growing opportunities such as increasing usage of social media applications, which require large storage, and 3D XPoint™ Memory.

- Total revenues of DRAM and NAND Flash markets are expected to grow in the future, mainly driven by lower supply compared to demand growth. The tight supply will push the pricing level higher. According to Gartner, the 2017 worldwide semiconductor revenue to reach $386B, growing 12.3% over last year, mainly contributed to the surge in DRAM and NAND Flash selling prices.

Threats:

- Micron is faced with extremely intense competition landscape, which is due to little or no product differentiation in memory storage. Even with the groundbreaking 3D XPoint™ Memory, Micron is believed to have no “economic moat”, as the industry is inherently devoid of product differentiation. Key players such as Samsung, Hynix, and the SanDisk-Toshiba partnership will soon come to market with their own yet similar products.

- To compete with peers, companies often launch price competition, which normally causes average selling prices tracking downward over time. In combination with the reason mentioned above, price competition usually drains companies’ profits, which in the long run would hurt every player in the market.

- Softening demand of PC and smartphone has posed challenges for semiconductor industry as a whole. According to IBISWorld, the overall demand for PC has decreased for the last five years at annual rates of -1.7%. Smartphone industry has also experienced a decrease in demand growth.

For Those Who Are New To Semiconductor Industry: Understand Micron’s Business

- What is DRAM? Dynamic random-access memory (DRAM) is a type of random-access memory that stores each bit of data in a separate capacitor within an integrated circuit. DRAMs are “designed for the sole purpose of storing data. Since DRAM memory cells are capacitors, the charge they contain leaks away over time, so does the data. To prevent this from happening, DRAMs must be refreshed. The frequency with which to refresh varies with different technology used to manufacture the chips.

- What is NOR Flash Memory? NOR Flash Memory is a type of non-volatile storage technology, which is able to retain information even if the power supply is switched off. NOR Flash is best suited for code storage and execution, usually in small capacities. Applications mainly consist of simple consumer appliances, low end cell phones, and embedded applications.

- What is NAND Flash Memory? NAND Flash Memory is also a type of non-volatile storage technology. It was first introduced by Toshiba in 1989. NAND Flash cells are 60% smaller than NOR Flash cells, providing the higher densities desired by low-cost electronic devices. Many current designs are moving to NAND flash to take advantage of its higher density and lower cost for high-performance applications. NAND and NAND-based solutions are ideal for high capacity data storage, and are used in virtually all removable cards.

- What is 3D XPoint™ Memory? 3D XPoint™ is the new generation of non-volatile memory technology, introduced by Micron and Intel in 2015 and became available in open market in 2017. Since the launch, 3D XPoint™ memory has been a stir, for its ability to provide higher-speed and higher-capability data storage than NAND, as well as up to 1,000 times lower latency and exponentially greater endurance (Source: Micron Technology).

Source: A Close Look at the Intel/Micron 3D XPoint Memory, Objective Analysis 2015

Conclusion: Bearish Expectations

We hold bearish opinion towards MU, especially for a short term of three months or less.

- Micron had been selling most of its groundbreaking 3D XPoint™ Memory products to Intel at a discount to market price since they jointly introduced the technology in 2015. The products are only available starting mid-2017, which gave competitors enough time to do research on this technology. I believe that Micron has lost the most perfect timing to capture this market. As a result, 3D XPoint™ Memory is expected to have limited positive influence on the company’s revenue.

- Semiconductor industry suffers from significant cyclicality. Market demand is driven more by demand than supply, which means providers can neither control industry cyclicality nor predict it. Market research shows that demand for PC has dropped and smartphone sales have been slowing, both of which account for a noticeable part of demand for memory technology products.

- Lack of product differentiation and intense price competition are factors to be concerned. For the long run, the price competition would hamper every player in terms of revenue growth, especially for smaller competitors such as Micron. The reasons include lacking bargaining power against suppliers and costumers, inability to cut or, at least level off, costs.

- Micron is an active player in international market, with 43% of its FY16 revenue from Mainland-China market, 12% from Taiwan, 8% from Japan, and 13% from Asia Pacific area excluding China and Japan. The strengthening of US dollar and increasing international competition have caused the demand to shift from US-made products to emerging countries, especially to Chinese-made products. Even as global demand for semiconductors rises, US industry manufacturers are facing severe competition on a global scale, which also explains part of the high revenue volatility.

- If we look at the historical chart of MU’s performance, it can be easily spotted that movement of the stock price followed Double Top pattern. Based on this pattern, the stock currently “peaks” at the second top, thus a decrease in stock price is expected.

Source: Yahoo Finance

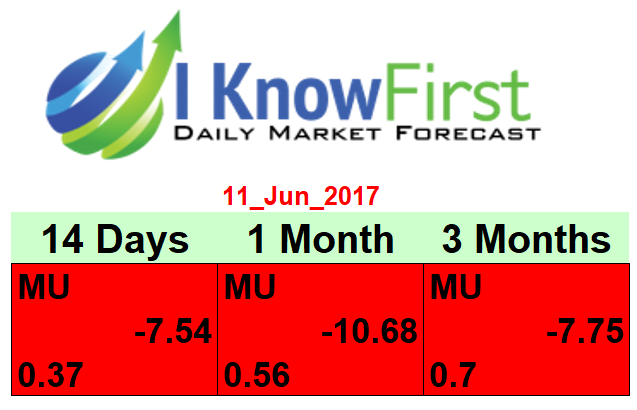

My bearish position on MU resonates with I Know First forecast released on June 11, 2017. The predictability increases in the long term, indicating that MU is a sell in the short term.

Past I Know First Algorithm Successes with MU:

I Know First published a bullish forecast for MU over a one-year period from June 5, 2016 to June 5, 2017, which yielded 142.69% return. Read the last 1 year forecasts performance published on June 8, 2017.

This bullish forecast on MU was sent to the current I Know First subscribers on June 5, 2016.

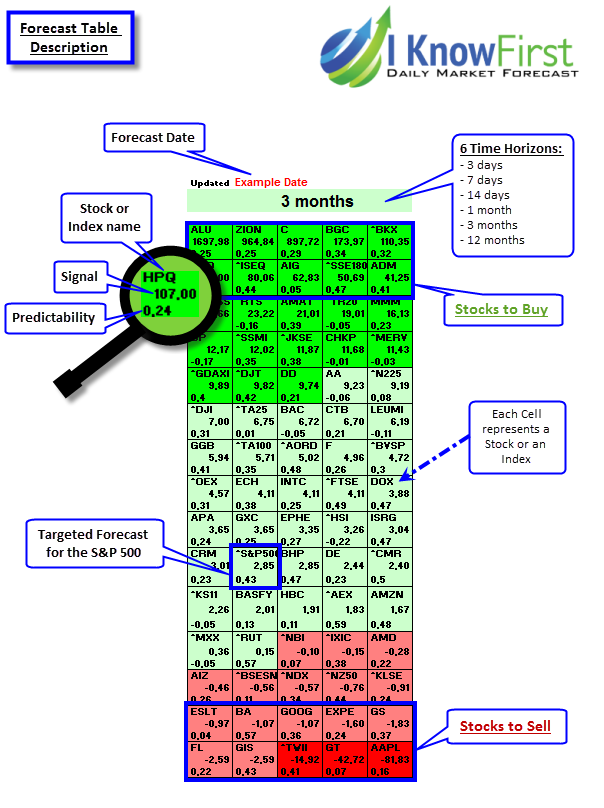

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go. (positive = to go up = Long, negative = to drop = Short position). The signal strength relates to the magnitude of the expected return. We use the signal strength for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. It allows the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.