Machine Learning On The Horizon For Investment Management

Linda Luo is a Financial Analyst at I Know First.

Linda Luo is a Financial Analyst at I Know First.

Machine Learning On The Horizon For Investment Management

Summary

- What Machine Learning Holds for Investment Management

- ML Techniques Can Enhance the Investment Decision-Making Process

- Investment Management and ML: Partnership, not Takeover

- I Know First Predictive Algorithm’s Role

In today’s data-driven world, progressive technology has given us access to a massive quantity of data. However, simply arming ourselves with faster computers and big databases does not fully empower companies and individuals to tap the full potential of big data. Not only should machines process all this data, but also learn how to process data to maximize efficiency. This is where machine learning, a subset of artificial intelligence, comes in. If computers can learn to digest data through dissecting, categorizing, and synthesizing on their own without being explicitly programmed repeatedly by humans, human capital can be relocated to a higher-level function while the machines churn away at the data.

The purpose of machine learning is to generalize. It does so by synthesizing an inordinate amount of data and finding hidden relationships, trends, and associations between data points. First the machine learns within a framework provided by humans using mathematical and programming tools. It takes in training data as a benchmark created for the machine to learn from. Subsequently, we test the system with testing data for accuracy. Machine learning algorithms are recursively self-improving, continuously adapting and “evolving” when exposed to more and more data, then extrapolating knowledge from historical data to make predictions on new data.

What Does This mean For Investment Management?

Machine learning has already disrupted several other industries, changing the landscape of education, healthcare, transportation, marketing, etc. It is widely viewed as a significant revenue growth driver for US technology giants, Google, Facebook and Amazon. Yet, machine learning’s adoption in the finance sector is still hesitant and sporadic. However, the investment management space will feel the ripple of machine learning’s disruption wave within the next five years. Large, established asset management firms and hedge funds such as BlackRock, Bridgewater, and Schroders have been directing funds towards the development of financial models and trading algorithms. Their efforts aim to build investment systems that can outperform humans through machine learning. Smaller entities in the investment management space should start taking note.

For instance, in the case of stock selection, the stock market is a chaotic and complex system. A stock’s trend may seem random at a glance. Despite this, AI and Self-learning algorithms can be used to learn and discern patterns from big data of past stock market activities to forecast future trends in the stock market. For investment managers attempting to navigate the chaos of financial markets, automating trading through the use of machine learning algorithms helps separate the signal from the noise in the stock market while eliminating the factor of human bias and emotions.

Algorithms are also used to simulate thousands of scenarios and possibilities within a second. They can do so at a speed and frequency faster than any human trader. Thus, using AI and machine learning algorithms in the stock market can significantly improve market efficiency. Consequently, human capital can be allocated to advance the sophistication of these disruptive technologies or other fields. Al algorithms can analyze various sets of data, from market prices and volumes to macroeconomic data and corporate accounting statements. Moreover, they can make market predictions as well as decide on a course of action.

The investment management industry is on the cusp of transformational developments by disruptive technologies as firms see machine learning capabilities as a key differentiator. Traditional industry practices will lag behind and struggle to keep up with the flood of real-time data.

