Machine Learning in Finance: IBM Announces Multi-Processor Data Flow

The article was written by Moises Meir, a Financial Analyst at I Know First.

The article was written by Moises Meir, a Financial Analyst at I Know First.

“The idea is to change the rate of how fast you can train a deep learning model and really boost that productivity.” – Hillery Hunter (Director of systems acceleration and memory at IBM Research).

Machine Learning in Finance

Summary

- IBM’s Breakthrough

- What is Deep Learning and what are its applications?

- Deep Learning in Finance

- I Know First’s Application of Deep Learning

Deep Learning revolution is here as the race to make computers smarter and more human-like has come to a new high, with IBM claiming it has developed technology that dramatically cuts the time it takes to crunch massive amounts of data and then come up with useful insights.

In its announcement, IBM says it has come up with software that can divvy those tasks among 64 servers running up to 256 processors total, and still reap huge benefits in speed. The company is making that technology available to customers using IBM Power System servers who want to test it.

IBM used 64 of its own Power 8 servers, each of which links IBM Power microprocessors with Nvidia graphical processors to facilitate fast data flow between the two types of chips. On top of that, IBM came up with what techies call “clustering technology” that acts as a traffic policeman between multiple processors in a given server as well as to the processors in the other 63 servers. If the traffic management process is done incorrectly, some processors sit idle, waiting for something to do. Each processor has its own data set that it knows, but also needs data from the other processors to get the bigger picture. If the processors get out of sync they can’t learn anything.

According to Hunter, expanding deep learning from a single eight-processor server to 64 servers with eight processors each can boost performance some 50 to 60 times. For example, 100% scaling means that for every processor added to a given system, that system would get 100% performance improvement. In reality, such gains never happen because of complex management issues and connectivity problems. IBM claims its system achieved 95% scaling efficiency across 256 processors using something called the “Caffe deep learning framework” created at the University of California at Berkeley. The previous record was held by Facebook AI research, which achieved 89% scaling.

In simple words, IBM claims to have come up with technology that is both much faster than and more accurate than the deep learning technologies already developed.

What is Deep Learning and What Are Its Applications?

Deep learning is a subset of artificial intelligence that attempts to mimic the activity in layers of neurons in the neocortex, the wrinkly 80 percent of the brain where thinking occurs. If Deep Learning is applied correctly, a machine would learn how to recognize patterns in digital representations of sounds, images, and other data by itself. A machine using deep learning has the possibility to perform unsupervised, which is a great step forward in the AI world.

Technically speaking, Deep Learning is the study of artificial neural networks and related machine learning algorithms that contain more than one hidden layer. The basic unit of a neural network is a neuron. A neuron might take in various inputs with assigned weights and output an answer. Each neuron is connected to others to form a neural net. This neural net might have a complex web of differently weighted inputs and outputs it uses internally before generating an answer.

Deep Learning has been used to improve many products and software, especially in big companies. In 2011 Google X announced that they used Deep Learning to reduce the voice recognition error rate on androids by 25%. At that point Google realized how powerful Deep Learning it could be, and hired top talents in the field and also bought DeepMind for $600 million. DeepMind became famous when they developed AlphaGo, the first software that beat an expert in strategic game Go. Go was believed that only humans would be able to master it, given its complexity, so it came as a breakthrough in the Machine Learning world.

There have been applications in the healthcare field, as Google is collaborating with London’s Moorfields Eye Hospital. Moorfields has given the algorithm access to one million images from historical eye scans. The machine is training itself to read the scans and spot early signs which indicate degenerative eye conditions.

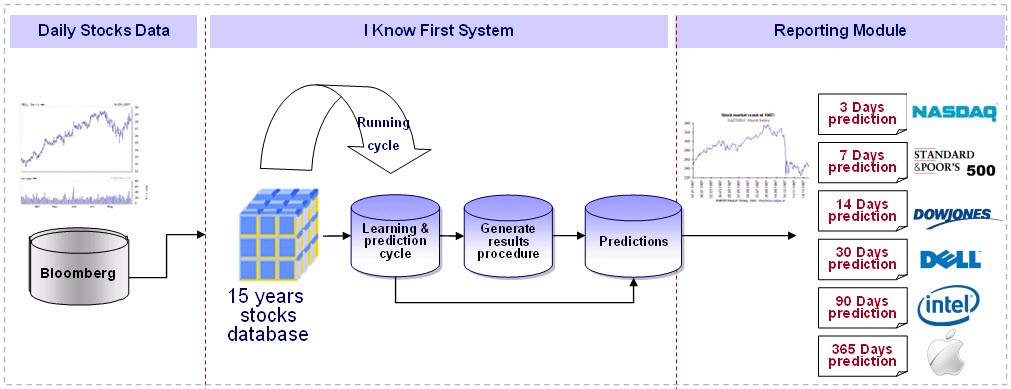

I Know First and Deep Learning

In the field of finance, much research in recent years has been focused on developing techniques for financial market prediction and forecasting. To predict future stock prices and market fluctuations is not an easy task, considering the numerous variables that can affect market behavior. Founded in 2011, I Know First was one of the first FinTech companies to implement artificial intelligence with deep learning neural networks with the function of market analysis and forecasting. I Know First developed a prediction system that uses artificial neural networks that are self-learning, flexible, and adaptive to the capital markets. The algorithm features a Decision Support System (DSS) to optimize the information produced by the years of data inputted. Each day, as the market changes, the system uses the new data inputs to learn from past data information and adjust the weighting of the hidden nodes to improve its predictive performance.

I Know First’s co-founders Yaron Golgher and Dr. Lipa Roitman came up with the idea to apply Artificial Intelligence and Machine Learning in the algo-trading world. Their company uses predictive algorithms based on artificial intelligence to process years of historical stock market data and develop different investment vehicles. There are two tiers to I Know First’s service. Tier I is a client-based daily support forecast. It provides clients with a heatmap of the top picks for bullish and bearish stocks over various time horizons. Tier II is institution-based. For Tier II, I Know First uses its AI algorithm to structure an investment portfolio.

I Know First uses a state of the art, self-learning AI-based algorithm to forecast and uncover the best investment opportunities. Every day, the algorithm inputs data from over 7,000 different financial assets, then the data is analyzed by comparing it to stored data and trends from the last fifteen years. After thousands of relationships and data points are analyzed, the algorithm outputs a prediction for each asset in six time frames. The form of the prediction is of two numbers that indicate which asset to buy, hold and sell. Then an email with the prediction is sent to all subscribers.