ML Techniques Can Enhance Investment Decision-Making

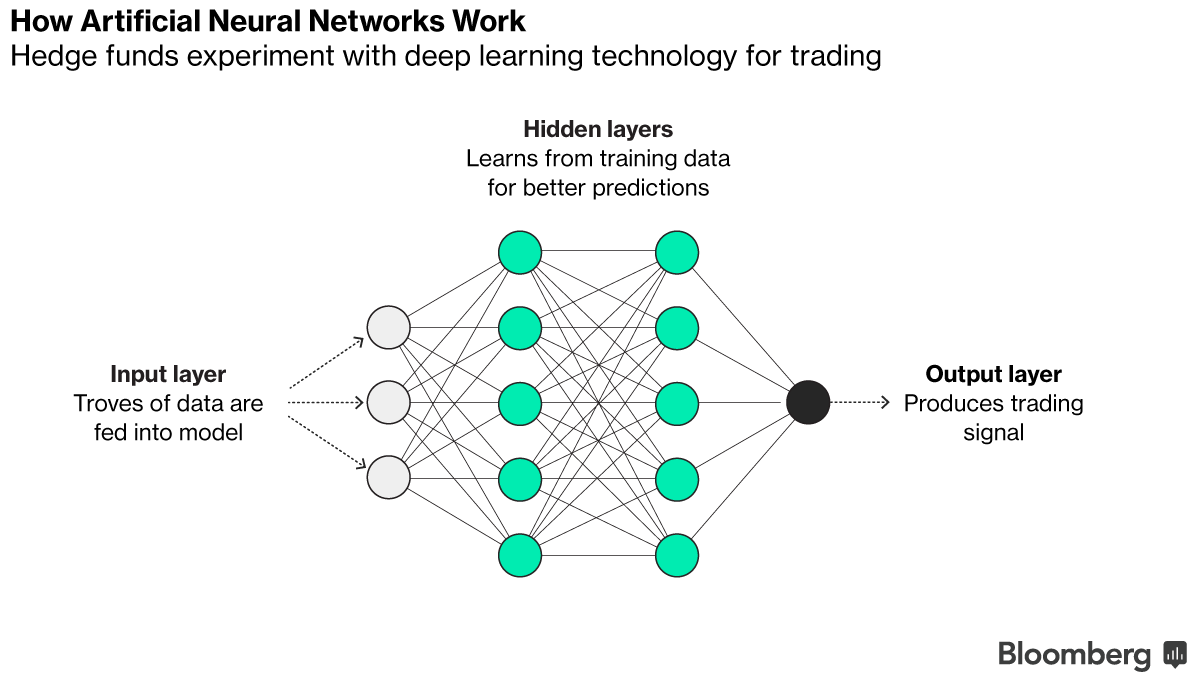

In particular, deep learning, a technique of implementing machine learning, has already been making significant breakthroughs. Examples include image recognition on par with human abilities as well as the advancement of speech recognition and language translation. Deep learning is concerned with algorithms that build on artificial neural networks. The structure and function of the human brain are the inspiration for this process. This technique utilizes matrices of artificial neurons to scan through data, organize and aggregate large unlabeled data sets into abstracted forms. This approximates the operation of a human brain at hyper-fast speeds. This is what makes deep learning so powerful and useful for predictions. We can direct its potential towards investment management.

For instance, deep learning can be applied to enhancing the process of fundamental analysis. This process has been a cornerstone of investment decision-making. Traditionally, investors look at a company’s income statements, balance sheets, earnings reports, and other public statements regarding its performance. Investors use this information as part of the decision regarding the company’s prospects as a viable investment. Deep learning can applied to digest a much larger set of data and information about a company at faster speeds. At the same time, it removes human biases that often detract from investment performance in the process.

Furthermore, machine learning can provide a solution to the classic hazard of overfitting. A frequent mistake by data scientists that leads to overfitting starts when they first run their algorithm on a subset of the training data set. Following the test, they look at another part of the data, the holdout set. If results do not turn out as predicted, they fine tune parameters of the algorithm. Over the course of each new test, the holdout set becomes contaminated. As a consequence, the results are overfitted, capturing the noise of the data and establishing spurious relationships between data points. The model becomes excessively complex with too many parameters.

However, machine learning can minimize this problem of overfitting by restricting the role of the human to establishing the overall investment framework. Within a framework that can include the stock universe, trading frequency, performance benchmarks, and risk constraints, the machine can be left to learn on its own without excessive human interference and find its way to the specific formulation of an investment strategy.

Partnership, Not Takeover

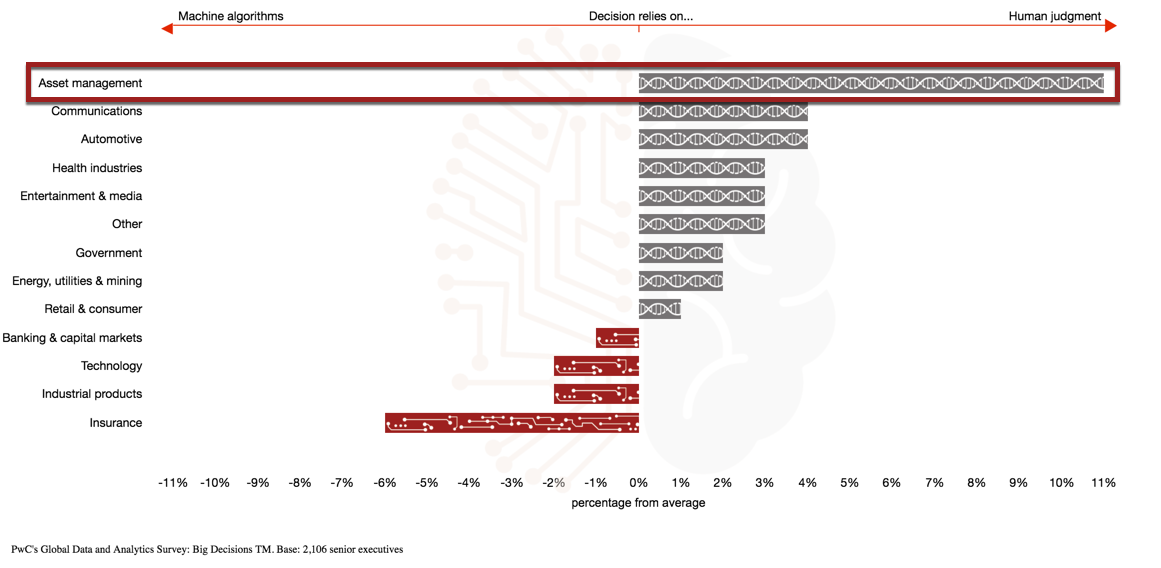

Amid some enthusiasm for the potential machine learning holds for the industry, the threat of machine takeover seems to present an existential risk to some investment managers fearing complete replacement. However, investment managers can actually harness the capabilities of machine learning to enhance the way they administer investment strategies. This is more of a collaboration with the machine, rather than complete dominance. A good balance of human and machine can maximize efficiency and streamline the decision-making process. This balance is lacking especially in the investment management industry. Traditionally, this industry is known for being conservative and slow to adopting new technology. As reflected below in PwC’s 2016 Data & Analytics Survey of over 2000 senior executives from various industries, asset management heavy reliance on human judgement over machine algorithms in decision-making is especially noticeable compared to other industries.

Obviously, quant managers will certainly make use of machine learning. In addition, even the most fundamental, non-quantitative managers can also enhance their capabilities and develop new ideas from the results of machine learning. For example, deep learning’s ability to develop hierarchal data enables the system to sift through and analyze thousands of pages of text sources such as earning calls, SEC filings, and social media. Subsequently, non-quant managers can develop new ideas by using the data that machine learning sourced and synthesized.

Advances in machine learning will replace humans through the automation of certain tasks. However, we can reallocate human capital towards higher functions where human judgement is actually a comparative advantage. As much as systems can learn on their, technology still needs humans, who will be critical for risk management and framework selection.

I Know First Predictive Algorithm’s Role

The I Know First Predictive Algorithm makes daily forecasts on more than 3,000 markets over six different time horizons, from 3 days to 1 year. The system is a predictive model that has its foundation in artificial intelligence and machine learning. It also incorporates elements of genetic algorithms and artificial neural networks associated with deep learning. The algorithm tracks current market data and adds it to the database of historical time series data, drawing upon our database of 15 years of stock share prices to make predictions over different time horizons. As we expose the algorithm to more data, it evolves and adapts to improve subsequent results, learning from its successes and failures.

The I Know First predictive algorithm is an example of machine learning as a significant complementary tool to enhance the investment decision-making process.

Conclusion

While technological progress is accelerating, human adoption of it has yet to catch up, especially in the investment management industry. Collaboration with technology can help counter inconsistencies and behavioral biases that inevitably accompany human judgement in the decision-making process. Utilizing forecasting algorithms and predictive analytics to develop optimal investment strategies is only the beginning for machine learning’s disruption of the investment management industry.